FINRA Cases Hit Record Lows. Warren Wants Answers

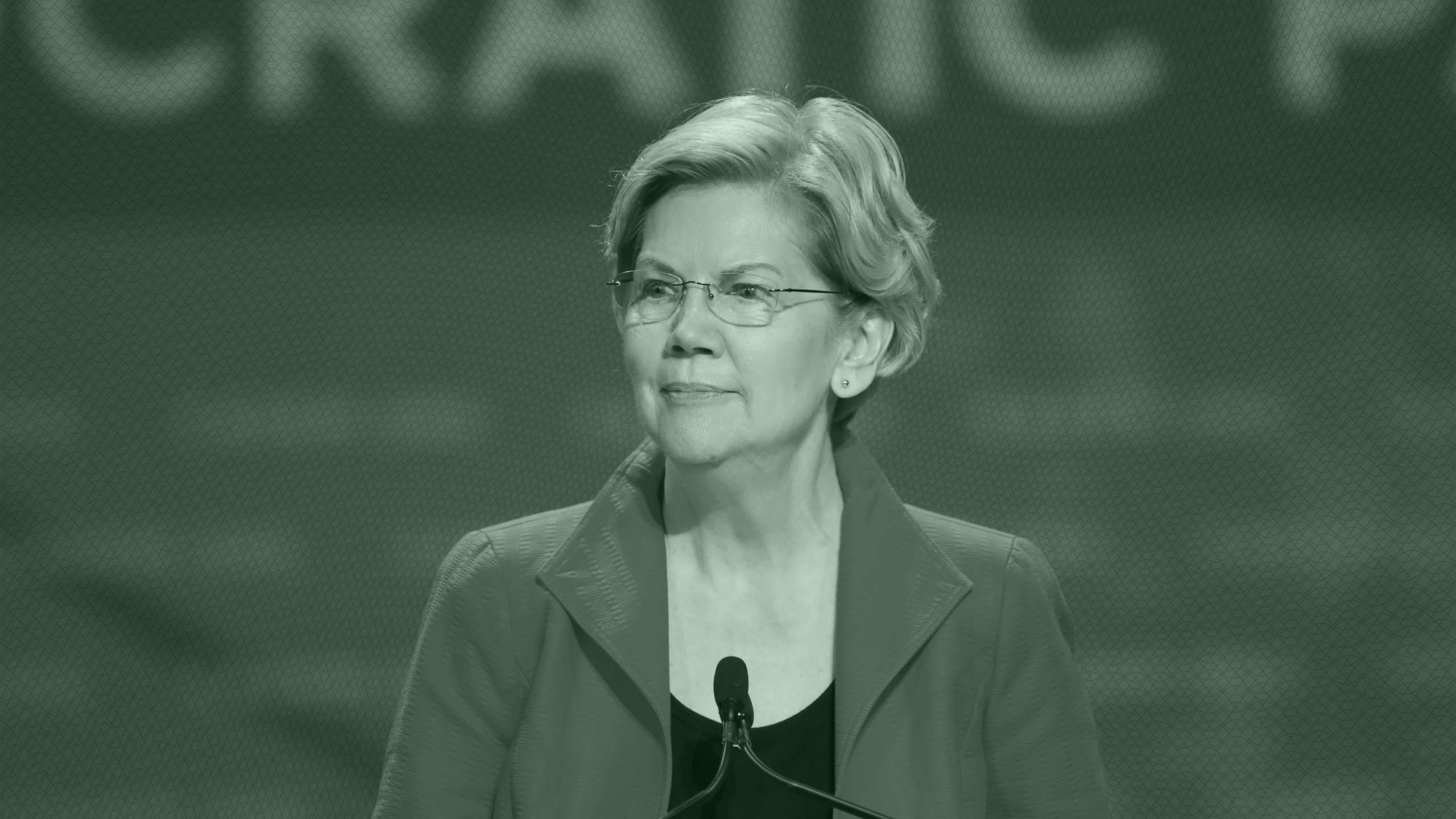

FINRA enforcement cases plummeted last year, sliding to the lowest level in the agency’s history, which caught the eye of Elizabeth Warren.

Sign up for market insights, wealth management practice essentials and industry updates.

One Wall Street regulator claims it’s doing more with less, but not everyone is buying in.

Enforcement cases brought by the Financial Industry Regulatory Authority plummeted last year, sliding to the lowest level in the agency’s history, according to a Bloomberg report. While fines ticked up last year, they made up only about half of what the agency brought in during a peak in 2016. Those brow-raising data points caught the eye, and ire, of Massachusetts Sen. Elizabeth Warren.

“This is a deeply troubling report,” Warren wrote in a letter to FINRA CEO Robert Cook. “I write today to seek an explanation.”

Off the Beat-en Path

There were just 426 enforcement actions carried out by the regulator in 2023, the lowest since FINRA was created in 2007, according to the letter. Fines imposed by FINRA for members that allegedly broke the rules have declined to just $88.4 million last year, down from $174 million in 2016. “Financial crimes cannot be prevented if you take the cop off the beat,” she wrote.

“Pointedly, FINRA is no longer the cop on the Wall Street beat, but, sadly, seems largely relegated to the role of a look-out for the industry’s larger firms,” said Bill Singer, a lawyer with more than 40 years’ experience in securities law.

Mo’ Money, Mo’ Problems: Meanwhile, headcount and employee salaries are on the rise. The total compensation and benefits for the 4,300 employees at FINRA in 2023 were, on average, $233,500 per worker, according to the self-regulatory organization’s annual report. That jumped by 4.7% from the previous year.

The calls over FINRA’s effectiveness are only getting louder. Project 2025, a conservative manifesto created by the right-leaning lobby group, unveiled plans to potentially abolish the agency if Republicans take over in November. FINRA now finds itself getting squeezed on both sides of the political aisle. A spokesperson said the agency is planning to respond to the senator’s critiques.

“The experiment of self-regulation is an abject failure with no justification for its continuance in 2024,” Singer said.

Is Less Really More? FINRA says it’s simply doing more with less. Although fines are down in recent years, FINRA said improved strategies and planning have streamlined its oversight, removing the need for more enforcement actions, according to Warren’s letter. Recent FINRA reporting outlined the progress at the agency:

- The self-regulator imposed $88.4 million in fines in 2023. The company also returned $7.5 million in restitution to harmed investors.

- FINRA expelled five members from the industry, suspended 257 brokers, and barred 178 brokers last year.