Good morning.

Iceberg averted?

US equities soared on Wednesday after POTUS announced a “really fantastic” framework for a deal over Greenland had been reached with NATO allies, soothing mild fears of all-out economic warfare. The Arctic blast of good news lifted the Dow (up 1.21%), the Nasdaq Composite (up 1.18%), and the S&P 500 (up 1.16%). But even an unofficial armistice wasn’t enough to power the heavy hitters past the small-cap Russell 2000, which continued a now 13-day streak of superior returns compared with the S&P 500. That marks the longest such underdog run since 2008. What can we say? If, as Canadian Prime Minister Mark Carney said in Davos this week, the “rules-based order” is finito, maybe it’s a small-cap world after all.

Housing Market’s Blue Christmas: Pending Sales Slide Most Since 2001

If misery loves company, then prospective US home buyers and sellers should organize a little get-together.

New data out Wednesday from the National Association of Realtors (NAR) showed US pending home sales fell in December to the lowest levels since the wary days of April 2020. Call it a Nobody’s Market, with both buyers and sellers facing unfavorable conditions. And it may only get worse. But don’t fret, Americans on both sides of the housing market equation: It’s not you, it’s geopolitical and economic forces far beyond your control.

Bond Voyage

The 9% drop in contract signings from November to December bucked analysts’ expectations of a slight gain. Homes sat on the market for an average of 39 days, compared with 35 days in December 2024; sales fell across all regions, down 3% year over year. So who buys a home during the holidays anyway? Relatively few people. But the association adjusts for the market-slowing effects of Christmas cookie comas, and last month still marked the steepest dropoff for any December since 2001.

The downturn comes at an interesting time. There are now 47% more sellers than buyers on the market, the largest chasm since 2013, according to a Redfin report published Tuesday. Theoretically, that would give buyers the advantage, were one to miss the forest for the trees. Total inventory fell 9% month over month to 1.18 million homes, continuing a trend of historic lows that has fueled an affordability crisis.

Again, not quite a buyer’s market, not quite a seller’s market. Only making matters worse, the US housing market now finds itself on the tail of an around-the-world line of macroeconomic dominoes:

- Yields on ultra-long 40-year Japanese Government Bonds (JGB) remain elevated above 4% after reaching all-time highs on Tuesday as investors grew concerned about Prime Minister Sanae Takaichi’s tax-slashing plans ahead of a February snap election. And what happens in Japanese bond markets doesn’t stay in Japanese bond markets: JGBs act as an indicator for US Treasury yields, which can act as an indicator for monetary policy …

- … Which means the continued wind-down of US interest rates that was expected this year now faces new headwinds, which means mortgage rates could climb again. Which means, yes, before buyers could even get excited about mortgage rates falling to near 6%, they might rebound higher.

How Greenland Was My Valley: Buyers did have one win on Wednesday. After President Trump announced the Greenland deal framework in Davos, US Treasury yields, which had hit recent highs earlier in the week, pulled back amid a broader reversal of the “Sell America” trade. The president spent much of the rest of his time in Davos talking about America’s housing crisis, vowing that the US will not become a “nation of renters,” while making his ban on institutional home buyers official via executive order. Perhaps maintaining global stability could be the third leg of an affordability agenda stool.

What Do the Fried Chicken Wars Say About the American Consumer?

Major restaurant chains are stumbling this year. Chipotle has highlighted softer spending from younger guests, Starbucks is working through weaker US traffic and even McDonald’s has acknowledged pressure among lower-income diners.

These headlines have fueled a familiar narrative that the economy is weakening and that consumers are pulling back. But the data tells a different story. Rather than retreating, consumers are becoming more rational, reassessing where they spend and gravitating toward the strongest relative value.

After years of post-pandemic pricing distortion, the gap between restaurant inflation and grocery costs has widened dramatically, and a new wave of discounting across quick-service restaurants (QSRs) – is reshaping traffic patterns across the industry. In this environment, value perception now drives performance.

Schwab Earnings Spotlight the Real Winners of Record Retail Investor Inflows

Everyday investors aren’t funnelling their savings into meme stocks. Instead, they put a record amount of money into stocks and exchange-traded funds (ETFs) last year. The winners of that trend? Large fund managers, of course.

Schwab and its rivals like Fidelity Investments and Vanguard may no longer get the trading fees they collected before Robinhood helped usher in the zero-commission era, but apparently, they don’t need them. Schwab’s trading revenue jumped 22% from the fourth quarter of 2024, and its net interest revenue surged 25%. The firm reported $158.2 billion in total new assets for the last quarter of 2025.

