What Does Mamdani’s Primary Win Mean for New York Real Estate?

To say housing is the defining issue in current New York City politics is likely a massive understatement.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

There’s a new mayor (Certainly? Probably? Potentially?) coming to New York, and he has some big, big plans. Specifically for the city’s housing market.

Late Tuesday night, New York State Assemblymember and Democratic Socialist Zohran Mamdani won the New York City Democratic mayoral primary, besting centrist candidate and former state Governor Andrew Cuomo. The win makes him the presumptive frontrunner in the city’s November election, and if he wins that election, he has promised to pursue a suite of housing reform policies. If they’re implemented, Mamdani could transform the real estate market of the largest US city — which already looks like a funhouse mirror version of the rest of the country’s.

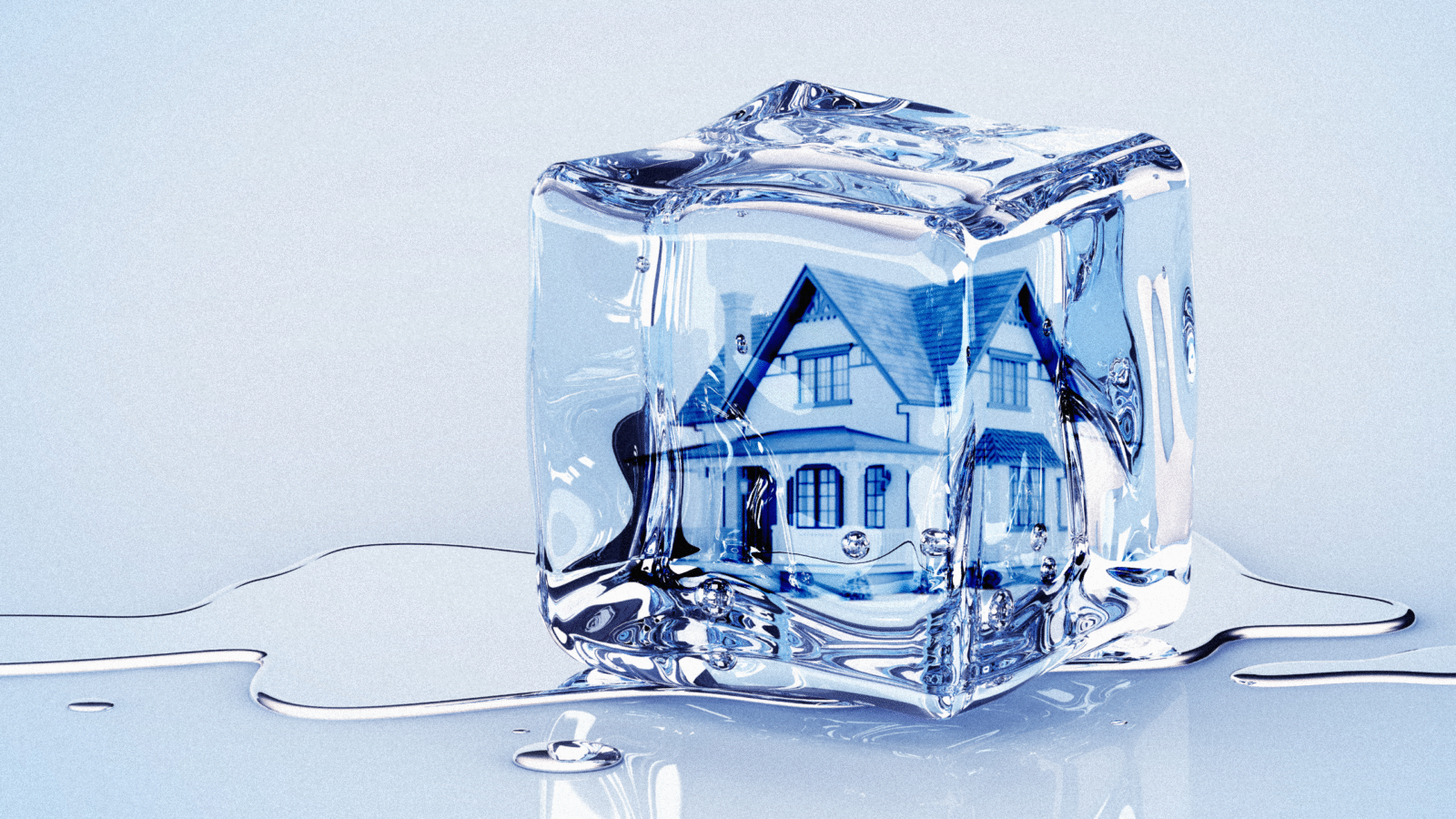

Rental Ice Age

To say housing is the defining issue in current New York politics is likely an understatement. In January, the New York State Comptroller’s Office released a report stating that homelessness in the state increased by 53% between January 2023 and January 2024, more than four times the national average. The jump was driven largely by widening homelessness in the city, which has a population of more than 8 million. Meanwhile, rent prices continue to climb higher and higher; in May, the median monthly rent in Manhattan reached an all-time record of $4,571, according to a recent report by Douglas Elliman. Rental-listing site Zumper reported that the monthly rent for a two-bedroom apartment leapfrogged 17.5% in the past year, more than in any other city. The city’s vacancy rate has fallen to 1.4%, the lowest point since 1968, according to the city comptroller.

Mamdani ran on a housing-reform platform built on two key pillars. First, implementing an immediate rent freeze for the more than 2 million New Yorkers living in rent-stabilized units. Second, committing $100 billion in public funds to construct more than 200,000 new rent-stabilized units over the next decade, with fast-tracks granted to “100% affordable developments.”

The city’s landlords and developers — who almost universally backed Cuomo — are unsurprisingly critical of Mamdani’s proposals, warning that the moves could discourage new investments. On Wednesday, investors responded by fleeing companies seen as especially exposed to New York real estate:

- Shares of Flagstar — a.k.a., the major New York real estate lender previously known as New York Community Bancorp — slid 4% on Wednesday, with Deutsche Bank analysts estimating as much as one-fourth of the company’s loan book would be exposed to Mamdani’s rent regulations.

- Meanwhile, shares of SL Green, Manhattan’s largest landlord, fell over 5%, and shares of the Vornado Realty Trust fell nearly 7% on Wednesday.

Only in New York: The extreme housing crunch in New York City — where Redfin says the median home price rose almost 9% in May to $880,000 — makes it something of an outlier nationally. Elsewhere in the country, the advantage is shifting in favor of buyers. According to a recent RedFin report, sellers now outnumber buyers by half a million nationwide, the biggest gap since 2013. Rental asking prices are actually decreasing in several major cities, including Denver, Austin, and Nashville. “Only in New York” can describe a lot of wonderful, weird experiences — though right now, it mostly means wining and dining and maybe even bribing apartment brokers, as desperate rent-seekers recently told The Wall Street Journal.