Investments

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

Buffett’s Berkshire’s Short Term Interest Rate Path Differs From Megarich Peers

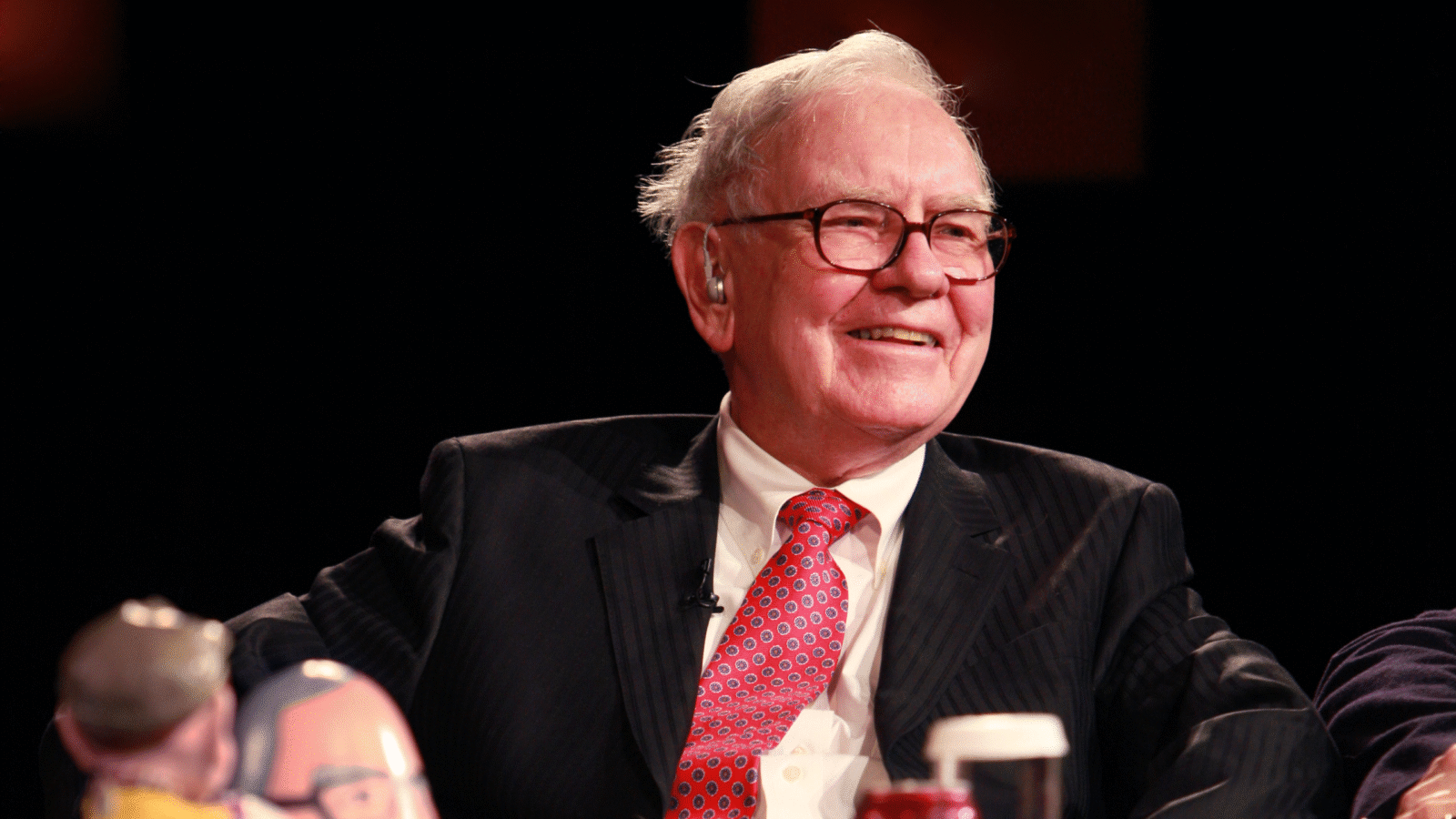

Photo via Lu Beifeng/VCG/Newscom

-

Berkshire Slips Amid Concern Retiring CEO May Take “Buffett Premium” With Him

Photo via Dennis Van Tine/ZUMAPRESS/Newscom