Good morning.

America’s banking behemoths have long been wary of introducing cryptocurrencies to their clients. Now, they want to launch their own.

Some of the largest financial institutions, like JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, and others, could be on the verge of joining forces to launch a stablecoin, according to The Wall Street Journal. Major companies and retailers may start conducting transactions with stablecoins — digital versions of assets like the US dollar that can be traded on crypto markets — and America’s top banks want to be ready when that happens. Financial advisors are warming up to the idea of crypto, too, and laxer regulations have already started ushering in a new wave of adoption.

And here we were rooting for Pickle Token to become the currency of the future.

Vanguard’s Latest 10-Year Forecast Pits Global Debt vs. AI

The global economy just ain’t what it used to be. Probably.

Expanding levels of debt and the emergence of artificial intelligence are two issues that are expected to go head-to-head in world markets over the next decade, according to a new forecast of probabilities from Vanguard. The research found the traditional view on growth — namely, 2% increases to GDP annually combined with a 2% inflation rate — isn’t that likely to pan out. Instead, long-standing deficits are expected to pull down spending, while new AI business models could supercharge growth, said Joe Davis, Vanguard’s global chief economist. Which scenario actually plays out is anybody’s guess.

“I focused 10 years out, but we do this at every horizon,” Davis told Advisor Upside at a bell-ringing event at Nasdaq last week. “The diagnosis was very eye-opening.”

Disarm the Alarm

The forecast is pointing to two likely outcomes. The first is a deficits-dominated world where long-term, structural debt leads to higher interest rates, lower growth, and poor equity performance. High deficits of about 8% of GDP could push 10-year Treasury yields to as high as 9%, he said. There’s more than an 80% chance that yields top 7% if deficits continue to rise. “I would not want to be alarmist,” Davis said. “But I also don’t want policymakers to be complacent on it, and investors not to think that that’s not possible.”

We like the second scenario a lot better: an AI-driven productivity boom. While we’re still in the early innings, the technology could reshape entire industries and offset those economic headwinds, improve productivity, and support moderate inflation and growth, he said. “Even though we still have debt issues, we’ve kicked the can for another 10 years, just like we’ve done for the past 10.”

Other prominent issues Davis cited include:

- Aging global populations that could become less productive and more costly to governments.

- A shift toward de-globalization that could impact trade.

- Geopolitical tensions that could upend supply chains, and much more.

Send Help. The equity market is particularly vulnerable in a deficits-dominated scenario meaning financial advisors may want to lay off the growth stocks, especially in tech-heavy sectors. On the other hand, they may consider recommending that clients overweight value stocks and non-U.S. equities. But if AI wins out, Davis recommended buying non-growth stocks as the technology will help everyone increase productivity.

“There’s a way you can hedge these risks a little bit better,” Davis said. “You don’t have to be clairvoyant.”

