Good morning and happy Monday.

“Open the exchange, HAL.”

Fortunately for all those in attendance last Wednesday, the first humanoid robot to ring the Nasdaq opening bell did not object, and a mutiny a la “2001: A Space Odyssey” did not occur. The occasion marked the launch of the KraneShares Global Humanoid and Embodied Intelligence Index ETF. That fund, which started up earlier this month, has its biggest allocations to companies including Jabil, Melexis, Amphenol, and MP Materials. The robot at the event wasn’t the HAL 9000, but rather the Unitree G1 Ultimate. Promotional materials show the robot is capable of much more than bell-ringing — it can run, jump, dance, and even flip toast in a skillet. No mention of its capacity for empathy, but in any case, its battery life is limited to about two hours.

Could it be programmed for a core objective to generate alpha?

ETFs Built On Tax Advantage Draw Congressional Scrutiny

An obscure ETF tax perk for wealthy investors might soon get more attention.

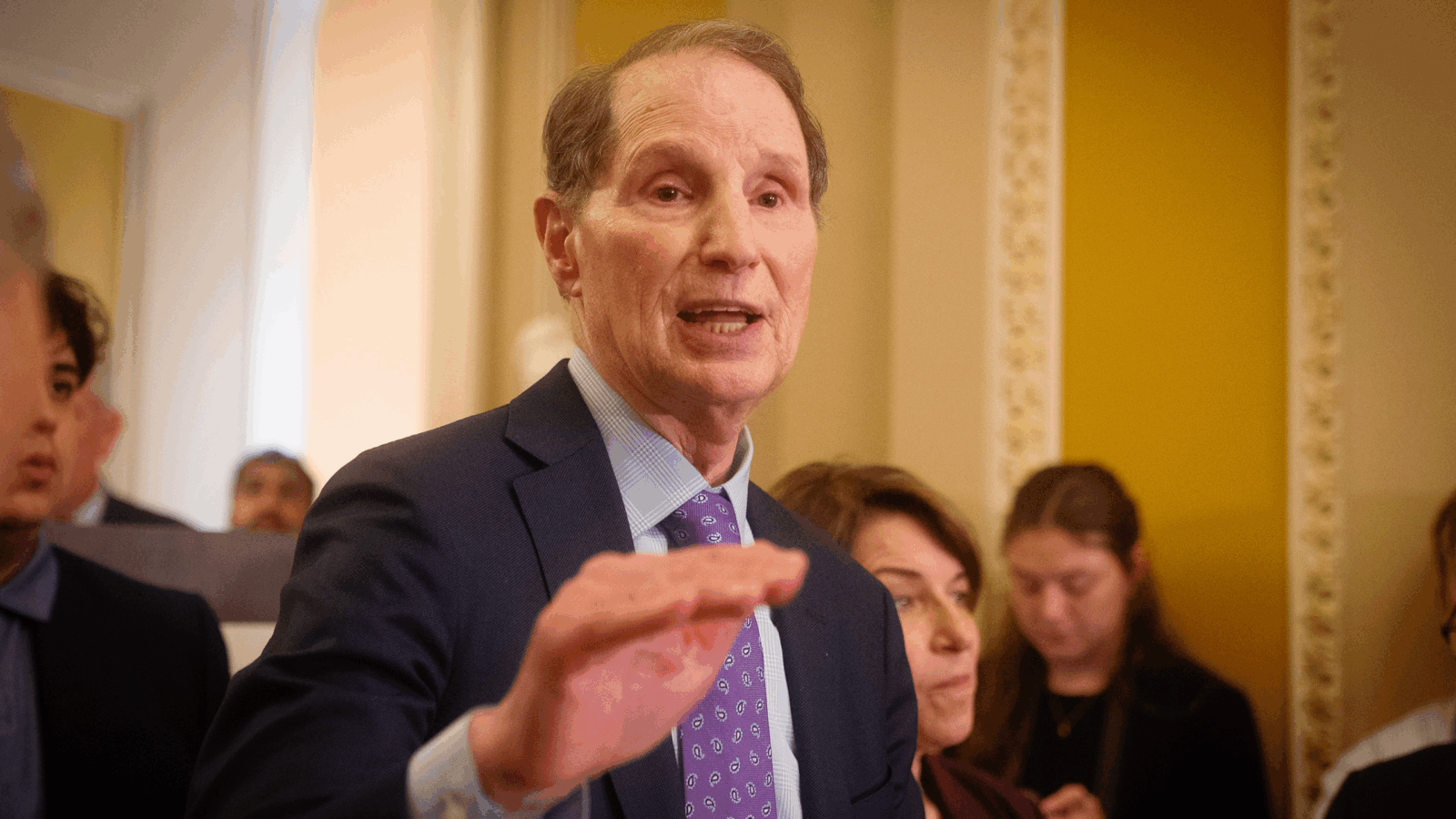

So-called 351 exchanges, which can allow stocks to be transferred into ETFs on a tax-deferred basis, are attracting scrutiny from Congress. At least one lawmaker has proposed a bill that would seek to limit 351s, which take their name from the relevant section of the US tax code. The strategy is somewhat new, and there are a handful of ETF issuers and RIAs that are focusing on seeding new exchange-traded funds with assets from separately managed accounts or big stock positions with untaxed gains. It’s unclear if the legislative package introduced earlier this month by Sen. Ron Wyden, D-Ore., has much support in the current Congress, but the sponsor is hopeful about his proposal’s longer-term prospects.

“This loophole-closing proposal raises revenue without increasing any tax rates, and it makes our tax code simpler and more fair,” Wyden said in an announcement. “You can bet we’ll have this on the shelf when it comes time for Democrats to pass an agenda that cleans up the harm Trump is doing to American families.”

Tax? What Tax?

Importantly for companies focused on this tax technique, the legislation, as currently worded, would not apply retroactively. Firms such as Cambria Investments and Alpha Architect offer 351 exchange ETF services, and some RIAs have started up ETFs with clients’ SMA assets, said Jeffrey Colon, a tax law professor at Fordham University. Alpha Architect is preparing its US Equity ETF (AAUS), which has a minimum investment of $1 million for contributed portfolios and is slated for a July 23 launch. By moving assets to an ETF, wealthy investors can effectively adjust their portfolios with no immediate tax consequences, Colon said. “That’s not an income tax system we should have. I call it a tax arbitrage,” he said. “Congress really should look at this.”

