Home Sales Rose in October, But the Trend Won’t Last

Sales of used homes in the US rose in October. But it may have been a flash sale, because mortgage rates are already climbing again.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

It’s always good to buy the dip, but we barely had a chance.

Sales of used homes in the US rose in October, the National Association of Realtors announced Thursday, as buyers took advantage of a dip in mortgage rates. But it may have been a flash sale, because rates are already climbing again. So what gives?

Get ‘Em While They’re Hot

Used home sales increased 3.4% in October compared with the month before, the National Association of Realtors said, besting a 2.9% monthly increase forecasted by economists surveyed by The Wall Street Journal. Compared with the same period in 2023, home sales increased 2.9% — the first year-over-year gain seen since June 2021.

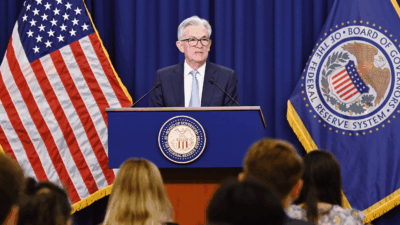

The leap in home sales largely reflects the drop in mortgage rates — which fell to as low as 6.08% — following the Fed’s supersize rate cut in September (home sales take a long time to close; October’s sales increase largely reflect buyers who took advantage of low mortgage rates in September).

But even with another quarter-point rate cut from the Fed earlier this month, mortgage rates are continuing to climb — and they’re not likely to stop any time soon:

- Mortgages usually get packaged together into bonds and are often guaranteed with government backing, so mortgage rates typically end up reflecting 10-year Treasury yields more than short-term interest rates.

- The yield on 10-year Treasury notes began climbing again following the Fed’s September cut, and mortgage rates have followed. The average 30-year fixed loan climbed to 6.84%, Freddie Mac said Thursday, up from 6.78% the week before and the highest since July.

Cancel Culture: The rise in rates may have made some buyers jittery. About 53,000 home purchases were canceled in October, good for just over 15% of homes that went under contract in the month, RedFin said in a report published last week. That marks the highest per-month cancellation rate in nearly a year.