Allan Roth: Lessons from a Surprising 2024

The popular author and financial advisor weighs in on major market trends of last year, and takes a (speculative) peek ahead.

Sign up for market insights, wealth management practice essentials and industry updates.

2024’s in the books. Though the Santa Claus rally didn’t materialize, it was still a great year for US stocks, gold, and Bitcoin. We’re all wondering what 2025 will bring, but before I get into that, let’s learn from what last year taught us.

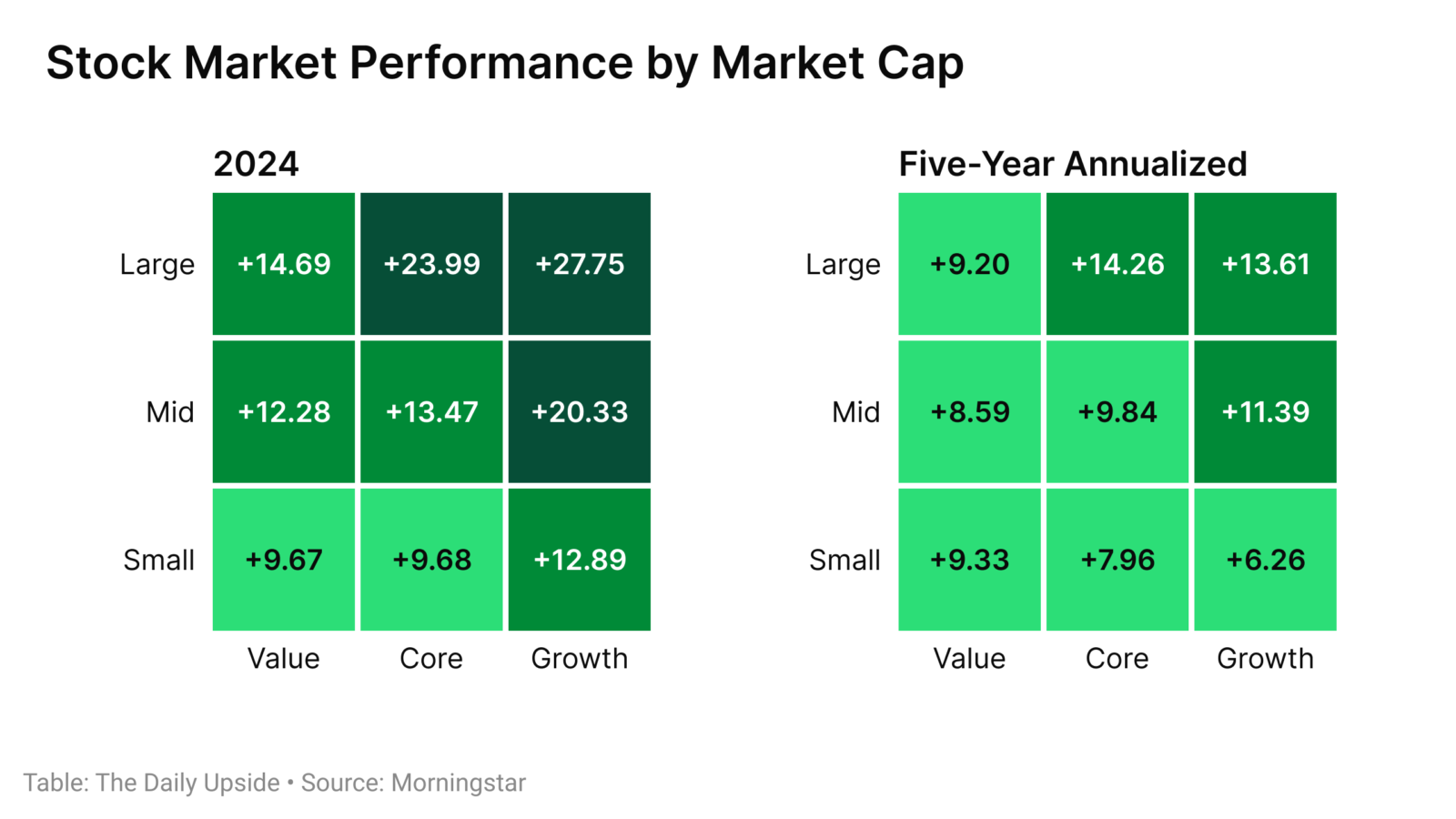

US stocks trounced international ones, just as they have over the past five years — and even longer. This performance was driven by the same large cap growth companies that have also driven the market over the past five years. Value and small cap stocks lagged again.

