Follow the Flows: Why Some Legacy Mutual Fund Firms Are Finally Exploring ETFs

Companies that were longtime holdouts on ETFs are expanding into the category, even as the SEC contemplates approval of dual share classes.

Sign up for market insights, wealth management practice essentials and industry updates.

There are some late bloomers in the world of ETFs.

While some of the big names in the business have been in it for a couple decades, there are plenty of traditional mutual fund shops that have only recently made the leap. Others may still be considering if, and when, to add ETFs. Within a few months, though, the rules of the road are probably changing. The Securities and Exchange Commission is widely expected to start approving a dual-share class structure, which will allow companies to add ETF share classes to existing mutual funds and vice versa.

But that hasn’t stopped firms from adding stand-alone ETFs or converting mutual funds to them. In recent months, companies including Lazard, First Eagle, Parnassus, Praxis, Thornburg, and Tweedy, Browne, have added their first ETFs. They have good reason to get into the space: ETFs can offer tax efficiency, they trade intraday and they provide transparency that some investors want. One other important detail … they’re cheap.

New in Town: “The tax advantages afforded by ETFs are simply too compelling to ignore,” said Bob Wykoff, managing director at Tweedy, Browne, which in December launched the Insider + Value ETF, its first product in the wrapper. “We’ve had an interest in ETFs for a very, very long time. But finding how we would come at it took us some time. There was a long learning curve.”

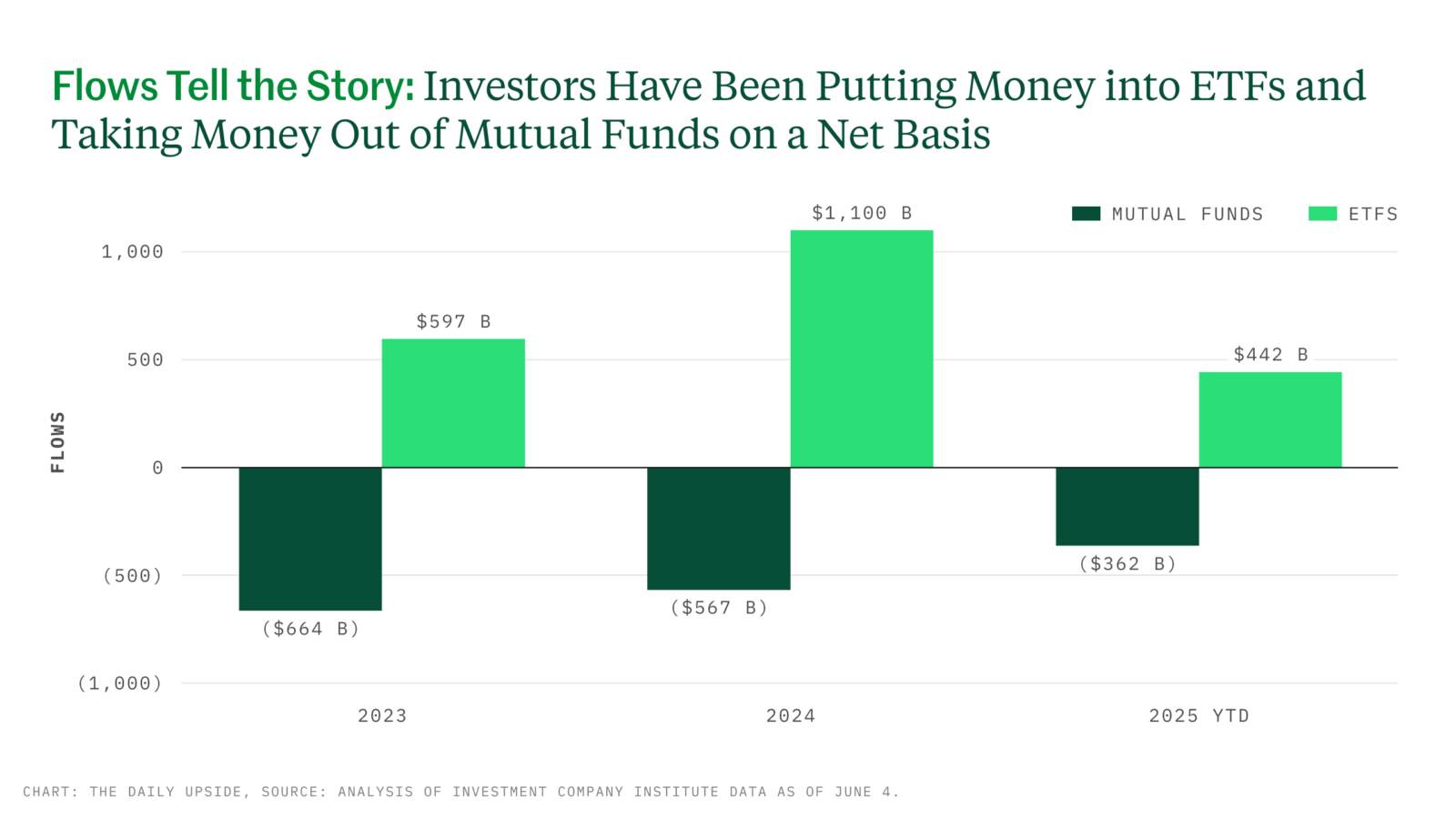

There are more than a few factors motivating asset managers to add ETFs. Actually, there are billions and trillions of them:

