Good morning.

Welp, that didn’t go according to plan.

JPMorgan Chase alleged that a former rainmaking advisor, Edward Turley, had unjustly enriched himself by “brazenly lying” to the firm over several years. Turley has had some dozen customer complaints filed against him since 2020, resulting in tens of millions of dollars in awards to clients, according to BrokerCheck records. He was barred in 2022.

Still, a Finra arbitration panel denied JPMorgan’s request for nearly $40 million in damages and now the brokerage owes the former advisor $520,000 in lawyer fees and other costs. On Turley’s track record alone, you would think JPMorgan had the edge. Hey, any given Sunday.

FINRA Faces Big Battles in 2025

It’s shaping up to be a long year for the Financial Industry Regulatory Authority.

The Wall Street watchdog is facing two lawsuits and criticism from lawmakers on both sides of the aisle that claim the agency is inefficient, ineffective, and even unconstitutional. Sen. Elizabeth Warren asked “is anyone working?” in a letter to the agency last year after her office found enforcement cases plummeted to their lowest level on record. Citing budget concerns, Project 2025, a GOP-backed report that has links to the incoming Trump administration, floated axing the organization altogether. Oof.

Making matters worse, a federal court limited FINRA’s ability to expel its own members and an unrelated suit is questioning the constitutionality of its enforcement. It could prove to be an impactful year for the regulator and one that could define the future of the agency itself. “Chipping away at enforcement seems like a likely avenue,” said Adam Gana, a securities attorney at Gana Weinstein. “You’re going to start to see erosion at the edges.”

Is FINRA Even Constitutional, Bro?

The most recent developments came in November when a group of three federal judges sided in part with Utah-based Alpine Securities, which argued FINRA’s move to expel the firm via an in-house enforcement system was unconstitutional. The court ruled that Alpine would face “irreparable harm” if FINRA was allowed to move forward and imposed future reviews by the Securities and Exchange Commission on expedited expulsions. The court did not address the constitutionality argument.

“FINRA really dodged a bullet,” Gana said. In July, a separate suit also claimed the enforcement process is unconstitutional because it doesn’t let members have their day in court. There’s a real possibility the upcoming rulings could crimp FINRA’s powers of enforcement, especially as a Republican administration looks to deregulate the industry, he said.

“FINRA remains confident that the self-regulatory model will continue … as it has for more than 200 years,” a FINRA spokesperson said.

Play Nice, Everybody. While the legal cases may take years to settle, that hasn’t stopped lawmakers from asking pressing questions. According to the Warren report, FINRA took “the cop off the beat” in 2023:

- FINRA expelled just five members, suspended 257 brokers, and barred 178.

- Fines for members dropped to just $88.4 million, down almost half from the $174 million imposed in 2016.

- Meanwhile, compensation and benefits for FINRA employees jumped to $233,500 in 2023, up 4.7% from the previous year, according to the agency’s annual report.

Gana says any changes to the regulator will likely come through the courts. Lawmakers are unlikely to find common ground to push new rules through Congress and a strong finance industry lobby in Washington will make it even more challenging. “The question becomes: What does the future of FINRA look like?” Gana said. “We’re years away.”

Kick Off 2025 With a Streamlined Process for Financial Planning

The value of financial planning comes from delivering actionable and sage advice to your clients. As such, your time should be spent designing and delivering that advice (read: not spent fumbling through onboarding and chasing down client docs).

After all, time is your greatest resource, and keeping clients happy is your biggest goal.

That is why the eMoney team put together three separate workflows to walk you through the most efficient way to onboard a client and begin the process of creating a successful financial plan.

Get tips on how to implement strategies that will help you with:

- Gathering new client information with a lead capture form.

- Conducting an assessment to evaluate whether your client is on track or falling short of their retirement goals.

- Hosting an introductory meeting to help your client set up their client portal.

Download the “3 Workflows for a More Efficient Financial Planning Process”.

Allan Roth: Lessons from a Surprising 2024

2024’s in the books. Though the Santa Claus rally didn’t materialize, it was still a great year for US stocks, gold, and Bitcoin. We’re all wondering what 2025 will bring, but before I get into that, let’s learn from what last year taught us.

