Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

It’s been anything but a breeze for wind.

Siemens Energy, a major German player in the wind energy industry, told investors on Monday the losses at its wind turbine division will likely climb higher than previously thought. This comes amid broader financing turbulence in the wind industry, according to a report in The Wall Street Journal. One executive at energy company Equinor didn’t mince words talking to the WSJ: “At the moment, we are seeing the industry’s first crisis.”

Blowing in the Wind

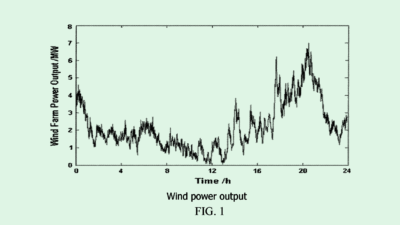

The cost of wind energy has fallen dramatically in recent years, Stephen Thomas, energy policy expert and emeritus professor at the University of Greenwich, told The Daily Upside. As an example, he pointed to the UK’s first major offshore wind farm contracts, which began in 2014 and were paid around £140 (approximately $224 at 2014 exchange rates) per megawatt hour. Indexed to inflation, that cost is now down to around £40 per megawatt hour. “I was frankly bewildered [by] the way prices came down,” Thomas said.

But wind projects represent a higher level of investor risk compared to good ol’ fossil fuels. “The only way renewables […] can be built is with contracts that take them out of the market and give them a guaranteed power purchase price,” Thomas said, adding: “if their costs of construction are higher than the ones their bid was based on, they are stuck with the contract price and will at best make less profit than expected, and at worst make a loss.”

Now, with a clutch of problems including abiding inflation and supply costs going up, some wind projects look like they might stall:

- According to the WSJ, at least 10 major offshore wind farm projects in the US and Europe worth a collective $33 billion have run into some kind of difficulty over the past few weeks.

- Siemens reported a loss of €712 million ($783 million) in 2022, and previously said it expected 2023 losses to be at most a few hundred million more. For its Q3 however, it reported a loss of €2.9 billion and CEO Christian Bruch described technical difficulties with its wind turbine blades as a “massive setback.”

Be There And Be Square: It’s probably not a huge surprise to our readers that bigger wind turbines create more energy, but exactly how the increase in energy production scales is pretty astonishing. “The power goes up with the square of the blade length, so if you double the blade length you get four times the amount of power, and if you triple the blade length you get nine times as much power” Thomas said, adding: “so there’s a very strong incentive to get as big as you possibly can.” So stop tilting at windmills and build bigger ones!