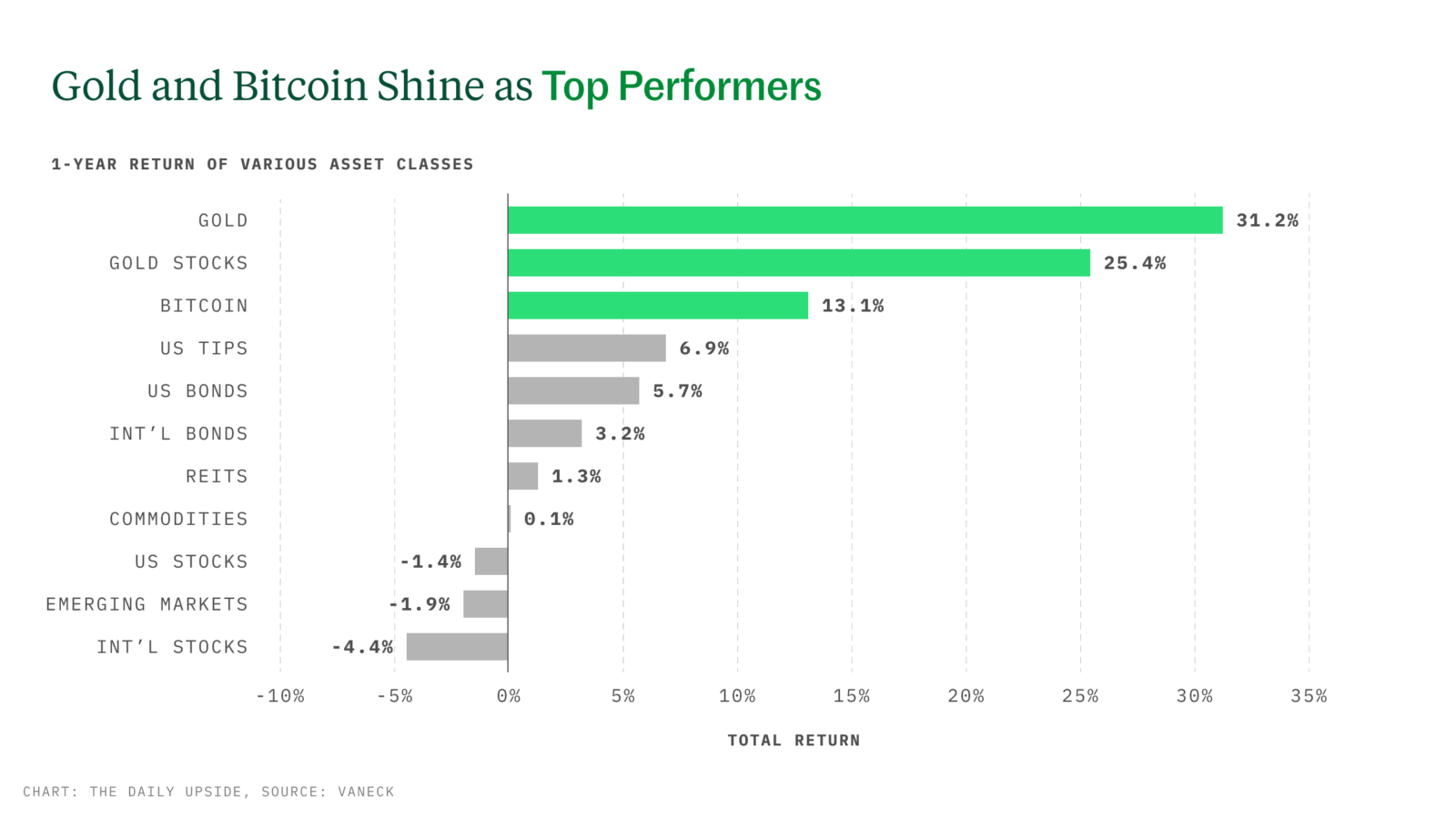

Investors Look To Gold And OUNZ Fits The Strategy

Gold isn’t just outperforming — it’s outperforming with a purpose. In a market shaped by rate risk, geopolitical stress, and what’s been dubbed the 3% fiscal reckoning, more advisors are treating gold as a core holding, not just as a hedge.

The VanEck Merk Gold ETF (OUNZ) offers direct access to gold in an ETF wrapper — with the vital flexibility to take physical delivery without triggering a taxable event. This flexibility can make OUNZ a compelling option: cost-effective, liquid, and adaptable to client-specific goals.

While traditional diversification tools and tactics are showing signs of strain, gold demonstrates ongoing resilience in the face of inflation and global-trade uncertainty. With the gold price topping $3,000, gold is becoming more relevant by the day.

For advisors looking for tax-aware, high-integrity exposure to gold, OUNZ provides real optionality. OUNZ is built for investors seeking stability, liquidity, and long-term strength.

Advisors Weigh In on Trump’s ‘Big, Beautiful’ Bill

At more than 1,000 pages long, President Trump’s tax cut bill is certainly big … but beauty may be in the eye of the beholder.

Passed by the House last week, the proposed legislation now heads to the Senate, leaving financial advisors in a holding pattern as they assess the potential impacts. While some tax saving aspects could benefit clients, advisors said other provisions could negatively impact the economy at large. What we do know is the bill is far from finalized.

“To make any drastic portfolio changes based on a bill that struggled to make it out of the House is at best a risky trade, and at worst a speculative gamble,” said Sean Dann, director of investment research at Marshall Financial.

