Industries

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

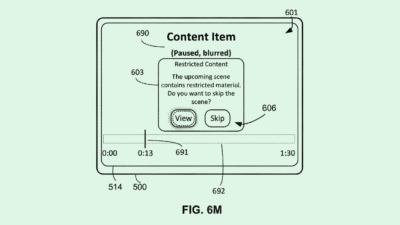

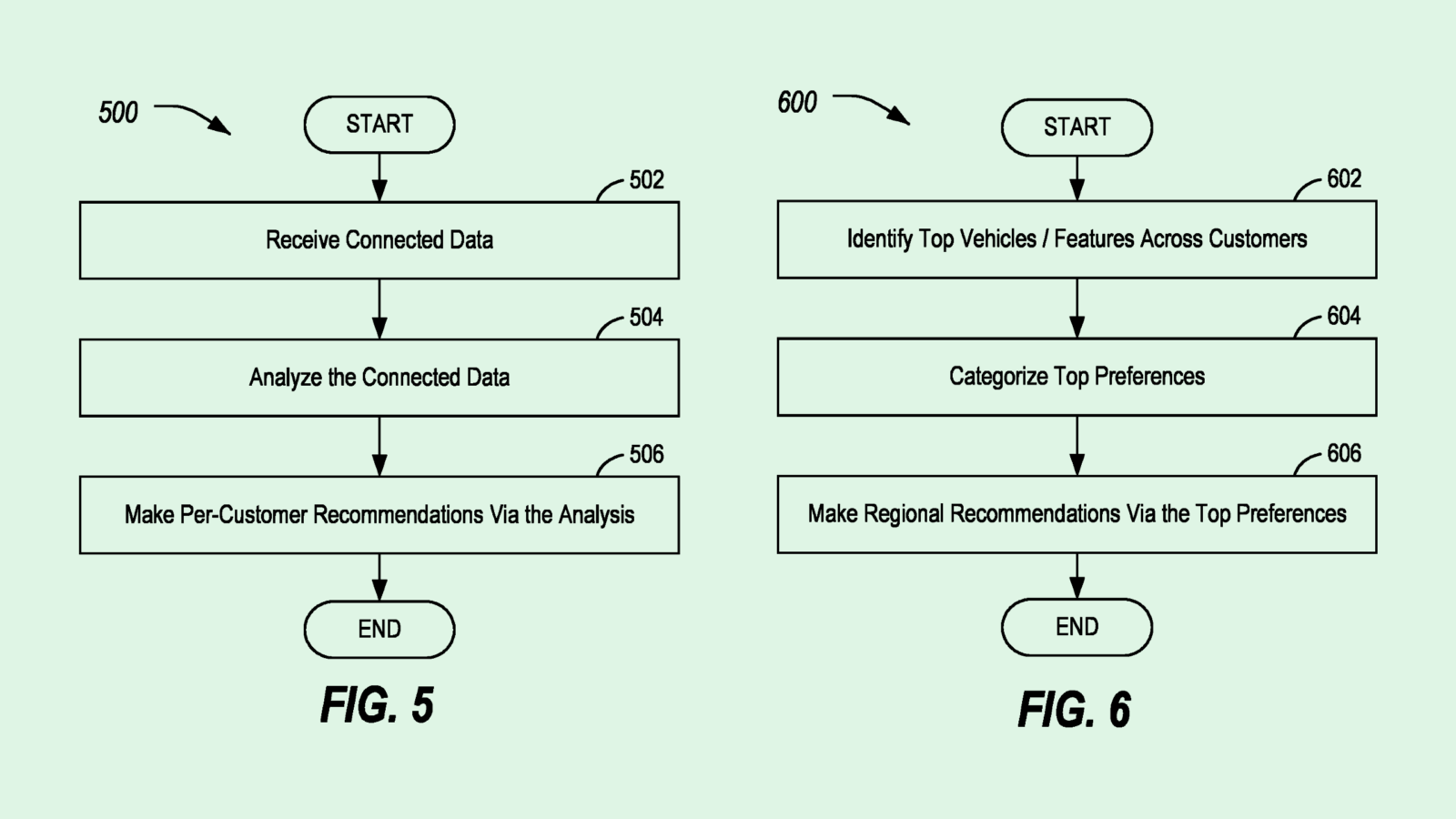

Ford Wants to Track Your Test Drive