There are some diversification rules governing 351 exchanges. No individual stock can account for more than 25% of the assets seeding an ETF, and the five largest holdings can’t represent more than half of the total assets. Additionally, the investors seeding the fund must collectively control 80% of it. “I am considering a 351 exchange for a client right now. It looks like a great solution for the client’s issue which is that they have a separately managed account with individual stocks where the manager has decided to drop out and stop managing,” said David J. Haas, owner of Cereus Financial Advisors. “Using a 351 exchange, they can transition the portfolio within a new ETF and delay any taxable gains until the ETF shares are sold.”

Wyden’s bill would halt 351 exchanges by flagging two categories of assets:

- It would apply to “contributions or transfers of any interest in an entity, if the return on the interest is limited and preferred.”

- “Marketable securities” transferred to a registered investment company would also trigger capital gains.

Limitless: ETFs can use “heartbeat” trades to avoid taxes on capital gains and dividends, and the tax-deferral element of 351s mean that portfolios can function like giant Roth IRAs, Colon noted. And if people stay invested until death, the capital gains may never be taxed, thanks to large exemptions for inherited assets. But ETFs focusing on 351s will likely draw more attention from Congress, Colon said. “It violates a lot of norms of good tax policy to do these transactions through an ETF that can’t be done outside an ETF.”

Calamos Launches First Autocallable ETF

The future is autocalling.

And alternatives manager Calamos is ready for it, pioneering an autocallable ETF that began trading last week. It’s the first ETF of its kind, providing monthly income via a coupon tied to equity markets rather than bonds, according to a release. The Calamos Autocallable Income ETF (CAIE) enters into swap agreements with JPMorgan and tracks the MerQube US Large Cap Vol Advantage Autocallable Index. The fund climbed 1.5% from Wednesday, its first day of trading on the NYSE Arca, through Friday afternoon.

