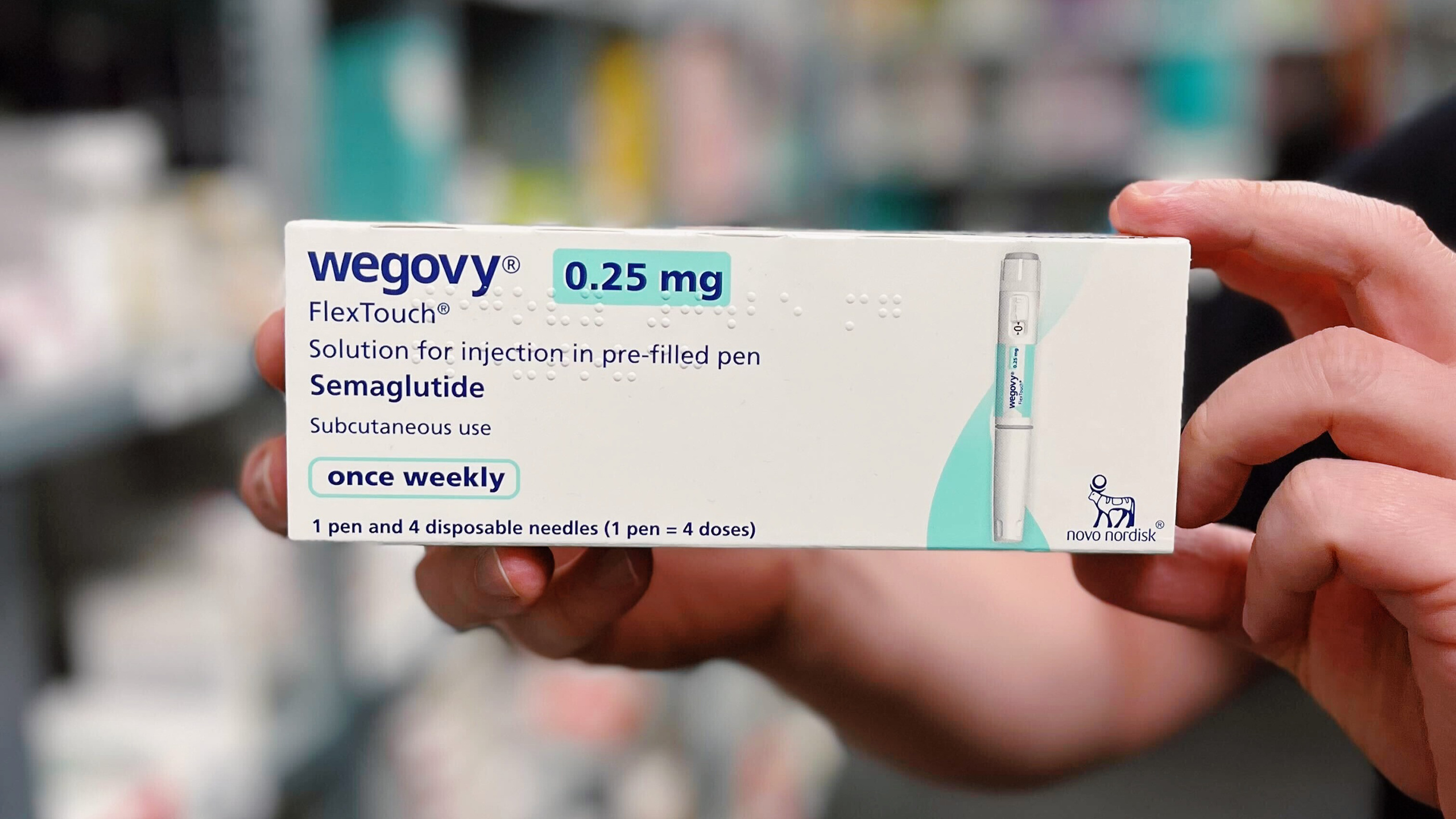

Wegovy-Maker Novo Teams with Online Pharmacies as Lilly Rivalry Heats Up

Novo Nordisk, maker of weight-loss drug Wegovy, struck a deal with online telehealth storefronts that sold cheap knockoffs during shortages.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

All it takes to change a pest to a partner is a signature on a dotted line.

Danish pharmaceutical giant Novo Nordisk, the maker of leading weight-loss drug Wegovy, is signing a deal with online telehealth storefronts that ate a chunk of its business selling cheap knockoffs during shortages last year.

Slimmed-Down Offering

Novo Nordisk’s strategic partnerships with telehealth providers represent an aggressive bid to secure market dominance against key rival Eli Lilly, manufacturer of the competing GLP-1 weight loss medication Zepbound.

Novo has been saddled with the perception that Lilly’s pipeline looks much stronger, which has helped drag NY-listed Novo shares down 24% this year. The company’s next-generation weight loss treatment CagriSema has disappointed in trials, while Lilly has a GLP-1 drug in pill form that it expects to be approved this year that would be a game changer (current treatments require injections). BMO Capital Markets analysts said earlier this month that, after Lilly grew revenue 32% last year and Novo 26%, they expect Lilly to leave its rival in the dust in 2025 with another 32% increase compared with only 16% to 24% for Novo.

Last year, the two firms’ grip on the market took a dent when Hims & Hers and other telehealth firms were allowed to sell cheaper copycat versions of their brand-name juggernauts made by compounding pharmacies during a shortage — but Novo and Lilly have caught up on supply and the Food and Drug Administration has ordered the compounding pharmacies to stop by May 22. Novo teaming with the telehealth firms suggests it’s looking to claim additional market share as the compound knockoff tide recedes:

- Novo plans to let three telehealth companies — Hims & Hers, LifeMD, and Ro — sell Wegovy to patients at a major discount: as opposed to the drug’s $1,349 per month list price, Hims will charge $599 per month (which it says “includes access to 24/7 care, ongoing clinical support, and nutrition guidance”) while LifeMD and Ro will charge $499 with no such bells and whistles.

- That’s still considerably higher than the compounded version of Wegovy, which telehealth firms were able to sell for $165 per month. Nevertheless, markets saw it as a big win for the companies: Hims stock climbed 23% Tuesday and LifeMD gained 41% (Ro is privately held). Novo rose a comparatively muted 4%, but could benefit more along with Lilly when the knockoffs stop in late May.

Dissenting View: While Lilly, whose stock is up 14% this year, has been a consensus market darling, analysts at one firm broke ranks on Monday: HSBC downgraded the company from “Buy” to “Reduce,” making it the only firm with a sell rating on the stock. The rationale: Wall Street’s simply too giddy, and both Novo and Lilly have missed earnings expectations in the last year thanks to overeager estimates. Weigh your investments accordingly.