Photo via U.S. Patent and Trademark Office

-

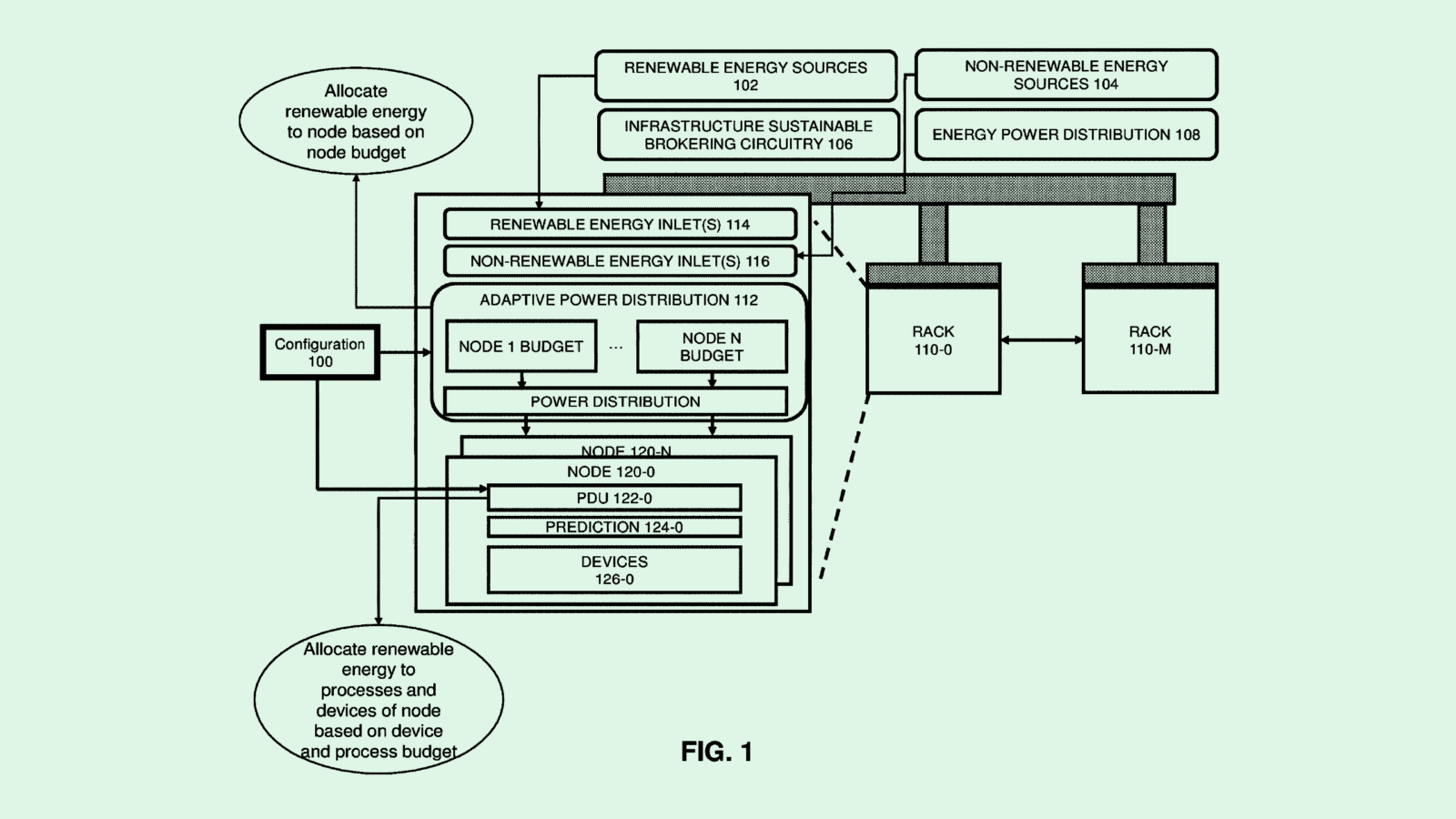

Intel’s Patent Could Help Data Centers Budget Their Energy Use

Photo via U.S. Patent and Trademark Office