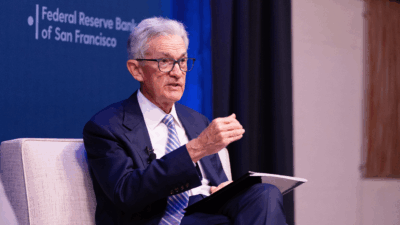

Central Banks in US, Japan, and the UK Prepare for Crucial Week

The US Federal Reserve and the Bank of Japan will meet this week. On Thursday, it will be the Bank of England’s turn in the spotlight.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

In these days of high interest rates, a single central bank meeting can produce a combination of anxiety and anticipation. This week, we have three of them.

Officials from the US Federal Reserve and the Bank of Japan will meet today and tomorrow, with any policy decisions coming Wednesday. On Thursday, it will be the Bank of England’s turn in the spotlight. Here’s where markets stand on each gathering.

A Tale of Three Countries

The conditions for a rate cut in the US are close. Even the Fed thinks so. Data released this month showed that while the US economy added slightly more jobs than expected in June, the labor market is cooling. The unemployment rate rose to 4.1%, up 0.1% from May and topping 4% for the first time in more than two years.

Inflation is down. The Consumer Price Index, which measures the change in prices for goods and services, fell to 3.0% in June from 3.3% in May, marking the second straight month of flat or declining prices. And the personal consumption expenditures price index rose less than 0.1% in June, according to data released Friday, while its 2.5% year-over-year increase is approaching the Fed’s 2% target.

As we said, the conditions are close, but we’re not there: Markets are pricing in just a 5% chance of a rate cut this week, according to the CME FedWatch Tool, but a 90% chance in September. Japan and Britain offer more suspenseful odds:

- The Bank of Japan, which ended eight years of negative interest in March, is expected to weigh another rate hike as officials look to bookend the days of deflation. Core inflation, which rose to 2.6% in June, has remained above the BoJ’s 2% target for more than two years — that has about a quarter of bond market participants surveyed by data provider Quick expecting a rate hike, while about a third of economists surveyed by Bloomberg concur.

- City economists in London are split about what the Bank of England will or won’t do Thursday. While headline inflation in the UK was 2% in June, and the slowest wage growth in roughly two years suggested a cooling labor market, services inflation was unexpectedly high at 5.7%. Markets are pricing a 40% chance of a rate cut, which could come down to a razor-thin 5-4 vote.

Currency Affairs: The Japanese yen, which fell to a 38-year low against the US dollar at the start of this month, has staged a feverish rally since July 11, rising 5% against the dollar amid hopes of a BoJ rate hike. Nick Twidale of ATFX Global Markets told The Japan Times that the BoJ would be a “party [pooper]” if it doesn’t tighten policy, which could reignite the carry trades that have weakened the currency.