Rent, Car Insurance Are Keeping Inflation High

Our new high-tech vehicles are becoming pricier to repair, and we’re getting in more accidents than ever before.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

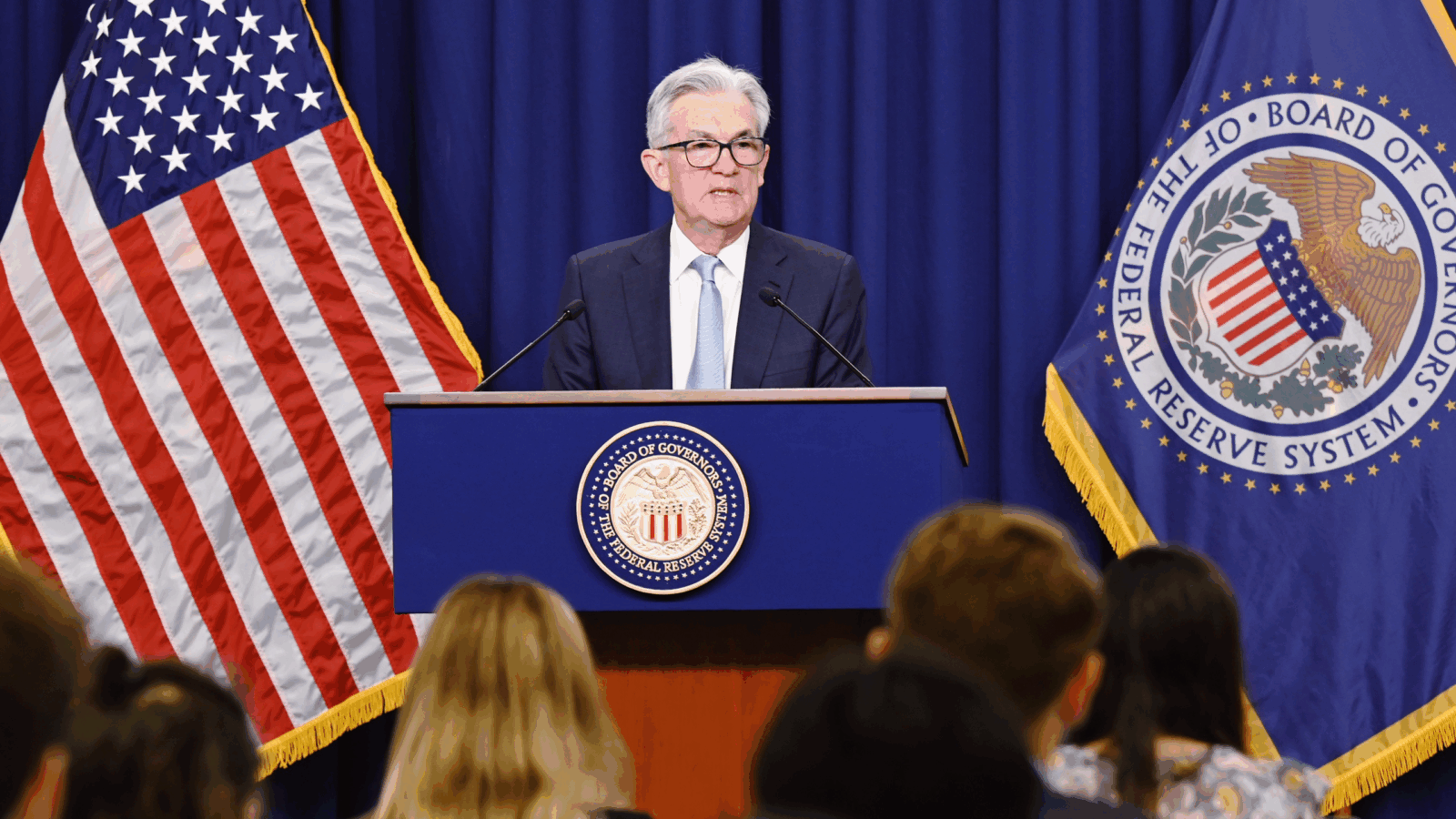

Apartment rents and car insurance are complicating Jerome Powell’s life. To stop inflation, he must tame them both.

Last week’s Consumer Price Index report bore frustrating, headache-inducing news: Prices rose 3.5% compared to a year ago in March, marking the third month straight of higher-than-expected data. While a couple of key categories experienced some much-welcome price relief — namely, new cars and oil — inflation remained stubborn in the shelter and services categories. Shelter costs, the government’s term for home and apartment rental prices, rose 5.7% in March compared to a year ago, or nearly double the average annual increase seen from 2015 to 2019.

Premiums at a Premium

Transportation services, meanwhile, were up a staggering 10% in March, powered in large part by the rapid rise in car insurance prices. The cost of auto insurance has now increased 22% in the past year, and nearly 50% since January 2020. There are plenty of accelerants at play:

- Modern, high-tech cars are expensive to repair. Fixing a new Toyota Camry following a head-on collision, for example, costs 43% more than a pre-2018 model, according to data provider Mitchell International; A standard internal-combustion engine car saw average repair bills of $5,564 in 2023, according to auto insurance processing company CCC Intelligent Solutions.

- Crashes have also increased; Almost 41,000 people died on US roadways last year, up 13% from 2019, according to the National Highway Traffic Safety Administration. Meanwhile, the industry may be short around 800,000 mechanics to meet demand in the next half-decade, a study from industry group TechForce Foundation found.

Worse, Hertz recently said that it found EV repairs are twice as pricey as regular cars, and there’s an even bigger shortage of EV mechanics. The insurance industry simply can’t keep up.

Get Rent: Rent market forces are a little cleaner to understand — and solve. Growth has already cooled from the rapid double-digit increases seen during the pandemic, and a building boom of new apartment buildings in many cities has effectively flatlined inflation on the “asking rent” on available or new units. “Renewal rents,” however, have been far stickier, rising as much as 7% in some markets last month, according to Yardi Matrix. Jerome Powell’s sanity may just rely on empty-nester Boomers finally selling their big homes.