This Is the Way

Capturing a share of those inflows requires investment, however. Fund companies either have to hire staff to help build out a platform or go with a third-party provider. First Eagle Investments, a $152 billion asset manager, opted to use RBB’s series trust rather than building its own for the two active equity ETFs it launched last year. “We definitely felt there was some urgency in getting to market,” said Frank Riccio, head of US wealth solutions at First Eagle. “We’re borrowing their expertise … They were critical to us getting to market within six months.” The arrangement doesn’t preclude First Eagle from adding its own ETF trust later, something the firm is likely to do if it makes sense financially, he said.

For mutual fund companies expanding into ETFs, several options are available, Daniel Sotiroff, Morningstar senior analyst for passive strategies research, told ETF Upside:

- They can convert existing mutual funds to ETFs.

- Asset managers can simply add new ETFs, which in some cases are strategy clones of existing mutual funds.

- The third option, pending SEC approval, is adding an ETF share class.

A considerable number of firms have opted to convert mutual funds into ETFs. A drawback to that tactic is that fund investors must have brokerage accounts to receive shares of the ETFs, Sotiroff said. Unlike ETFs, mutual fund shares can be owned outside of brokerage accounts, which is where the difficulty arises. “That’s one of the hurdles they have to get through, if they want a good client experience in all of this,” Sotiroff said. Another not-so-insignificant issue is that ETFs do not have the revenue-sharing fees that some mutual fund shares do, which means that broker-dealers may not be compensated by ETF sales. And that may keep some distributors from approving the all-but-certain wave of ETFs that will follow from dual-share approval, unless they reach alternative compensation agreements with asset managers.

Or Just Make One

Companies like T. Rowe Price and Capital Group have added products that mimic the investment strategies of existing mutual funds, Sotiroff noted. But creating clones isn’t the only way to go. Tweedy, Browne, for example, added a fresh strategy via its first ETF. Like First Eagle, that firm used RBB’s series trust to bring its ETF to market. “I would say it’s somewhat experimental,” managing director John Spears said of the investment thesis of the ETF launched last December. The company has long studied insider buying, and data it analyzed from 2022 and 2023 led to interest in an international strategy. An ETF turned out to be a better tool for the job than a mutual fund, he said.

“We’ve always been long-term investors,” Wyckoff said. But the data from the firm’s insider buying study showed that the best results came from owning stocks from six months to as long as three years. “It became clear to us that there may be a shorter holding period for these shares, so tax efficiency became even more important in the process,” he said.

If At First You Don’t Succeed … Russell Investments added exchange-traded funds at the end of May. The $332 billion global asset manager introduced a suite of five subadvised active products, which brought the company back into the world of ETFs. It isn’t the firm’s first go-round, as it briefly operated a line of more than two dozen funds starting in 2010, data from Morningstar Direct show. All of those, except one actively managed fund, were liquidated in 2012 following low sales. The single remaining ETF was killed off in 2015.

Many firms, however, have taken first stabs at ETFs this year. Among 31 asset managers, a total of 44 ETFs have been launched through mid-June 2025, according to data from Morningstar Direct.

Share and Share Alike: A massive bonus for mutual fund sponsors waiting for the advent of dual-share classes is tax savings. Mutual funds sitting on years of capital gains can potentially work some of those off via the in-kind redemptions in an ETF share class. Still, there are potential drawbacks even beyond ETFs being less advantageous to distributors, Sotiroff said. “The biggest hurdle I see is the capacity concern. A fair amount of active managers have a limit in what they can manage before they lose their edge,” he said. “You can’t really shut the ETF down to new money.”

Further, advisors may not necessarily want the clone of a mutual fund strategy in the form of an ETF, First Eagle’s Riccio said. Even so, that firm is among those asking the SEC for permission to add an ETF share class, he said, adding that they want to have the option. Tweedy, Browne, which also recently applied for dual share class approval, sees it as an evolution of the business. “We wouldn’t be around for 104 years if we didn’t adapt, and the ETF world seems to be the brave new world,” Wyckoff said. “We’re going to be part of it.”