Big Tech’s Energy Rush Hits a Hurdle

FERC kiboshed a bid to increase the amount of power that a nuclear plant in Pennsylvania is allowed to supply to one of Amazon’s data centers.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Last week the Federal Energy Regulatory Commission kiboshed a bid to increase the amount of power that a nuclear plant in Pennsylvania is allowed to supply to one of Amazon’s data centers.

The fallout from FERC’s decision was felt on Monday, as producer share prices tumbled and Big Tech was left to ponder where on earth it will find the energy it needs to fuel its AI ambitions.

Speedrunning Energy Infrastructure

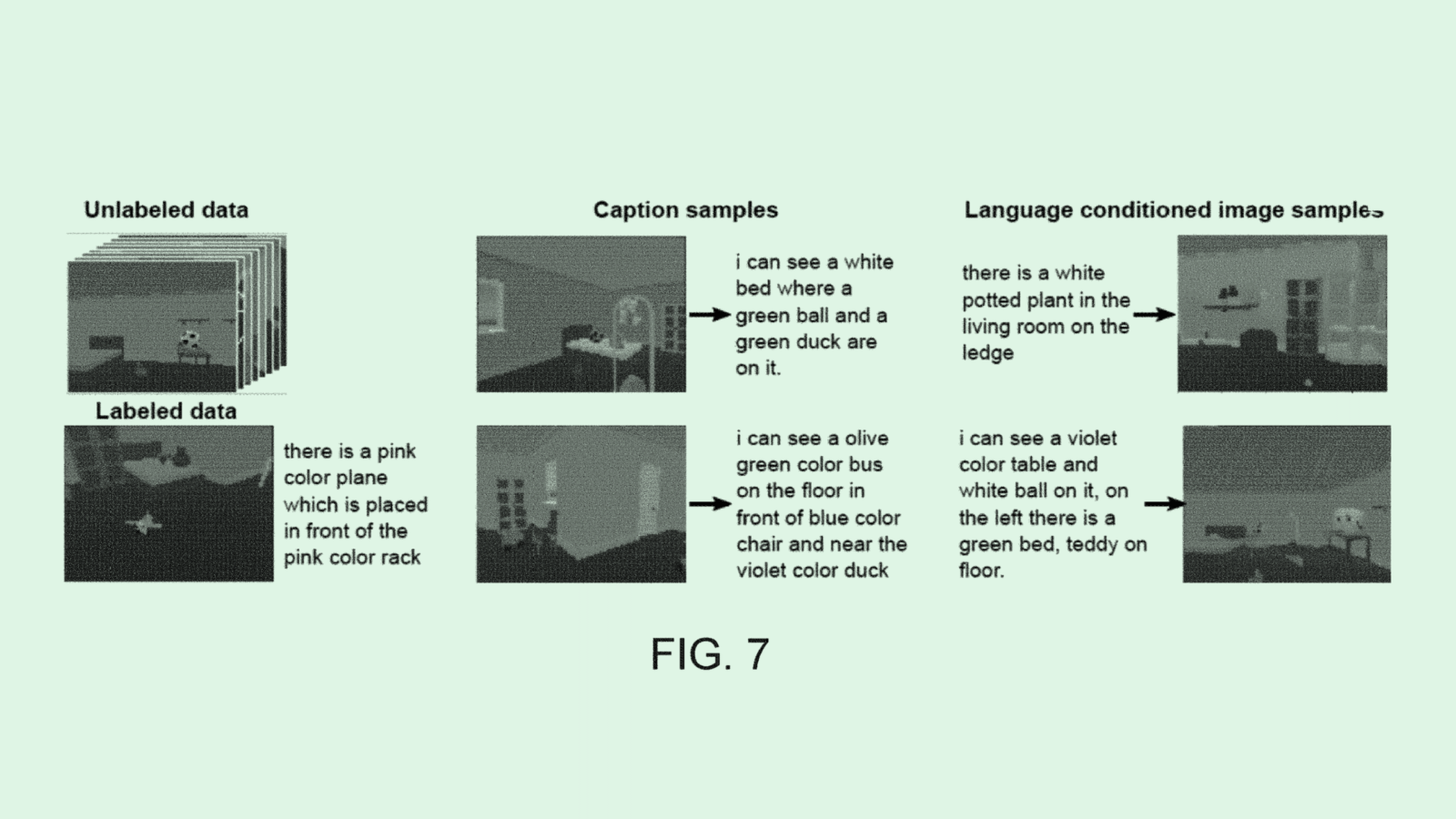

Building and running generative AI tools takes an extraordinary amount of power — enough to upend the modern electricity market — so Big Tech companies have been flocking toward the energy industry looking for ways to shore up future capacity and stay in the genAI arms race. Microsoft and OpenAI already had a penchant for nuclear power (Bill Gates and Sam Altman are both backers of nuclear power startups), and in recent months Amazon and Google have joined the uranium-laced party.

Big Tech has been trying its hardest to cut out the middleman and strike deals to spin up energy projects, but the energy industry — and nuclear energy in particular — is not built for companies that like to move fast and break things. The wider drive toward deals like Amazon’s appears to be on FERC Commissioner Mark Christie’s mind, as he wrote in the decision: “Were we to approve this proposal at this time […] we would be setting a precedent that would be used to justify identical or similar arrangements in future cases.” The FERC decision put a slight damper on the nuclear stock rally this year:

- Power producer Talen Energy, which sold Amazon the data center campus that would be powered by the nuclear plant, took a roughly 10% hit to its share price following the news on Friday, which fell another 2% on Monday.

- The contagion spread across the nuclear industry on Monday: The share price of Constellation Energy, which is seeking similar deals to Talen and has been one of the best-performing stocks on the Nasdaq this year, plummeted nearly 13%.

Still, not everyone is convinced that the nuclear boom is over. “I think it’s more than a hiccup,” Evan Caron, co-founder and CIO of climate-tech incubator Montauk Climate, told The Daily Upside. “I think it shows that the regulators are really thinking about how to balance significant additional load growth with the needs of the community and focusing on ratepayers, a balanced approach to growth, and making the big data center operators pay for their fair share.”

Industry Buzz: As stinging as the FERC setback may have been, it isn’t the only thing restricting Big Tech’s nuclear dreams. The Financial Times reported on Monday that Meta had plans to build an AI data center powered by nuclear power in the US, but they were scuppered by both regulatory and environmental concerns, including the fact that a rare species of bee made its home next to the proposed project site. Although radioactive bees sound like a great way to kick off a new superhero franchise, in real life they probably aren’t that fun.