While net revenue of $6.34 billion came in lower than the $6.37 billion analysts were expecting, it’s clear that Schwab is riding the high of the record inflows mom-and-pop investors put to work.

Forever Young

Everyday investors closed 2025 with inflows that were nearly twice the five-year average, surpassing the previous record set in 2021 by almost 17% and skyrocketing past 2024’s figure by nearly 60%, JPMorgan analysts wrote in a note earlier this month.

Massive brokers saw the benefits. Schwab’s daily trading volume rose 31% year-over-year.

“We’re winning with all demographics,” Rick Wurster, president and CEO of Charles Schwab, told CNBC. “We’ve seen the young generation come to Schwab at record levels and get invested earlier than the prior generations … One-third of our new-to-firm clients last year were Gen Z investors, and the average age of our clients has actually come down by 10 years in the last decade.”

But to continue attracting those younger investors, they have to be open to changes:

- A 2024 Bank of America study found that 72% of high-net-worth investors ages 21 to 43 say it’s no longer possible to achieve above-average investment returns by investing solely in traditional stocks and bonds. They’re increasingly turning to alternative assets, such as crypto. Wurster said during the company’s earnings call that it’s on track to launch Bitcoin and Ethereum spot trading in the first half of this year.

- Offering access to the increasingly popular prediction markets, however, isn’t high on Schwab’s priority list at the moment. “I think there is a really bright line between gambling and investing,” Wurster told The Wall Street Journal in December. “The blending of those two is not a great thing.”

Financial Ecosystems: As more investors enter the market, they’re looking for advice on how to weather its ups and downs and manage their overall finances. As a result, major brokerages are transforming into financial ecosystems. Just take Robinhood, which grew from a platform for investors to trade stocks and ETFs into one that offers private wealth management, traditional FDIC-insured bank accounts and mortgage lending via partnerships. Meanwhile, Wurster said in a statement that “clients are conducting more of their financial lives at Schwab, with record engagement across wealth management, trading and banking.”

