Industry News

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

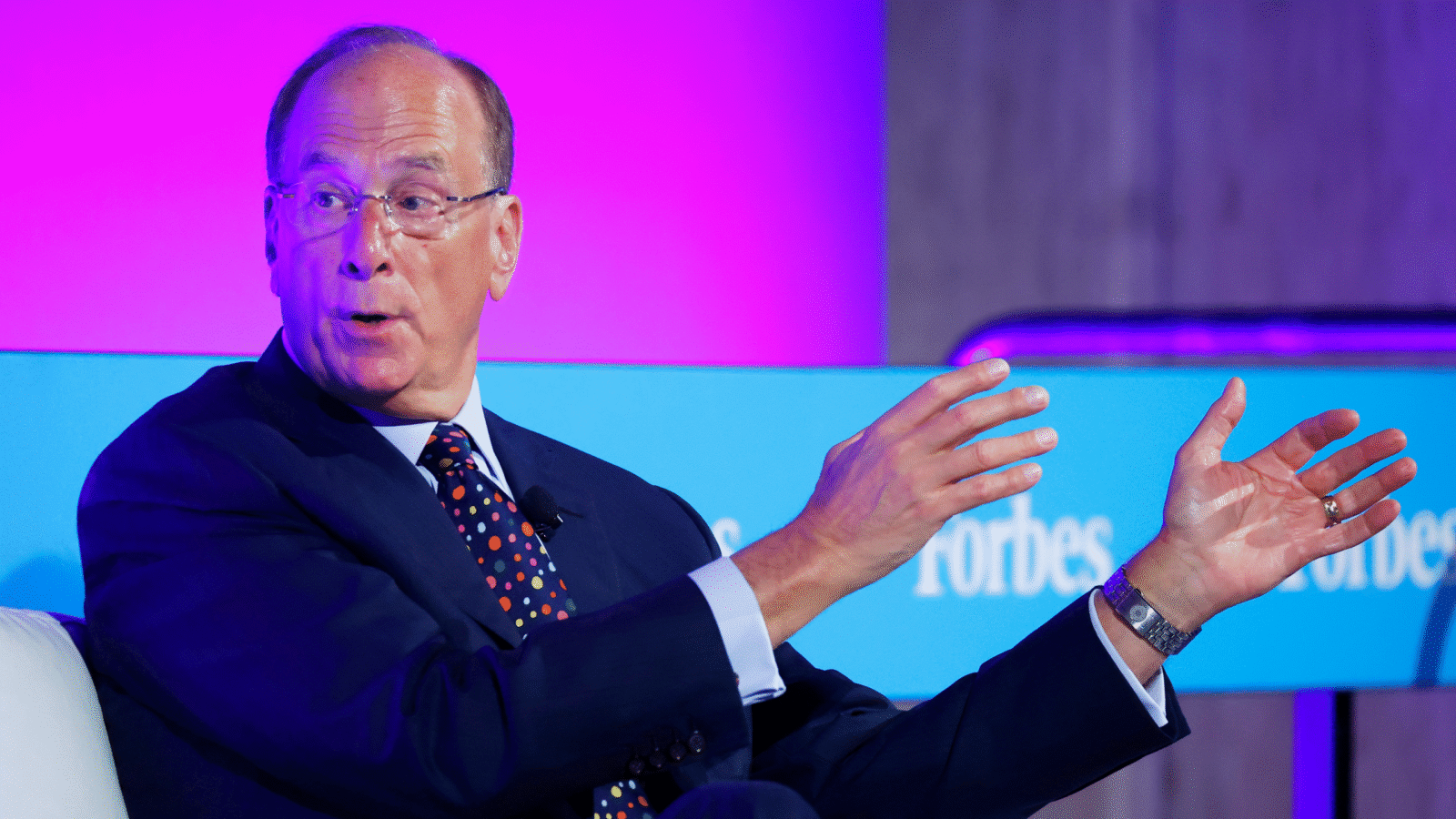

BlackRock’s Tokenized ETFs Are Only The Beginning, CEO Says

Photo via John Angelillo/UPI/Newscom