Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

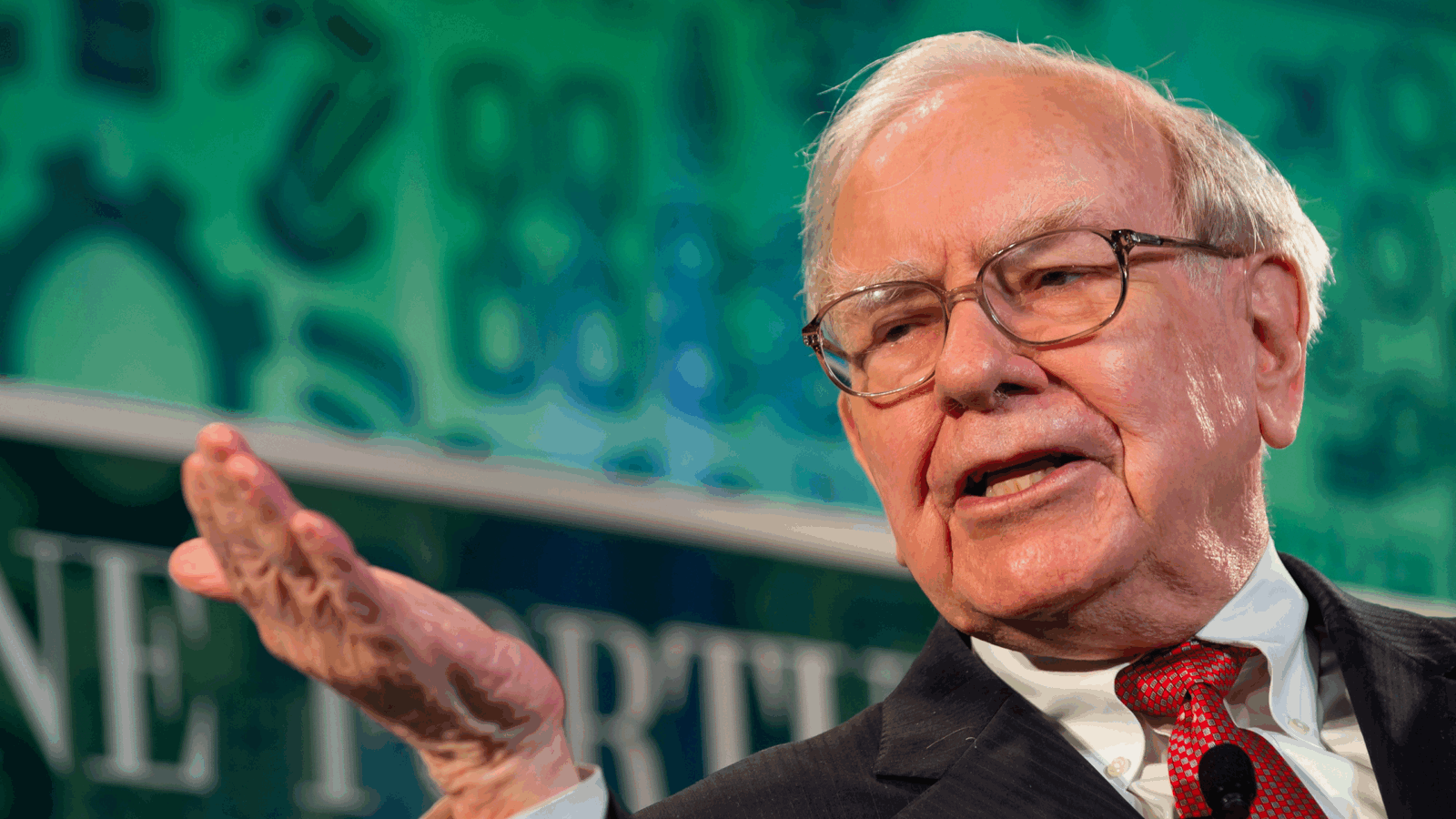

It’s been less than one month since Berkshire Hathaway CEO Warren Buffett said “little excites” the investment giant and its $150 billion pile of cash. But on Monday, the Oracle of Omaha found something worth celebrating with a slice of Dairy Queen’s ice cream cake (a beloved Berkshire portfolio company).

Berkshire announced plans to acquire insurer Alleghany for $11.6 billion. What’s so exciting about it? The CEO is a Berkshire veteran who has followed the Berkshire investment playbook like it’s a holy text.

Man in the Mirror

Despite its stock’s rock-solid performance as of late, Berkshire has been in something of an acquisition rut. The stock market’s bull run in 2021 drove up valuations, making it increasingly hard to find the kind of high-return acquisition his firm is known for. To bide the time, Buffett turned to stock buybacks, a tactic he largely avoids and at times has criticized. Earlier this month, he also plunked down $1 billion to expand Berkshire’s stake in Occidental Petroleum, with a backdrop of surging prices at the pump.

In Alleghany, Berkshire finally found something it knows to be bankable: its own investment tactics. The insurer is led by Joseph Brandon, who was CEO of Berkshire’s General Re unit from 2001 to 2008 and he has turned Alleghany into a reflection of his former employer:

- Just like Berkshire, Alleghany has used the lucrative earnings from its insurance and reinsurance companies to buy an assortment of no-nonsense noninsurance firms, including toymaker Jazwares, Wilbert Funeral Services, and hotel developer Concord Hospitality. It made $1 billion in profits last year.

- Berkshire is offering a 29% premium on Alleghany’s share price over the last month — if completed, its $11.6 billion equity value will mark Berkshire’s biggest acquisition in six years.

CEOs Be Shoppin’: Berkshire plans to pay for Alleghany in cash — that’s the beauty of a $150 billion war chest — though Monday’s deal gives Allegheny a “go-shop” period of 25 days where it can seek out other, more favorable deals. But it’s hard to imagine someone rolling up with pockets as deep as Buffett’s.