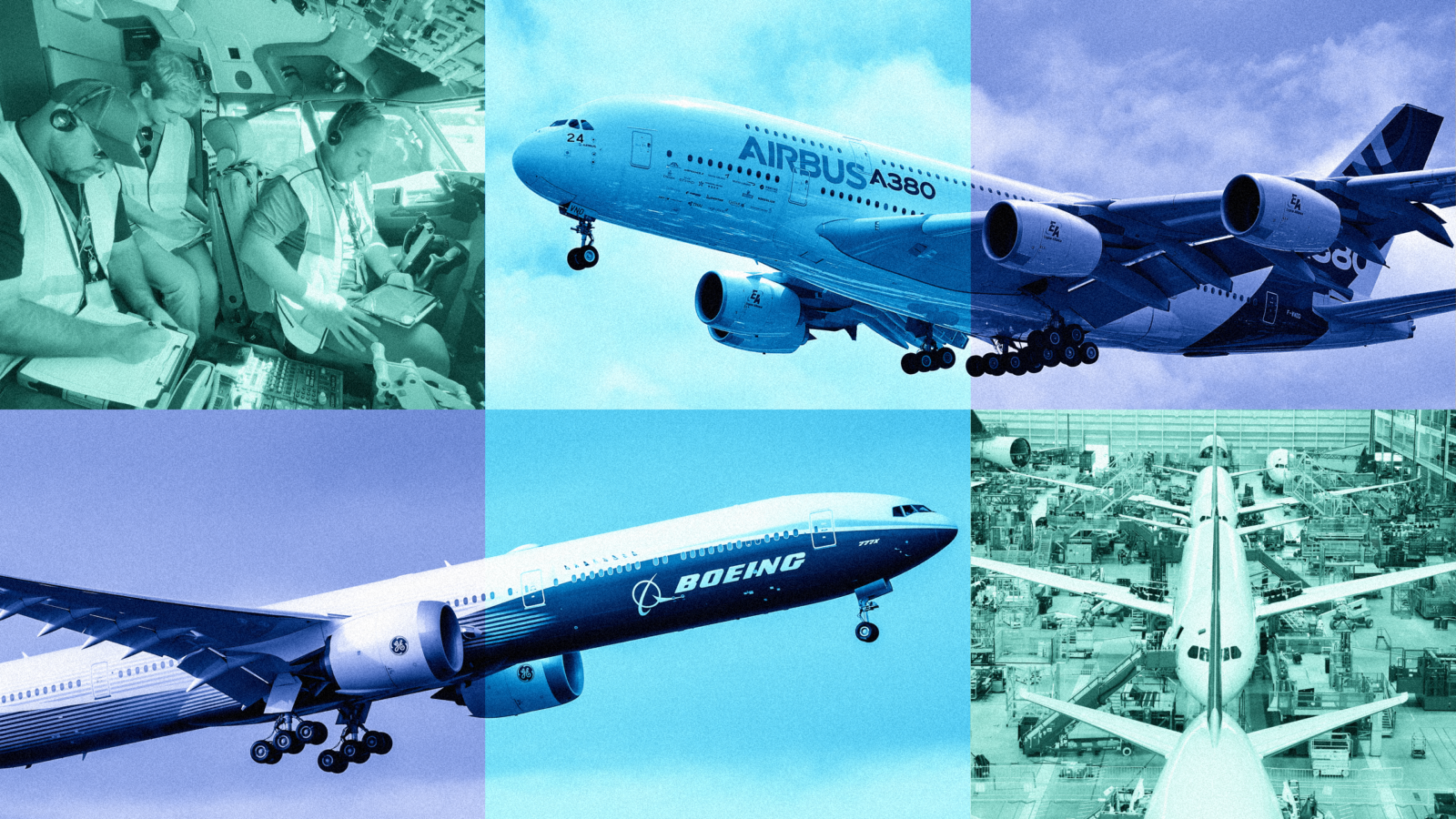

Boeing Charts Flight to Positive Cash Flow as Archrival Airbus Hits Turbulence

The rosy projections sent Boeing shares up more than 10% on Tuesday, rubbing salt in the wounds of its archrival Airbus.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Up is suddenly down in the world of aviation. And no, we’re not talking about pilot controls or making a cryptic Stranger Things reference.

On Tuesday, Boeing’s CFO said the company has finally achieved escape velocity from its turbulent recent history, projecting billions in free cash flow next year. The good news comes just after rival Airbus hit a quality control rough patch of its own.

Headwinds, Tailwinds

In case anyone forgot, Boeing is just a year or two removed from an epic tailspin that featured disasters, near-disasters, whistleblowers, modestly terrifying results from a Federal Aviation Administration safety audit and a prolonged worker strike. As a result, the company hasn’t turned an annual profit since 2018 and is on track for a $2 billion cash burn this year despite looking at its highest annual delivery total in seven years. Now? CFO Jay Malave told an investor conference the company is on course for free cash flow in the “low single digit” billions of dollars next year, thanks to improvements in its production cadence. Eventually, Malave says the company will hit the $10 billion free cash flow cruising altitude that executives had previously promised for 2025.

The rosy projections sent Boeing shares up more than 10% on Tuesday, rubbing salt in the wounds of its archrival. On Monday, Airbus confirmed a Reuters report that it is facing quality problems on fuselage panels on some of its A320-family jets, which just so happen to have flown past Boeing’s 737 this year as history’s most delivered jetliner. The industrial problem came after Airbus was forced to ground 6,000 A320 aircraft for a software update; its shares have plummeted roughly 10% in the past month.

Still, as Boeing regains ground on its chief rival, years of negative headlines remain a drag on its top-flight speed:

- Boeing still expects to face a significant fine from the US Department of Justice next year as it resolves a case born from the two fatal crashes of its 737 Max in 2018 and 2019.

- Meanwhile, Malave also said on Tuesday that commercial service certification for its 737 Max 10 planes is unlikely to come until late next year, pushing some scheduled deliveries into 2027.

Trans-Pacific Flight: And just as Boeing gets the wind beneath its wings, a new challenger is taking flight. Last month, the Chinese state-owned aerospace firm COMAC took its long-awaited C919 aircraft, a Boeing 737 competitor, to the Dubai Air Show. It’s part of a push to sell the plane in various global markets as it continues to lack certification from Western regulators.