Because of the explosion of the mega-cap growth stocks, the “Magnificent 7” now have a combined value of $18.49 trillion or 29% of the total US stock market. In fact, the Vanguard Total Stock ETF had to issue a disclosure that there is a non-diversification risk due to this concentration.

International stocks have badly lagged the US. While even explaining the past is guesswork, the concentration of tech (including AI), a surging dollar, and wars in Ukraine and the Middle East are my best guesses as parts of the cause.

Champing at the Bit

Bonds have had what some people say is horrible performance, gaining only 1.38% last year and losing 0.33% annually over the past five. I say the performance has been outstanding as it was due to interest rates surging, rather than bankruptcies. As the Federal Reserve cut the Fed Funds rate by a full percentage point, the 10-year Treasury rate rose from 3.88% to 4.58% in 2024. The performance is outstanding because we can now earn returns well above inflation expectations.

Gold is shining again with a 26.66% rise in 2024 and a 11.12% annualized return over the past five years. I’d love to offer an explanation but it’s merely supply and demand. (I bought gold in 1980 that hasn’t even kept up with inflation.)

Finally, you’d have to be sleeping under a log to have missed Bitcoin surging, up nearly 10-fold over the past five years. It more than doubled this year as the crypto craze hit new heights. Like gold, there is no intrinsic value as it doesn’t produce cash, like stocks and bonds do. Is it a bubble and, if so, will it crash? I know I don’t know. Bitcoin now has a $1.93 trillion market capitalization. While that’s a huge number, it’s barely half that of the most valuable individual single stock – Apple. Will Bitcoin become the new digital gold? I don’t know, but remember my gold lagged inflation over the past 44 years.

What 2024 Can Teach US

I went back about a year and looked at some of the forecasts for 2024 made by some of the investment firms I most respect, like BlackRock, Morgan Stanley, and Vanguard. Below are some of their forecasts and incredibly compelling logic that turned out to be wrong.

- Valuations are most stretched in the US. As a result, we have downgraded our US equity return expectations to an annualized 4.2% to 6.2% over the next 10 years from 4.4% to 6.4% heading into 2023. Within the US market, value stocks are more attractive than they have been since late 2021, and small-capitalization stocks also appear attractive for the long term.

- Cash may be getting less attractive. With the Fed forecasting three interest rate cuts in 2024, we could start to see cash rates fall as soon as March. Unlike bonds, cash does not benefit at all from falling rates — it simply delivers a lower yield. The combination of high coupon rates and yields that are more likely to fall than rise should make for attractive bond returns.

- Favorite potential winners include smaller cap US quality companies, as well as companies in India, Mexico, and Japan.

I could go on and on with more of these forecasts but I found one nugget of valuable wisdom. 2023 was a humbling year for many in the asset management business. While the year ended on a high note, many of the highest conviction calls from the start of the year turned out to be wrong.

Of course, that didn’t stop firms from making predictions for 2024 that also turned out to be wrong.

Here’s to 2025

I think Jason Zweig at The Wall Street Journal said it best: We have an addiction to predictions as we try to make the world less uncertain. It’s lonely to feel like we have no control of the future but, for most things including investing, it happens to be true.

When someone asks me what I think the markets will do next year, I explain that I’m 100% certain that I absolutely don’t know, other than giving a midpoint estimate with a huge range. I explain that, while I’m good at predicting the past, I can’t even remotely explain it. I’m still waiting for a decent explanation as to why US stocks gained over 21% as COVID-19 hit in 2020, along with plenty of other horrible economic news.

My advice is to embrace uncertainty. Own every sector of every publicly held company on the planet, or at least as close as one can with a total US and total international stock index fund. I personally believe in market cap weighting as the only way to all but ensure I beat most investors. While I don’t like the current market concentration, I’m not smarter than the market. That concentration risk, however, is part of the reason I stay the course with international stocks.

And if I really did know what financial markets had in store for us in 2025, you’d find me on the Forbes 400 list rather than writing and advising. Trust me, I’m not on that list and never will be.

The views expressed in this op-ed are solely those of the author and do not necessarily reflect the opinions or policies of The Daily Upside, its editors, or any affiliated entities. Any information provided herein is for informational purposes only and should not be construed as professional advice. Readers are encouraged to seek independent advice or conduct their own research to form their own opinions.