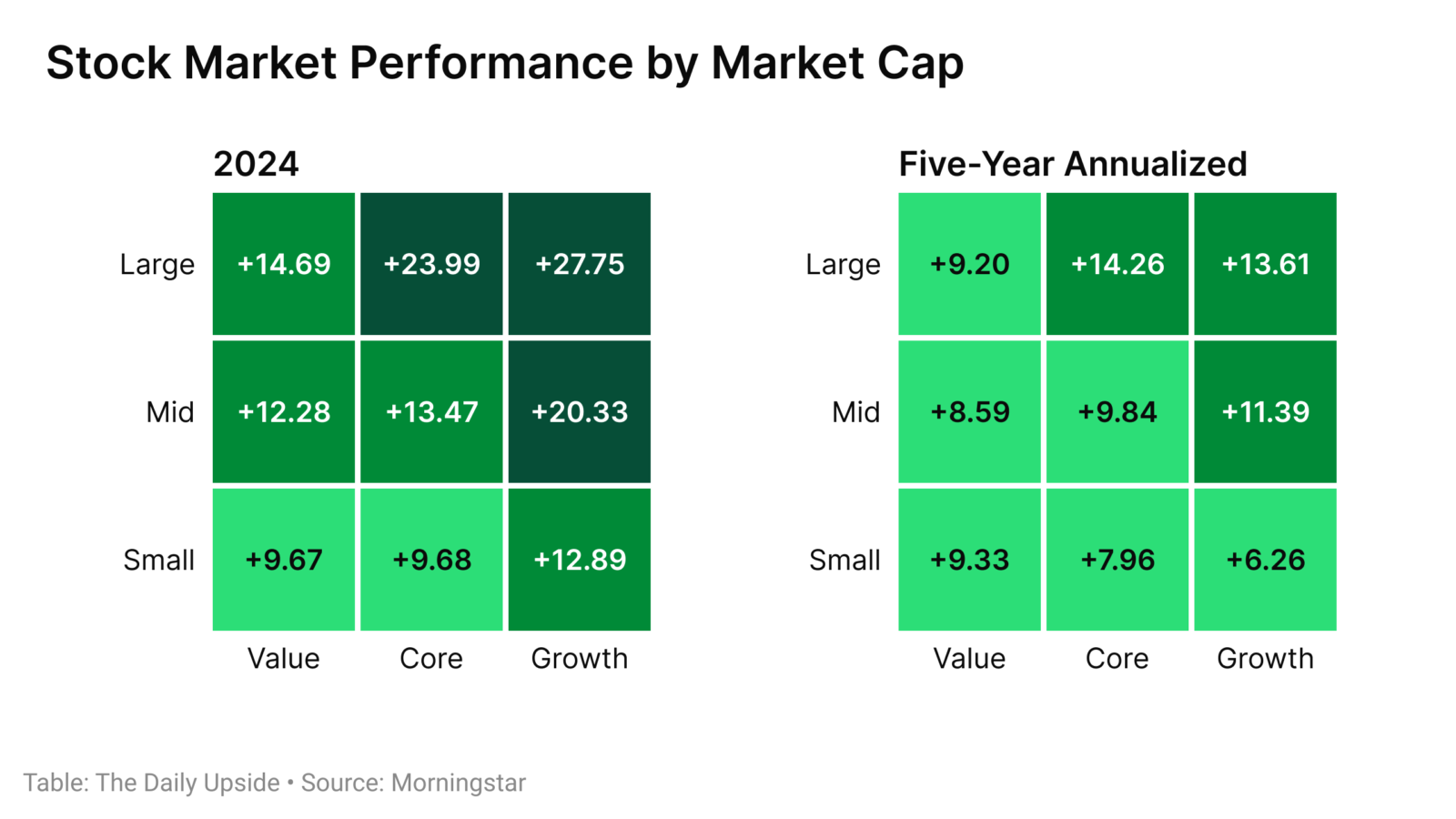

US stocks trounced international ones, just as they have over the past five years — and even longer. This performance was driven by the same large cap growth companies that have also driven the market over the past five years. Value and small cap stocks lagged again.

Because of the explosion of the mega-cap growth stocks, the “Magnificent 7” now have a combined value of $18.49 trillion or 29% of the total US stock market. In fact, the Vanguard Total Stock ETF had to issue a disclosure that there is a non-diversification risk due to this concentration.