The Dark Knights

The Congressional Budget Office projects the bill may add $3.8 trillion to the national deficit over the next decade — a key concern for the bond market. As of Friday, yields on 20- and 30-year Treasurys were trading above 5%, signaling growing investor concern over US debt. That market pressure could force policymakers to pull back spending, similar to the bond vigilantes of the Clinton era, said Mark Heppenstall, CIO at Penn Mutual Asset Management.

“The higher interest rates go, the less opportunity we have to fund things like tax cuts,” he said. “Eventually, the costs become too burdensome.”

But it’s not just the tax bill driving up yields. Inflation, tariff uncertainty, and Moody’s recent downgrade of the US credit rating are also contributing, Heppenstall said. “The whole idea of US exceptionalism is beginning to unwind, and we’re seeing a lot of stock and bond markets outperform US assets.”

Please, Pass the SALT. Another major highlight for clients is the increase in the state and local tax (SALT) deduction. Highlights from the proposal include:

- Raising the cap from $10,000 to $40,000, which would primarily benefit residents in high-tax states like New York and California, advisors said.

- A proposed increase in the estate and gift tax exemption would raise it from $5 million to $15 million in 2026.

“Having a solid number to plan with helps a lot of high-net-worth individuals plan for their heirs more efficiently,” said Matthew Saneholtz, CIO at Tobias Financial Advisors.

Make America Financially Responsible Again

A novel program in the bill is the Money Accounts for Growth and Advancement, or MAGA accounts, which would provide children trusts seeded with $1,000 from the federal government. Parents could contribute up to $5,000 per year, which will then be invested in US stocks. The funds can go toward expenses, including college tuition, small business loans, and first-time home purchases.

The accounts’ eventual value will depend on how they stack up against more traditional savings vehicles like Roth IRAs, 529 plans, and Uniform Transfers to Minors Act accounts, said Catherine Valega, a CFP with Green Bee Advisory. “Poor families will likely find themselves unable to add any funds themselves,” she said. “This will benefit mostly the wealthy who already have enough options.”

Advisors’ Ultimate Defense Against Cyberattacks: Humans

Click clack, clack, clickety-clack. We’re in.

When you think of cybersecurity breaches, you probably imagine tech-savvy hackers bypassing firewalls and breaking into mainframes. But in reality, many breaches result from simple human error with employees getting conned by phishing scams. In wealth management, where employees rush to serve clients, it’s easy to fall into a scammer’s trap.

“We focus so much on external hacks and hardening our systems, but internal employees can be just as damaging,” said Ryan Beach, CEO of consultancy F2 Strategy.

Extra Upside

- Like and Subscribe. The secret to video marketing — treat it like a client meeting.

- Tariff Tizzy. More than half of US businesses expect to take at least a 25% revenue hit from tariffs.

- A Tactical Approach To Making Gold Work For Clients. VanEck’s OUNZ offers tax-efficient gold exposure with built-in flexibility to take physical delivery. Explore the gold ETF that does more for client portfolios. **

** Partner

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, and Lilly Riddle.

Advisor Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at advisor@thedailyupside.com.

Disclaimer

*Investing in the VanEck Merk Gold ETF (“OUNZ,” or the “Trust”) involves significant risk and may not be suitable for all investors. OUNZ is not registered under the Investment Company Act of 1940 (the “1940 Act”) and lacks the protections mutual funds or ETFs have under the 1940 Act.

Not intended as a recommendation to buy or sell any names referenced herein. Digital assets are subject to significant risk and are not suitable for all investors. Past performance is no guarantee of future results.

The Sponsor for the Trust is Merk Investments, LLC. The Marketing Agent for the Trust is Van Eck Securities Corporation.

© Merk Investments LLC

© Van Eck Associates Corporation

Chart Source: VanEck, FactSet. Data as of April 7, 2025. Digital assets involve significant risk and may not be suitable for all investors. Past performance is not indicative of future results. Index performance is not representative of fund performance and cannot be invested in directly. This is not an offer to buy or sell any security, strategy, or index referenced. For definitions and index/asset class descriptions, visit: https://www.vaneck.com/us/en/vaneck-advisor-upside-disclosures