“It replicates some of what structured notes do, and that space has grown tremendously,” said Matt Kaufman, the company’s head of ETFs. “All the boats have risen with the tide. I think that’s going to happen with autocallables as well.”

Autocall Me Maybe

The arrival of autocallables — structured products that are automatically redeemed when certain conditions, such as the underlying asset reaching a specified value, are met — further broadens the spectrum of ETF products. Calamos is betting on autocallables reaching the same level of popularity as buffer ETFs and structured annuities, said Kaufman.

The fund uses a laddered structure in which different notes have different maturity dates, staggered weekly. Kaufman said the product is ideal for investors who want a high-risk, high-reward, regular income option without the reinvestment risk that comes with single-note autocallables. “A lot of advisors today who are buying autocallable notes, those notes can get called away … and then you have to go shopping again. You have to reinvest your proceeds,” Kaufman said. “All of that goes away when you build a laddered version of this inside of an ETF.”

CAIE’s MerQube index is tied to $3 billion in JPMorgan structured notes, Kaufman added, giving investors exposure to the roughly 52 laddered autocalls inside the fund. According to recent data:

- Autocallable structured notes made up more than $104 billion in issues last year, according to Calamos.

- Derivative income funds and covered-call strategies saw $39 billion in net inflows, pushing total AUM to $114 billion, per Morningstar.

Having Faith. Vinit Srivastava, the co-founder and CEO of MerQube, said the diversified aspect of index-based autocalls reassures investors that their investments will generate returns. “As the market is changing, we think option-linked ETFs will keep growing,” he added. “Things that people did not consider, like [autocallables], to be in their portfolio, they will see more of that going forward.”

ETF Investors Lured to AI, Crypto, Fintech

Crypto and AI, now part of this balanced portfolio.

Retail ETF investors are all about innovations and the latest developments in financial services, with younger generations in particular drawn to new categories that they don’t consider speculative. The top areas of interest among ETF owners are financial technology, AI, and crypto, data from Nasdaq’s annual ETF Retail Investor Survey show. For example, about half of Gen Z and millennial ETF investors own shares in crypto funds. People are also more interested in commodities, which is the category with the largest increase in interest at 57%, up from 54% a year ago. Part of the reason is that investors may consider crypto to fall under commodities, said Giang Bui, head of US equities and ETFs at Nasdaq.

“These hot themes are always going to be top of mind,” she said.

Tell Me More. No, Really

One of the biggest findings from the February survey is that ETF investors are becoming less swayed by social media, and instead are turning to more reliable and in-depth sources for their due diligence. “People are digging deep to understand what they’re investing in,” Bui said. “We’ve gotten to a place where there is too much financial content that exists. You’ve got to figure out what the best source of information is.”

The investors surveyed identified what they consider the most reliable sources of information on ETFs:

- 84% said conversations with financial advisors told them what they needed to know.

- 71% said online videos gave them enough information.

- 70% pointed to online magazine or newspaper articles as top sources.

Going With the Flow: US-listed ETFs brought in well over $1 trillion last year, more than double the 2023 net sales, the report noted. That obviously speaks to demand, but figures from April might be even more telling, Bui said. Despite market volatility amid the tariffs announced the week of April 7, numerous ETFs launched and had overall inflows, she said. “It’s really a testament to peoples’ trust in the ETF structure,” Bui added. “They’re not shying away from ETFs despite what the market might be.”

Extra Upside

- Big Fish in a Big Pond: JPMorgan debuts its biggest active ETF.

- Giveth and Taketh: Billionaires sell Nvidia stock and buy IBIT.

- Hold on for One More Day: A look at international ETFs for the long term.

Edited by Sean Allocca. Written by Emile Hallez, Griffin Kelly, and Lilly Riddle.

ETF Upside is a publication of The Daily Upside. For any questions or comments, feel free to contact us at etf@thedailyupside.com.