Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Just three weeks ago, a Bloomberg headline read: “Out of the Woods? The S&P 500 Recovers 50% of Year’s Drawdown.” The market was ripping higher and seemed poised to “get a lot more believers in,” as an analyst from B. Riley put it.

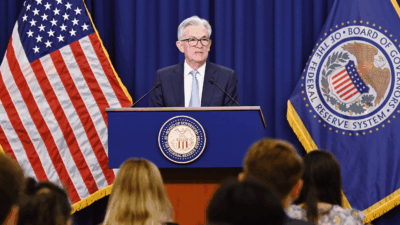

Now we’re not just back in the woods. It’s the Blair Witch Project after Fed Chair Jerome Powell took center stage in woodsy Jackson Hole, promising to take “forceful and rapid” steps to tackle inflation, which remains four times higher than the long-term target.

Since he uttered those unflinching words, stocks have fallen each and every day, and believers are in short supply. Here’s a breakdown of the fallout.

Nightmare on Elm Street: Housing affordability was already at record lows, and with aggressive rate hikes likely, rates on the average 30-year fixed-rate mortgage jumped to 5.66% this week, up from 5.55% last week and way up from 2.87% one year ago. According to Freddie Mac, the rise in rates adds $509 to the average mortgage payment. There is only so far a family can financially stretch for a white picket fence, and earlier this week a Goldman Sachs report predicted sharp declines in new and existing home sales, in large part driven by unaffordability.

Tight Squeeze: On Wall Street, a late afternoon rally snapped a four-day losing streak for the S&P 500 and Dow Jones Industrial Average. But global equities markets are still down as institutional investors slowly wise up to The Fed’s aggressive cycle of quantitative tightening. With its balance sheet doubling to $8.8 trillion since March 2020, the Fed is now slashing its holdings by as much as $95 billion per month.. Through quantitative easing, The Fed buoyed the stock market and so-called risk assets by snapping up US treasuries and mortgage-backed securities. Now, as Société Générale and others point out, QT could deliver the opposite effect.

The Almighty Dollar: That’s not to say the US economy is a Boschian hellscape. The Greenback has seen three consecutive months of gains and is now sitting at a 20-year high vs. peer currencies, with the dollar index up 14% this year. Capital with no local allegiances tends to flow where it’s treated best, and with higher rates — and what many economists consider a stronger economy than energy-starved Europe — the US appears relatively well off. As Jane Foley, head of FX strategy at Rabobank posed to the FT, “If you’re going to sell the dollar, what are you going to buy?”

So, where do we go from here? Jeremy Grantham, co-founder of asset manager GMO, made waves on the internet yesterday predicting an “epic finale” to the current “superbubble,” claiming the market “features an unprecedentedly dangerous mix of cross-asset overvaluation.” But not everyone is quite so terrified. Many economists believe a so-called growth recession — a protracted period of below-optimal growth but not a true recession — could make the woods a lot less scary.