Wall Street Gets Charged Up on Rivian Despite Short-Circuiting EV Market

The increased price targets came just a week after Rivian announced it had developed its own artificial intelligence chip.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Amid a withering downturn for the US electric vehicle industry, Rivian just delivered something rare: optimism.

The Irvine, California-headquartered EV manufacturer scored an upgrade last week from Baird analyst Ben Kallo, who changed his rating for the stock to “Buy” from “Hold” and raised his price target to $25 per share from $14. Kallo wrote that “2026 is the year of R2” — the company’s new midsize SUV. The automaker’s stock popped 15% Thursday following the news, ending the trading day up more than 50% for the year. On Friday, Wedbush raised its price target for Rivian to $25 per share from $16.

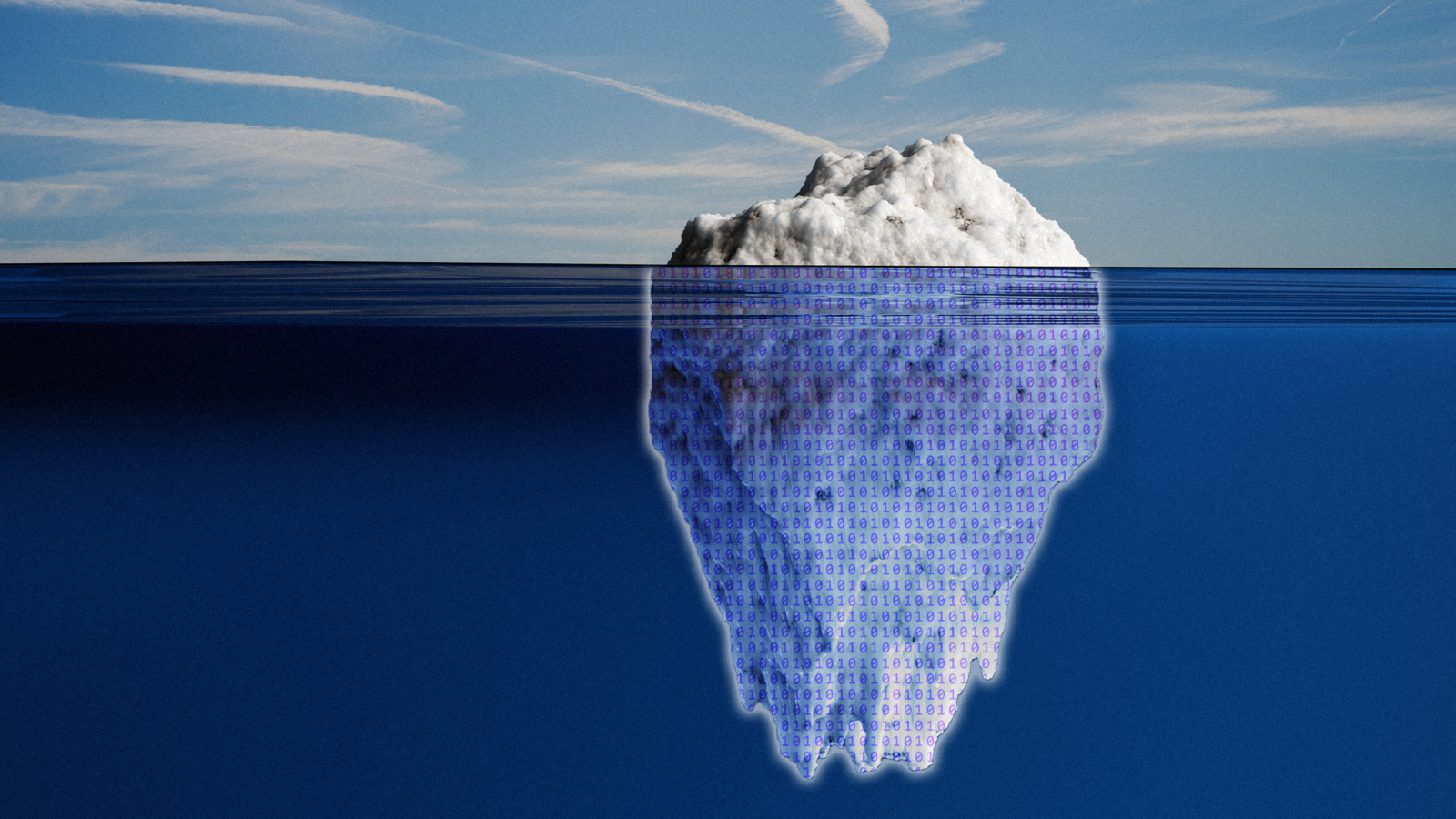

The increased price targets came just a week after Rivian announced it had developed its own artificial intelligence chip, making it less dependent on Nvidia, and that it was continuing its progress toward fully autonomous vehicles by expanding its hands-free driving feature. (Investors didn’t seem convinced the move would translate to growth, and the stock fell roughly 6.1% that day). A Dec. 18 update from the company says that tech improvements will allow drivers to take their hands off the steering wheel on more than 3.5 million miles of roads in the US and Canada, both on and off highways.

Slowdown Ahead

Rivian’s journey to self-driving comes as momentum for EVs has generally slowed amid the Trump administration’s recent proposal to ease Biden-era fuel economy requirements as part of a broader shift away from non-combustion-powered autos.

Other EV makers have also been taking hits:

- Last week, Ford Motor said it expects to take about $19.5 billion in charges, primarily related to its EV business. The automaker is pulling back from EVs and turning to gas and hybrid models that can actually turn a profit. “Instead of plowing billions into the future knowing these large EVs will never make money, we are pivoting,” Ford CEO Jim Farley told The Wall Street Journal.

- California’s Department of Motor Vehicles recently threatened to ban Tesla from selling its EVs for 30 days unless the company quits what regulators say are misleading marketing tactics.

Lawyering Up: Sixteen states and the District of Columbia are suing the Trump administration over what they say is the unlawful withholding of more than $2 billion in funding for EV chargers. “This is just another reckless attempt that will stall the fight against air pollution and climate change, slow innovation, thwart green job creation and leave communities without access to clean, affordable transportation,” California Attorney General Rob Bonta said in a statement.