Finance

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

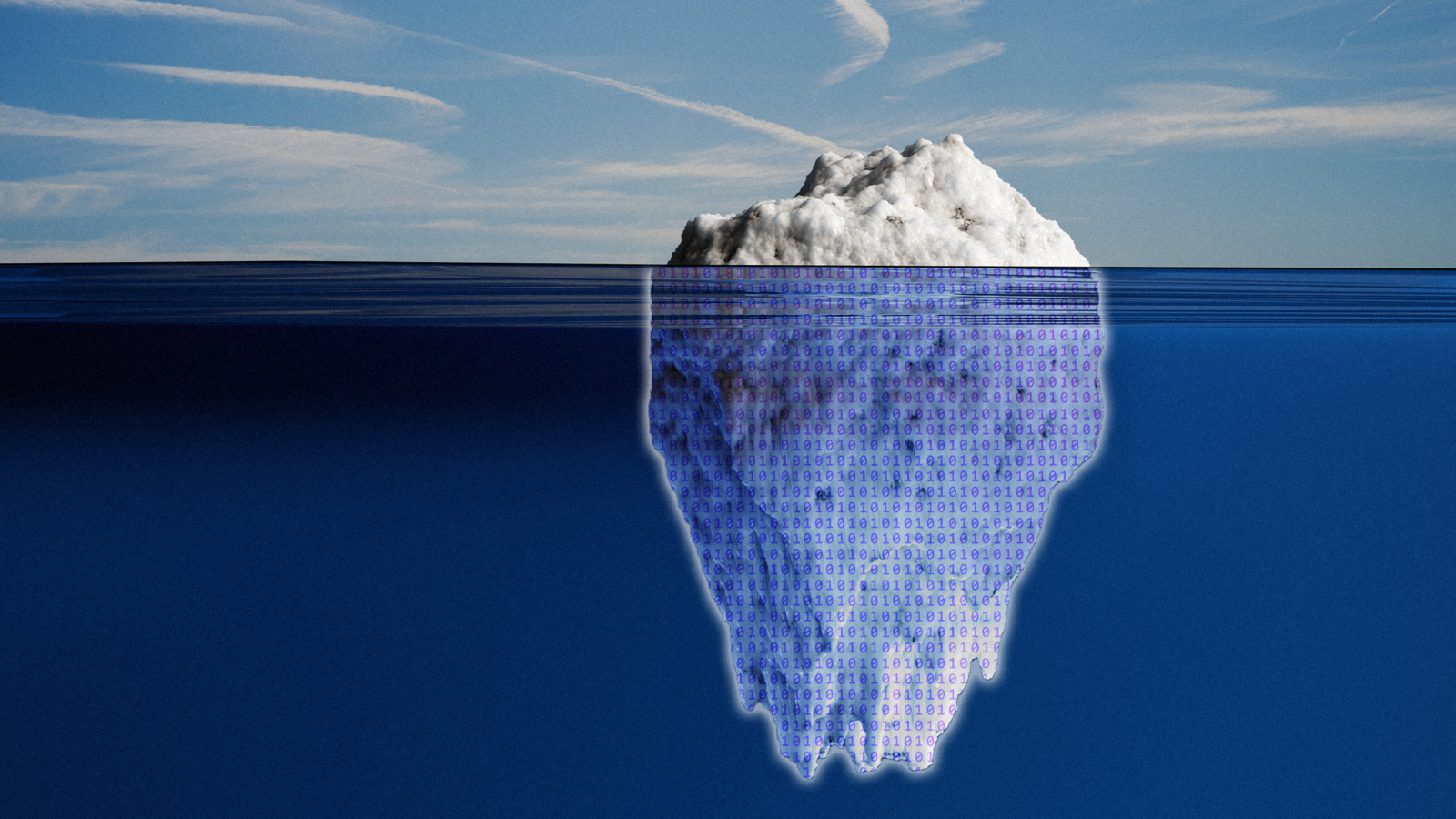

Dan Ives: Trillions in AI Spending Are Just the Start of ‘Fourth Industrial Revolution’

Photo illustration by Connor Lin / The Daily Upside, Photo by Dragon Claws via iStock