Lebron James’ SpringHill Co. Sells Minority Stake at $725 Million Valuation

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

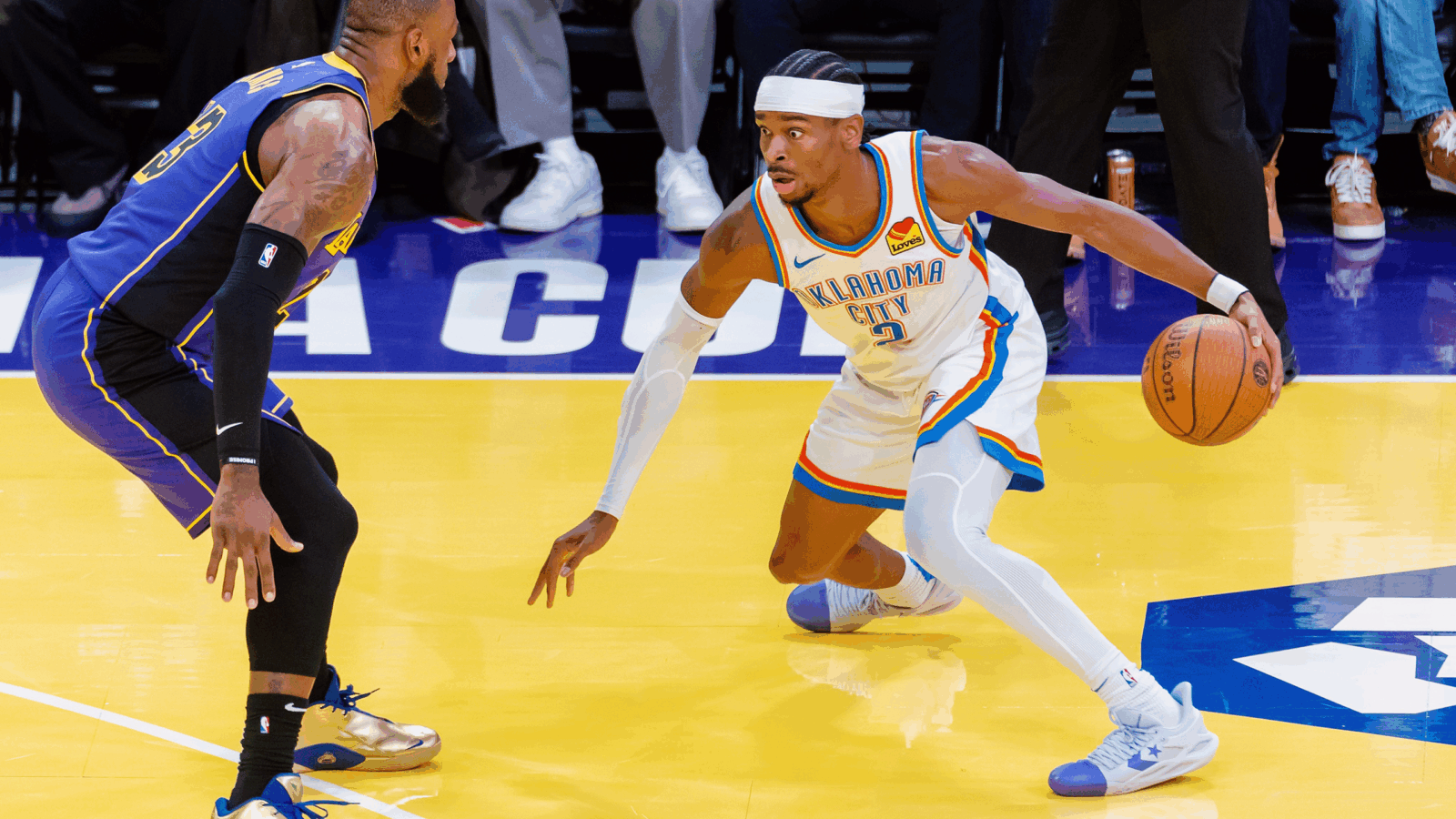

Lebron James conquers all. On the court, he’s vanquished contemporary NBA legends like Tim Duncan, Kevin Durant, and Steph Curry. At 36, and still one of the best in the league, James is even dunking on Father Time.

And now, King James is making it rain in Hollywood — on Thursday, his entertainment company scored an infusion of capital from some big names, in a deal that values the business at a cool $725 million.

All-Star Investors

With “Space Jam: A New Legacy” in the bag and popular HBO talk show “The Shop” still airing, Lebron’s multimedia production house, SpringHill Co., is looking to launch new projects. But first, the group — which was co-founded by Lebron’s business partner Maverick Carter, and boasts Serena Williams on its board of directors — went hunting for new capital.

On Thursday, SpringHill announced it had sold a minority stake to a consortium of investors. Just like in the NBA, Lebron has a knack for surrounding himself with all-star talent to help carry out his mission:

- Investors include Nike, RedBird Capital, Epic Games (creators of your kids’ favorite video game, Fortnite), and Fenway Sports Group — the umbrella company that owns the Boston Red Sox and English Premier League team Liverpool F.C.

- With an upcoming content slate that includes shows and movies for Netflix, CBS, and HBO Max, SpringHill expects to earn more than $100 million in revenue over the next four quarters, an insider told The Wall Street Journal, and between $150 and $200 million in 2022.

Give-And-Go: This is the second partnership between SpringHill and Epic Games, following an agreement this past summer that saw LeBron appear as a playable character in Fortnite. Now, SpringHill is set to create content associated with the video-game sensation, along with Epic’s other titles.

Heating Up: SpringHill isn’t the only recent tangle-up of sports and capital. On Thursday, Axios reported that Arctos, a private equity group with a pro sports-team focus, raised over $3 billion in investor commitments. Early rumors suggest most of it is already committed to minority stakes in teams including the Golden State Warriors and the Red Sox.