Investments

-

Financial Advisors Are On the Fence About Bitcoin ETFs

Photo illustration by Connor Lin / The Daily Upside, Photo by Layerace via Freepik

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

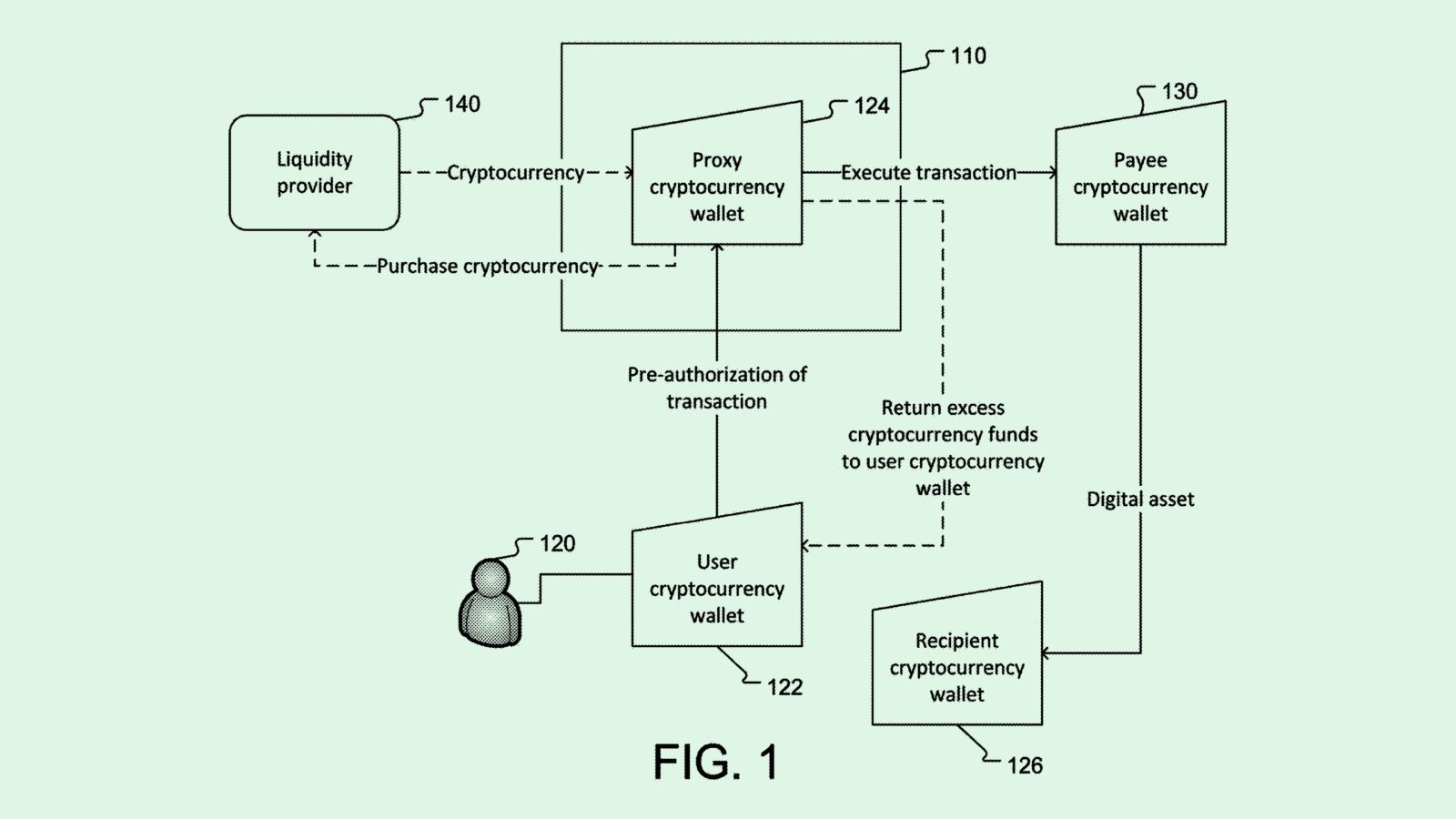

Stripe Seeks Blockchain Patent As it Plays Crypto Catch-up

Photo via U.S. Patent and Trademark Office

-

Robinhood’s Crypto Unit Receives SEC Wells Notice

Photo via Connor Lin / The Daily Upside