Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

“… So dawn goes down to day. Nothing gold can stay.” So wrote the poet Robert Frost in Q4 1923, and so said the stock market in Q1 2022.

For the first time in two years, Wall Street’s three main indexes wrapped up a losing quarter Thursday. Set against piping hot inflation, rusty supply chains, rising interest rates, the theater of war, and a two-year-old pandemic, most analysts are looking forward with caution.

Must What Goes Up Come Down?

The reasons markets are down can be seen anywhere these days. Go to a McDonald’s and pay 6% more for a Big Mac than a year ago. Ride the subway and see people in N95 masks. Fill up at the pump and feel like you just got robbed. Turn on CNN and see war on the news ticker, assuming they’re finished obsessing over Will Smith. Try to buy a PlayStation 5 or get a mortgage rate below 4% (good luck!).

The important question is whether all the macroeconomic hurdles staring markets in the face mean more choppy waters ahead, or if a rally in the second half of March means otherwise:

- The Dow and S&P 500 fell about 3% and the Nasdaq more than 7% in the first three months of 2022. It was their first negative quarter since Q1 2020, when the Covid pandemic began in the US.

- But the S&P 500 and Nasdaq finished March up 5% each, and the Dow rose 4%. Yet the S&P 500 has fallen 35 days this year, the most in any first quarter since 1984, according to Bloomberg data.

The Hot Takes: “We think from here investors are going to, at some point, realize, wait a second, growth is slowing and interest rates are rising and inflation is still high,” Erik Knutzen, managing director at Neuberger Berman, told CNBC. “This is still a challenging set-up for equities.” Cliff Asness, CIO of investment fund AQR Capital Management, tweeted that the numbers are overblown: “Lots of articles on how the ‘S&P is heading for its worst quarter in two years’ where they make that sound like an important thing. That’s the worst of [eight quarters], a tiny sample, and the S&P is only down 3.52%.”

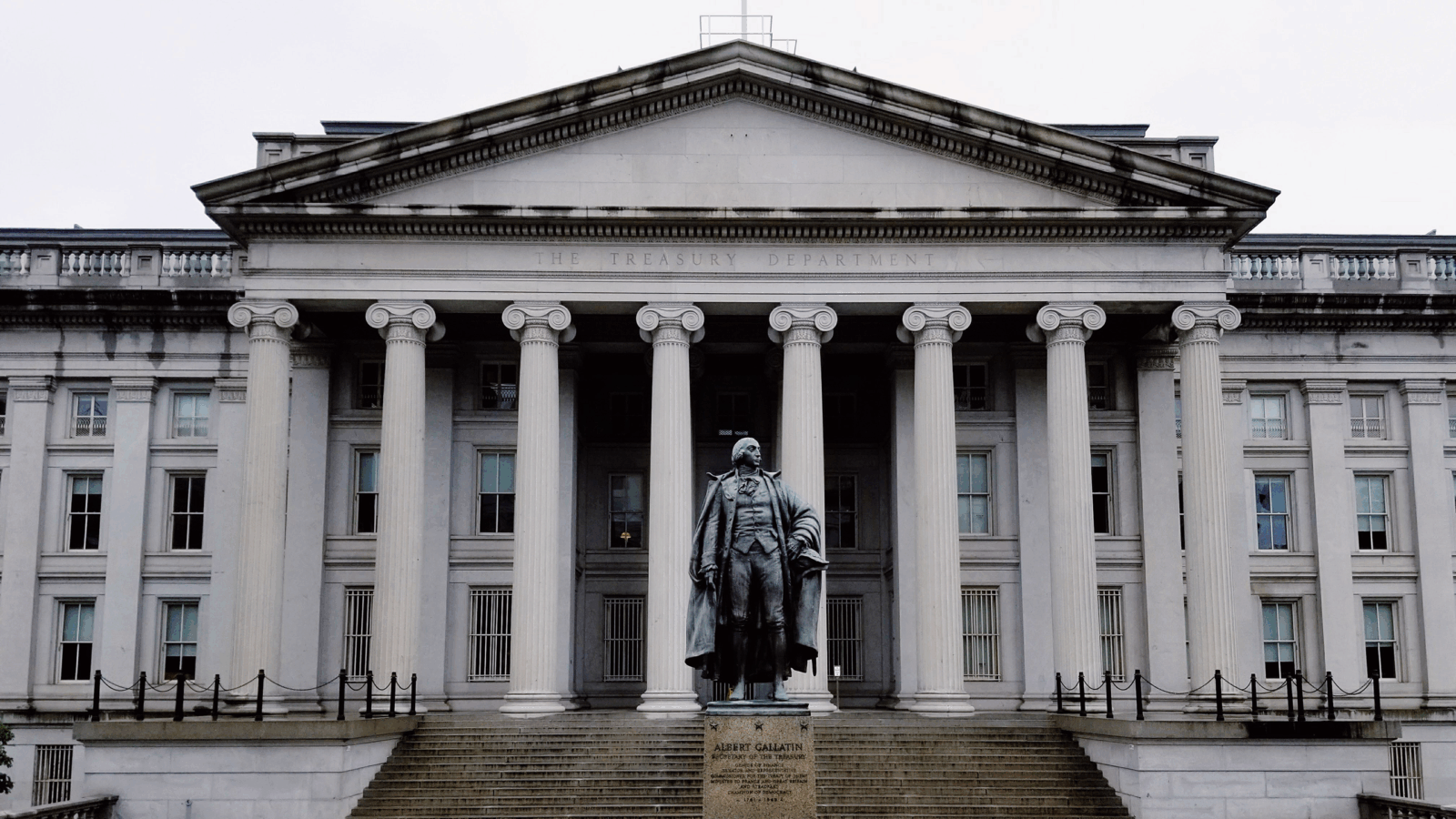

No Shelter: The bond market, traditionally seen as a safe haven when stocks are dicey, has not lived up to that reputation. The Bloomberg U.S. Aggregate bond index — which tracks US Treasuries and high-rated corporate bonds — reported a negative 6% return this quarter, the worst since 1980.

Someone Has to Make Money: At least somebody is making good off that feeling of getting robbed at the pump. The S&P GSCI, which tracks commodities futures including oil, rose 34% in the first quarter, the biggest boost since 1990.