ETF Sales: A Tale of Bitcoin and the S&P 500

BlackRock and Vanguard have raked in cash in very different places, highlighting some of the differences in their ETF customer bases.

Sign up for exclusive news and analysis of the rapidly evolving ETF landscape.

Looking at ETF sales at two asset management giants, you’d think they’re from different worlds.

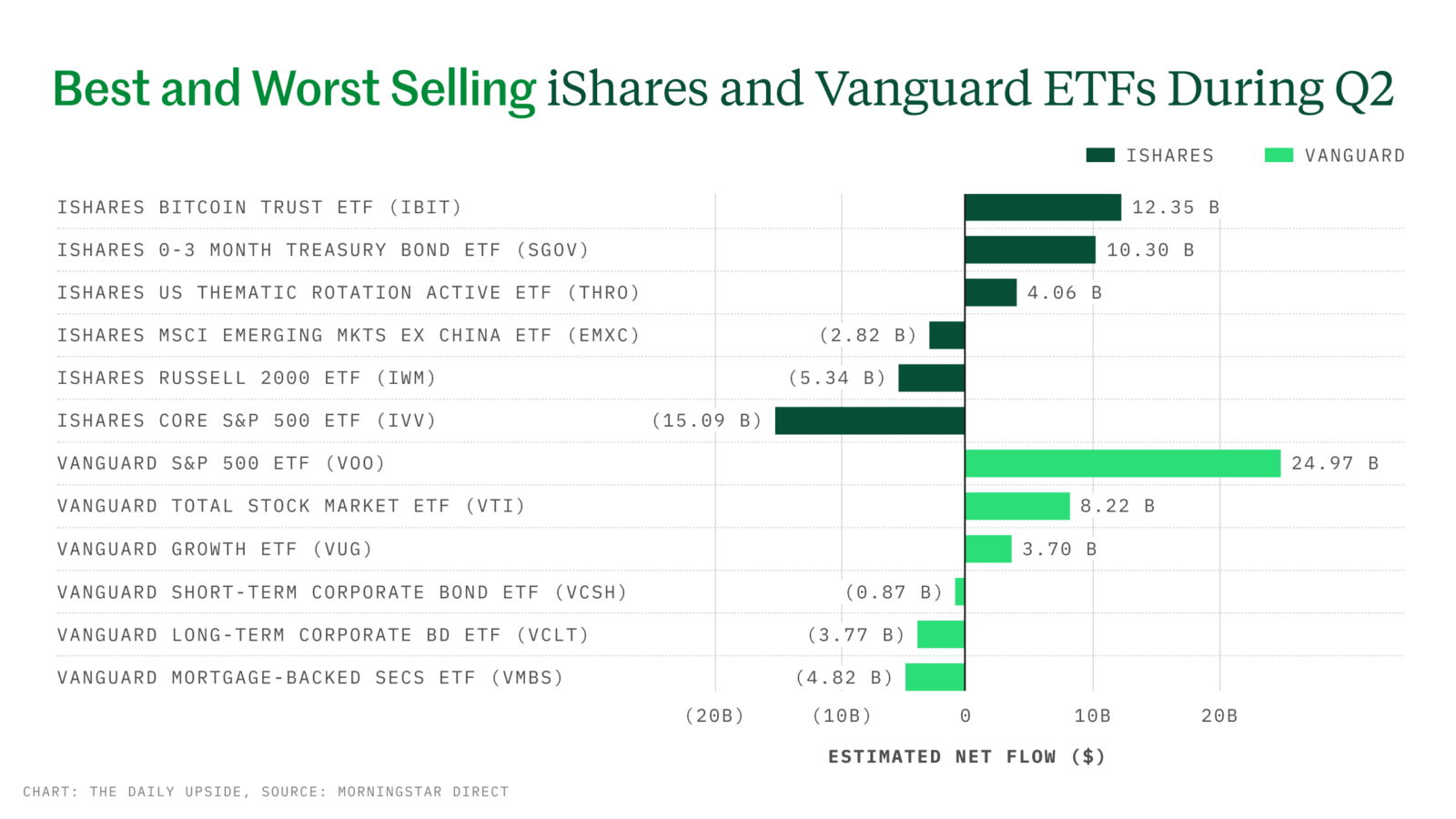

Flows at BlackRock were all about Bitcoin during the second quarter, while sales at Vanguard reflected demand for US equity. BlackRock’s iShares Bitcoin Trust ETF (IBIT) has become the fastest-growing exchange-traded fund ever, raking in $12.3 billion in that time, currently representing more than $87 billion in total assets, a report this week from Morningstar shows. Meanwhile, Vanguard’s S&P 500 ETF (VOO) brought in $25 billion. While investors seemed to pull back from large cap US equity in iShares’ line, the opposite was the case for Vanguard. That has a lot to do with the types of clients the firms attract, said Morningstar’s Daniel Sotiroff, one of the authors of the paper.

“People are buying VOO because it’s a forever fund,” he said.

Different Strokes

Assets in the ETF, Vanguard’s largest, are now over $714 billion, while the broader strategy, which includes mutual fund share classes, sits at more than $1.5 trillion. Investors buy that fund for different reasons than the SPDR S&P 500 ETF Trust (SPY) or the iShares Core S&P 500 ETF (IVV), Sotiroff said. Flows in and out of SPY seem to correlate more with performance, while those for IVV seem to be somewhere between SPY and VOO, he said. In IVV’s case, about $15 billion evaporated from the fund in Q2, at least a small part of which appears to be due to BlackRock’s model portfolios shifting allocations, as about $4 billion flowed into the US iShares Thematic Rotation Active ETF (THRO), the report noted. Additionally, “since IVV is so large and so liquid, I have to imagine there are people out there using it for other tactical reasons,” Sotiroff said.

One advisor said that recent ETF decisions have been all about taxes. “We’ve maintained ETF positions largely in dividend-paying strategies and funds with high turnover, where using ETFs helps us avoid large capital gain distributions,” said Sean Beznicki, director of investments at VLP. “This structure has been particularly useful in managing tax exposure while maintaining desired allocations.”

While some of the flows at Vanguard and BlackRock show performance chasing, none of the top-selling ETFs at those firms were among the best performers during Q2. A separate Morningstar report found the best returns at two ARK ETFs and others:

- The ARK Innovation ETF (ARKK) returned nearly 48% during Q2, while the ARK Space Exploration & Innovation ETF (ARKX) returned 36%.

- The TCW Transform Systems ETF returned over 29%, and the Franklin Focused Growth ETF returned nearly 26%.

I Bet on IBIT: While it’s hardly a clear-cut case of Bitcoin vs. the S&P 500 in ETF land, there are some unusual things happening, Sotiroff said. Investors have tended to buy IBIT while Bitcoin is on a hot streak, but they aren’t really selling when it’s down. “It’s like people buy in and hold,” he said. “It’s very odd. I’ve never seen a pattern like that before.”