Finance

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

SpaceX, OpenAI Dominate Speculation About $3 Trillion IPO Geyser

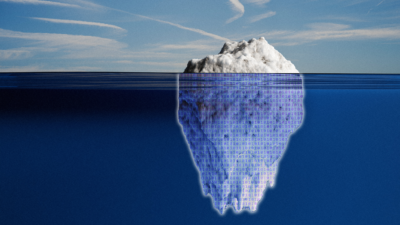

Photo illustration by Connor Lin / The Daily Upside, Photos by Andrey Krav and Frentusha via iStock