Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Zero-Covid hasn’t meant zero-cash for every Chinese company.

Chinese securities regulators have warned they will be keeping a watchful eye on the IPOs of companies that benefited from the country’s stringent “Zero-Covid” policy — just as major cities ratchet back into widespread lockdowns.

Tests And Takeaway

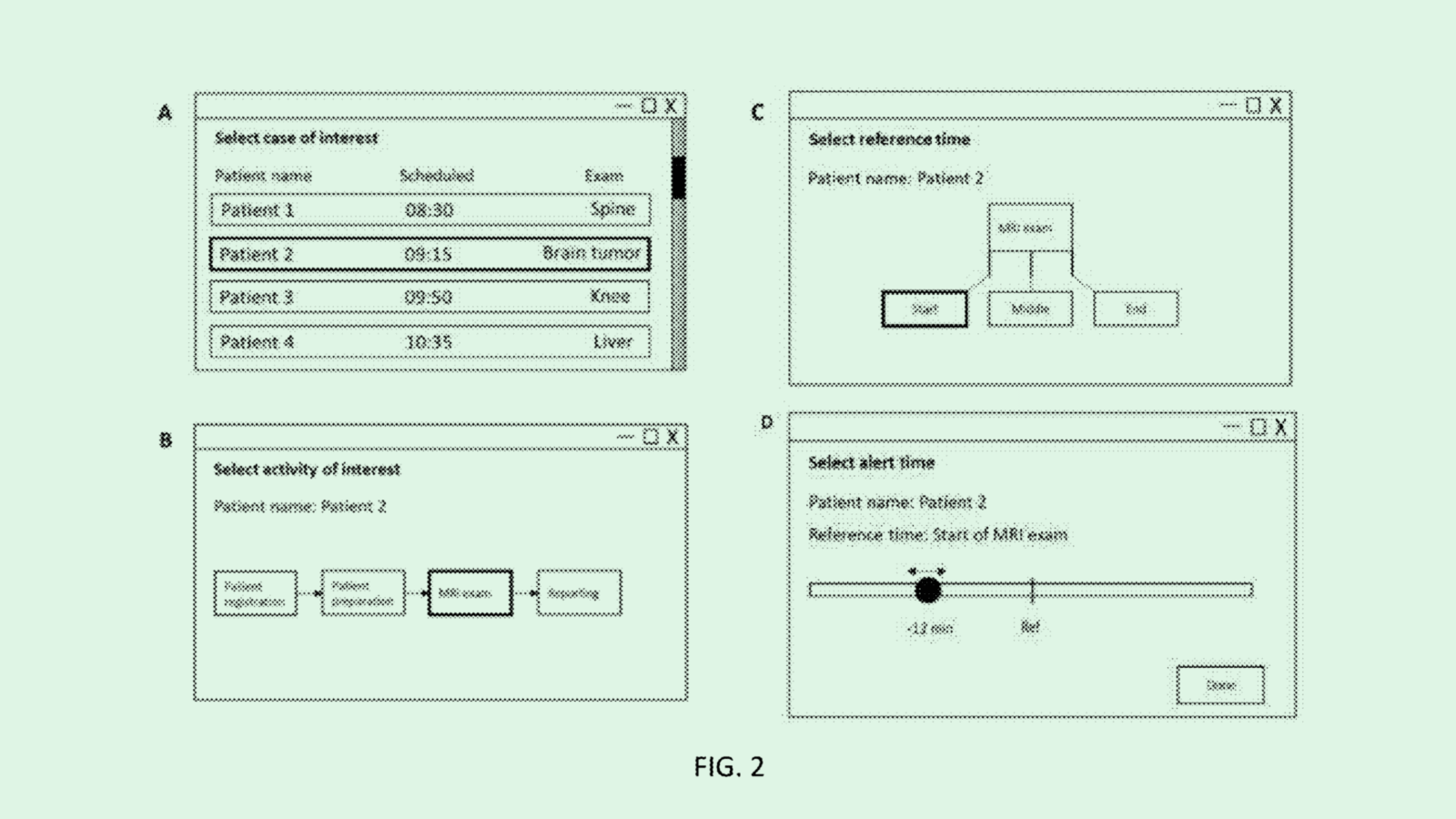

China’s covid cases reached a record high this week as the country remains trapped in a zero-covid lockdown cycle vicious enough to give the rest of the world 2020 PTSD. But while said policy has damaged China’s economy and trapped Disneyland visitors, a handful of companies have turned adversity into advantage, sparking the country’s IPO market to raise record highs of over $58 billion this year. Included in that figure are a clutch of companies that deal with Covid tests, as well as those that deliver food to citizens trapped indoors.

China’s stock exchanges are now seeking to mollify citizens incensed by ever more companies jumping on the IPO train to profit off their prolonged misery:

- The Shenzhen stock exchange said in a social media post: “We pay close attention to the listing applications of companies involved in nucleic acid testing, and insist on strict reviews, especially in the front of business sustainability.”

- To give a sense of just how big the bubble is, lockdown food supplier Pang Pang Xiang’s profit margin went up 74% from January to May 2022, overlapping with Shanghai’s lockdown.

No Picnic for Ant: Ant, meet Raid. Sources told Reuters that China is gearing up to impose a fine of over $1 billion on corporate giant Ant Group whose planned $34 billion IPO was scuppered by the government in 2020, prompting co-founder Jack Ma to vanish from public view for ten months. Just a small reminder of what can happen when Beijing thinks a company needs a good wing-clipping.