International stocks have badly lagged the US. While even explaining the past is guesswork, the concentration of tech (including AI), a surging dollar, and wars in Ukraine and the Middle East are my best guesses as parts of the cause.

Champing at the Bit

Bonds have had what some people say is horrible performance, gaining only 1.38% last year and losing 0.33% annually over the past five. I say the performance has been outstanding as it was due to interest rates surging, rather than bankruptcies. As the Federal Reserve cut the Fed Funds rate by a full percentage point, the 10-year Treasury rate rose from 3.88% to 4.58% in 2024. The performance is outstanding because we can now earn returns well above inflation expectations.

Gold is shining again with a 26.66% rise in 2024 and a 11.12% annualized return over the past five years. I’d love to offer an explanation but it’s merely supply and demand. (I bought gold in 1980 that hasn’t even kept up with inflation.)

Finally, you’d have to be sleeping under a log to have missed Bitcoin surging, up nearly 10-fold over the past five years. It more than doubled this year as the crypto craze hit new heights. Like gold, there is no intrinsic value as it doesn’t produce cash, like stocks and bonds do. Is it a bubble and, if so, will it crash? I know I don’t know. Bitcoin now has a $1.93 trillion market capitalization. While that’s a huge number, it’s barely half that of the most valuable individual single stock – Apple. Will Bitcoin become the new digital gold? I don’t know, but remember my gold lagged inflation over the past 44 years.

- 4 Key Drivers to launch your enterprise transformation

Less Than Half of RIAs Have Successions Plans

Clients aren’t the only ones who can fall behind on retirement planning.

Less than half of independent advisors said they have a written succession plan in place to help pass on their business once they retire, according to a recent report from DeVoe & Co. The 42% that have written plans marks a record low for the industry since the M&A consultancy started tracking the data in 2019. Even worse, one in three firms admitted leadership transitions would be “bumpy” at best.

“The consequences can be severe,” said CEO Dave DeVoe, adding that operational disruptions could lead to lost clients and lower firm valuations.

What’s the Plan?

The record lows are partly due to the RIA industry’s own success. As valuations continue to increase, advisors feel they just can’t afford to buy out their firms’ founders. Unable to secure an internal transition, RIA leaders have been giving up succession plans altogether, according to the report.

Preparing your firm for the next generation also requires plenty of expertise that many advisors simply don’t have. Principals often start succession plans but simply get overwhelmed when considering the major life changes surrounding retirement and beyond. It’s a complicated process both mentally and emotionally, the report found.

“Succession planning isn’t just about preparing for retirement or leadership changes, it’s about building a sustainable business model that instills confidence among clients, retains top talent and protects the firm’s legacy,” DeVoe told The Daily Upside.

Don’t Worry. There’s good news, though. While many firms would prefer to transition internally, sometimes that’s not a viable option and they often end up selling to a larger firm. Luckily, larger firms generally have more robust succession plans in place. The DeVoe report found:

- RIAs with more than $1 billion in AUM are twice as likely to have a succession plan as firms with less than $1 billion.

- Some 30% of RIAs intend to draft a plan and 20% have drafted a plan but have not implemented it yet, both of which are improvements from 2021.

Advisors are at least thinking more seriously about planning, and that’s good for the industry as a whole. “A succession plan is not just an administrative necessity — it’s a strategic imperative,” DeVoe said.

Extra Upside

- Trump Bumped: Bond traders expect to take a hit during the second Trump term.

- Climate Change: JPMorgan is the sole major bank still in the United Nations’ Net-Zero Banking Alliance.

- Making the Jump to Independence? Betterment’s “How to Start an RIA” guide walks you through essential considerations like obtaining legal guidance and certifications, registering with the SEC, and setting up your tech stack. Read the guide today.*

* Partner

ICYMI

- Coming Down the Pike. What’s top of advisors’ minds for 2025?

- A Little Help from My Friends. How advisors aim to court the DIY investors of the world.

- Mag 7. The Nasdaq is on a run and so are the ETFs that track it.

Advisor Upside is edited by Sean Allocca. You can find him on LinkedIn.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.