US Raid in Venezuela Compounds Uncertainty for ETF Investors

ETF investors may seek asset classes they view as safer in a volatile era. One issuer filed for a Venezuela Exposure ETF.

Sign up for exclusive news and analysis of the rapidly evolving ETF landscape.

Last year’s uncertainty drove investors to safe-haven assets early in the year. So far, though, 2025 doesn’t have anything on 2026.

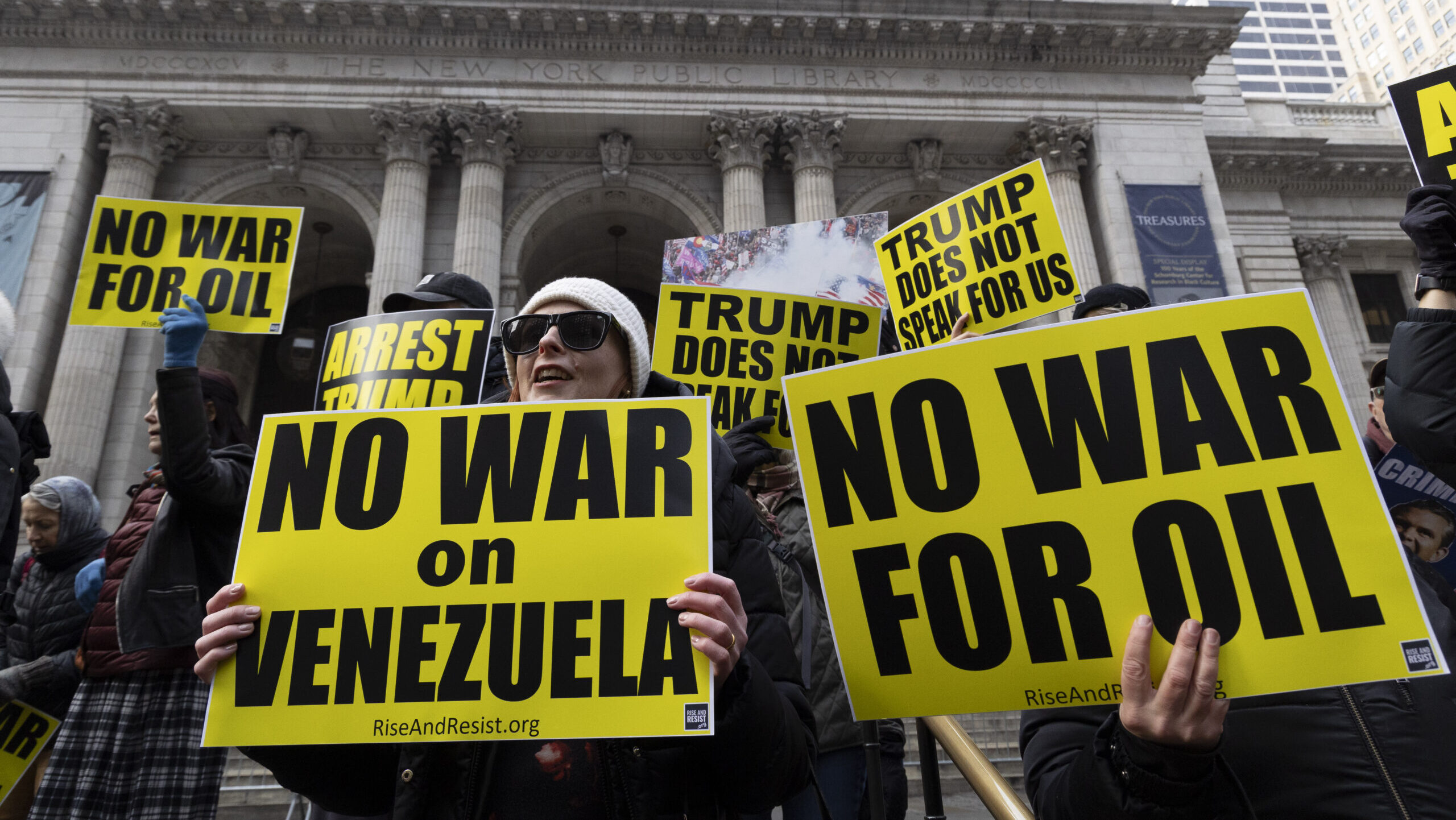

For anyone who missed the numerous news alerts, the US captured Venezuelan president Nicolás Maduro over the weekend in a raid that reportedly killed dozens and may lead to a long-term restructuring of oil markets. In comments since Maduro’s arrest, President Trump and officials in his administration alluded to a takeover of Greenland, territory controlled by a NATO ally, and said that even without the US taking any action, “Cuba looks like it’s ready to fall.”

“The events in Venezuela over the weekend have added both policy and economic uncertainty,” said Aakash Doshi, global head of gold strategy at State Street Investment Management. “If you look at the US Economic Policy Uncertainty Index, even under Trump 1.0, that averaged not that much higher than [under] Biden or Obama. But if you look over the past 12 months, the uncertainty index is more than double what we’ve seen over the prior 12 years.”

Gold vs. Liquid Gold

Trump has been clear about intentions to open up Venezuela’s vast oil reserves and has set up meetings with petroleum company executives, Reuters reported Tuesday. Chevron, the only major US oil company operating in Venezuela, saw a jump in its stock price Monday, before falling Tuesday, with a year-to-date gain of nearly 3%, and the Dow Jones U.S. Oil & Gas Index up less than 2%. Meanwhile, spot gold prices and the SPDR Gold Shares ETF (GLD) were up close to 3%.

Near-term market impacts may be limited, according to asset managers:

- “Venezuela’s political shift is unlikely to drive broader market repricing in the very near term,” Janus Henderson equities and fixed-income leaders said in a commentary. “Yet its implications — for energy supply, emerging market sovereign bonds, geopolitical tensions and supply chain diversification — warrant continued attention.”

- “Safe-haven flows have lifted gold and created brief volatility, but fundamental impacts on USD, equities, commodities and rates remain contained absent further escalation,” Adrian Helfert, Westwood CIO of multi-asset strategies, said in a statement.

- One company, Teucrium Investment Advisors, has a different take. That company wasted no time over the weekend, filing with the SEC on Monday for a Venezuela Exposure ETF that it would seek to trade on NYSE Arca.

Crude Awakening: The US ETF with the highest percentage of its allocation to Chevron, the $247 million Strive US Energy ETF (DRLL) has climbed just under 2% year to date as of Tuesday. That firm did not respond to a request for comment. But the initial rise in oil prices following the US intervention in Venezuela was modest, given no historical precedent of a regime change globally leading to a quick ramp-up in oil production, Doshi noted.

“It opens a lot of uncertainty … The events of last weekend are bullish for gold,” he said.