Archegos’ Hwang Sentenced to 18 Years For Gargantuan Fraud That Walloped Wall Street

Hwang’s sentencing bookends a dramatic saga that began with the shock implosion of his firm that cost Wall Street billions.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Bill Hwang, the billionaire behind Archegos, whose collapse was described as a “national calamity” by a federal prosecutor, will be doing hard time after all.

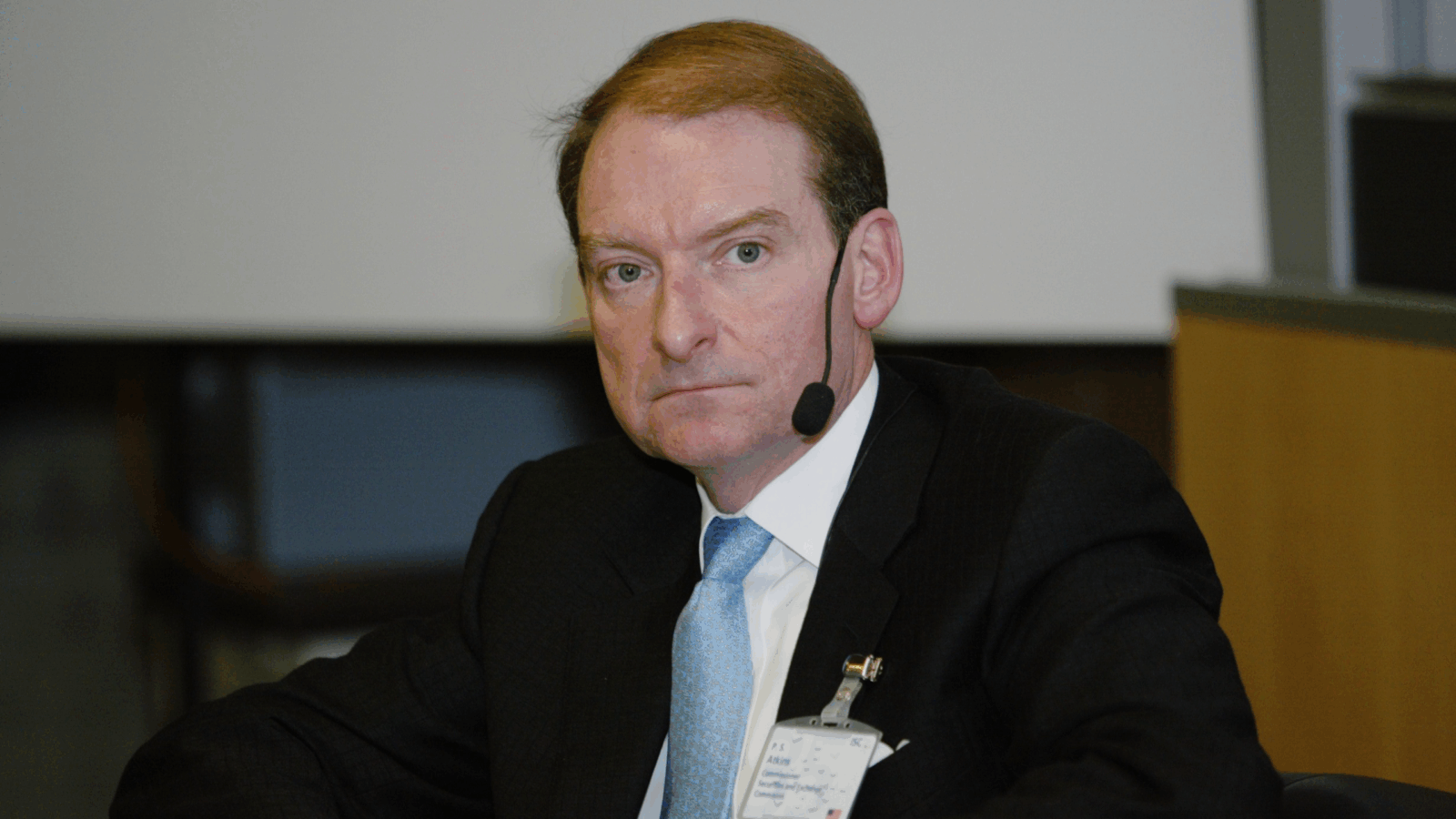

Brushing aside the “utterly ridiculous” suggestion from Hwang’s defense team that he serve no prison time, US District Judge Alvin Hellerstein sentenced Hwang to 18 years in prison for fraud and market manipulation on Wednesday.

On a Scale of Bankman-Fried

Hwang’s sentencing bookends a dramatic saga that began with the shock implosion of his firm that cost Wall Street billions. Mentored by the late hedge-fund billionaire and Tiger Management founder Julian Robertson, Hwang launched Archegos as a New York-based family office in 2013, despite his previous hedge fund shutting down a year earlier after the firm pleaded guilty to wire fraud.

Prosecutors said Hwang lied to banks about Archegos’ portfolio — it managed $36 billion at its peak — to borrow money for risky wagers on stocks, especially in the media and tech sectors. The bubble burst in March 2021 when the price of some of his biggest bets dropped and he couldn’t meet margin calls. Archegos was wiped out in less than a week. Banks were left on the hook for $10 billion. While most counterparties recovered, Archegos’ legacy includes possible precedent for harsher white collar sentences and a Swiss banking giant in ruins:

- US Attorneys sought a 21-year-sentence for Hwang, unusually long for a Wall Street crime. “The amount of losses that were caused by your conduct are larger than any amount of losses I’ve dealt with as a judge,” Hellerstein said, at one point comparing Hwang to crypto-fraudster Sam Bankman-Fried, who was sentenced to 25 years in prison.

- The most infamous collateral damage from Archegos’ failure was Credit Suisse, which booked $5.5 billion in losses related to its prime brokerage services to Archegos and collapsed in March 2023. Swiss rival UBS bought the bank, as Hwang’s misdeeds literally reconfigured one of the world’s most important financial centers.

Sensing a losing position, a lawyer for Hwang’s lawyer at one point tried to get Hellerstein to consider a four- to five-year sentence, invoking his charitable deeds and his modest lifestyle in New Jersey. The judge didn’t buy the humble living claim, noting Hwang’s “new apartment in Hudson Yards,” a pricey development in midtown Manhattan.

The Hurting: “I feel deep pain for all of Archegos’ employees, the banks and all the employees at the banks who suffered,” Hwang told the court. “I am grateful to God for so many blessings I’ve had in my life.”