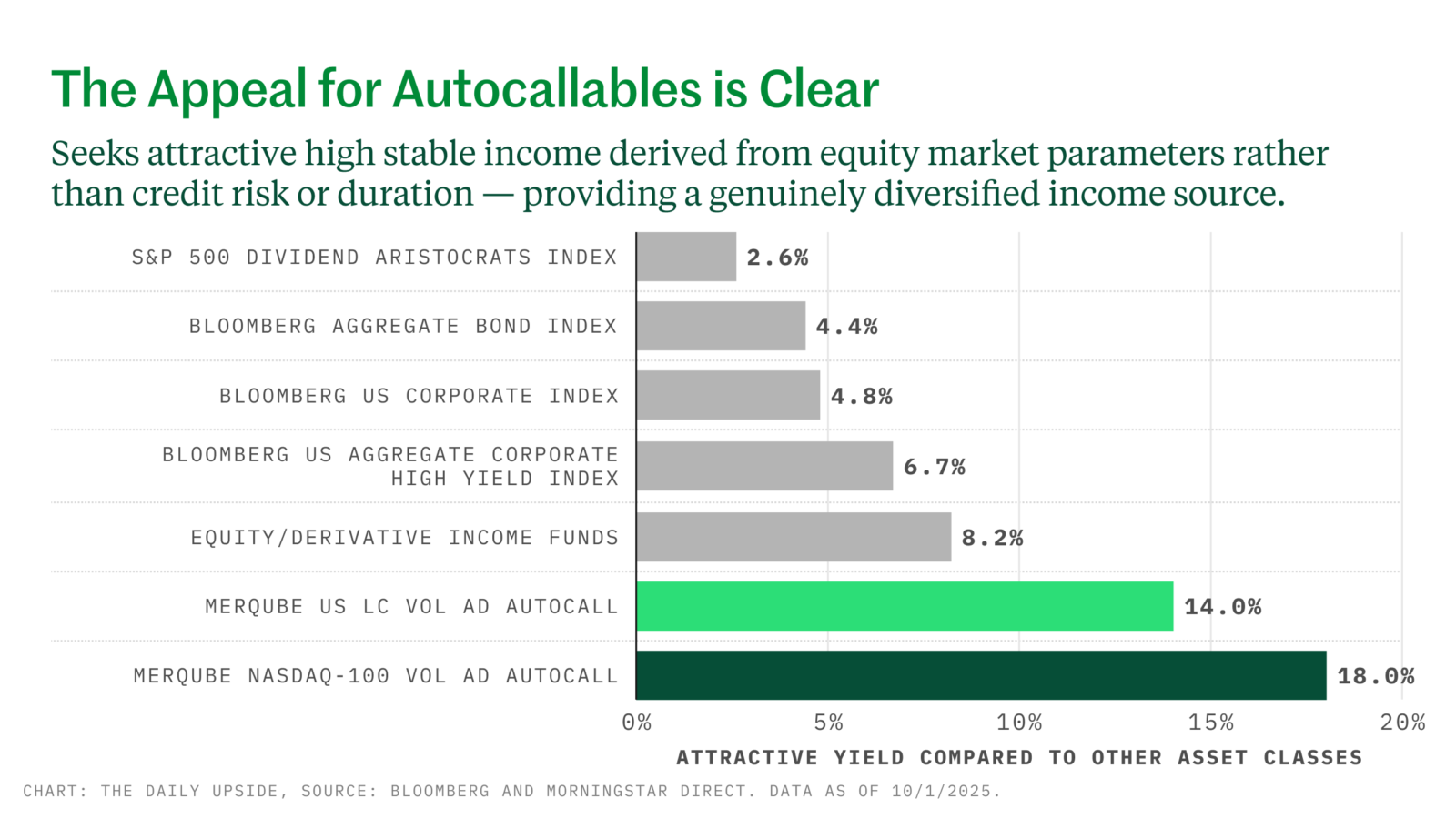

Quality Yield Can Be Elusive. The S&P 500 dividend aristocrat index offers a whopping 2.6%. The Bloomberg US Aggregate Corporate Bond Index? A relatively meaty 6.7%. Structured products can offer the potential for much more. Calamos Autocallable Income ETFs most recent distributions (December 30) offered yields of 14% and 18%. Learn more about the mechanics of autocallables from a $45 billion behemoth.

Johnson & Johnson Crushes Patent, Pricing Probs

Johnson & Johnson is vying to become the first among its healthcare peers to make $100 billion in annual revenue. The pharma company said yesterday it broke past $94 billion in 2025 and expects to reach 12 figures this year. Both measures, along with last quarter’s revenue of nearly $25 billion, exceeded analysts’ estimates.

Expectations for next year were especially rosy considering Johnson & Johnson agreed to slash drug prices this month as part of a deal with the Trump admin to exempt its products from tariffs. Chief Financial Officer Joseph Wolk said that the deal would cost “hundreds of millions of dollars,” but J&J’s strong portfolio was “digesting” the impact — like it was sketchy sushi, not a nine-figure hit.

J&J’s optimism could allay investors’ concerns about another tummy ache: the expiration of exclusivity patents for its blockbuster psoriasis drug, Stelara.

Patent Cliff? J&J Prepped a Parachute

Johnson & Johnson seems to be gliding above Stelara’s sales dropoff. As competitors including Amgen’s Wezlana entered the market, sales of Stelara fell more than 40% last year to about $6 billion. That dropoff was steeper than analysts predicted.

However, J&J is offsetting the losses with climbing sales across its other products:

- Six of J&J’s cancer drugs saw sales jump more than 20% last quarter, with blood cancer treatment Darzalex raking in more than $14 billion. Carvykti, a newer multiple myeloma drug, reached blockbuster status after making more than $1 billion in annual revenue. Outside of oncology, sales of psoriasis treatment Tremfya also climbed.

- J&J reported strong growth in its medical device unit, MedTech, which accounts for more than a third of the company’s revenue. Sales in the business rose nearly 8% last quarter.

Tough Pills: J&J sets the tone for the rest of the healthcare industry: Eli Lilly and Amgen are set to report in the first week of February. J&J seems confident it can absorb costs stemming from President Trump’s drug-pricing deal; 15 other companies have negotiated their own agreements. But J&J has another trial, literally, hanging over it. A special master on Tuesday recommended allowing expert testimony supporting the link between J&J’s talc products and ovarian cancer. J&J faces more than 73,000 suits related to its baby powder, which it stopped selling in 2020, and other talc-containing products.

Extra Upside

- Fed independence: Supreme Court justices, including some appointed by President Trump, appear skeptical of his moves to fire Federal Reserve Governor Lisa Cook.

- Attention Economy: Ryanair CEO Michael O’Leary is monetizing a social media war of words with billionaire Elon Musk. “Bad publicity sells far more seats than the good,” he says.

- Start Your Week With The Prof G Markets Newsletter: A breakdown of what’s moving markets, with unfiltered takes from Scott Galloway, Ed Elson, CEOs and analysts. Read the latest on Trump’s Powell probe and how geopolitical crises impact markets.*

* Partner