Grayscale’s CEO Steps Down as Investors Bail on Bitcoin Fund

Grayscale’s ETF charges a fee of 1.5%, while many of its rivals have continuously slashed fees down to almost nothing.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

It’s a Monkey’s Paw parable straight out of Tales from the Crypt(o).

Less than nine months after Grayscale Investments won a lengthy court battle against the SEC to start offering a spot Bitcoin ETF to the public, its CEO has departed and its flagship fund is losing ground to several rivals.

Fee-Fi-Fo-Fudge

The early days of crypto were heady times for Grayscale. Before the legal victory to transition to a spot Bitcoin ETF, its Grayscale Bitcoin Trust had a first-mover advantage as one of the few ways that investors could bet on Bitcoin without having to buy the cryptocurrency itself. But the idea of a spot ETF — with funds tying prices to Bitcoin they actually own and offering easier redemptions for investors — was so straightforward and appealing that it made sense to force the issue in court. To be fair, the SEC has long been suspicious of crypto, not the least because security issues like this seem to happen all the time.

Unfortunately for Grayscale, that first-mover advantage disappeared quickly:

- The Wall Street Journal said Monday investors have pulled more than $17 billion since the conversion to an ETF in January. Meanwhile, nine new Bitcoin ETFs, including those from BlackRock and Fidelity, have seen inflows of more than $30 billion.

- It seemingly all comes down to fees. Grayscale’s ETF charges a fee of 1.5%, while many of its rivals have continuously slashed fees down to almost nothing.

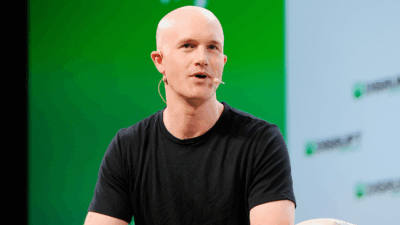

CEO Michael Sonnenshein has stepped down after about three years on the job. The WSJ said sources disclosed that a search for a new CEO had begun in late 2023 but wasn’t related to the fund’s performance or outflows. It also reported that Sonnenshein had previously said he wasn’t worried about the investor exodus, but maybe he should have been?

Legal Loophole: The irony of the fee war is that Bitcoin ETF providers can technically charge high fees without regulatory oversight because they’re not considered providers of “normal securities” and thus not covered by the fiduciary-duty obligations of the Investment Company Act of 1940, as a recent Barron’s piece pointed out. Fortunately, investors are solving the problem themselves.