Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

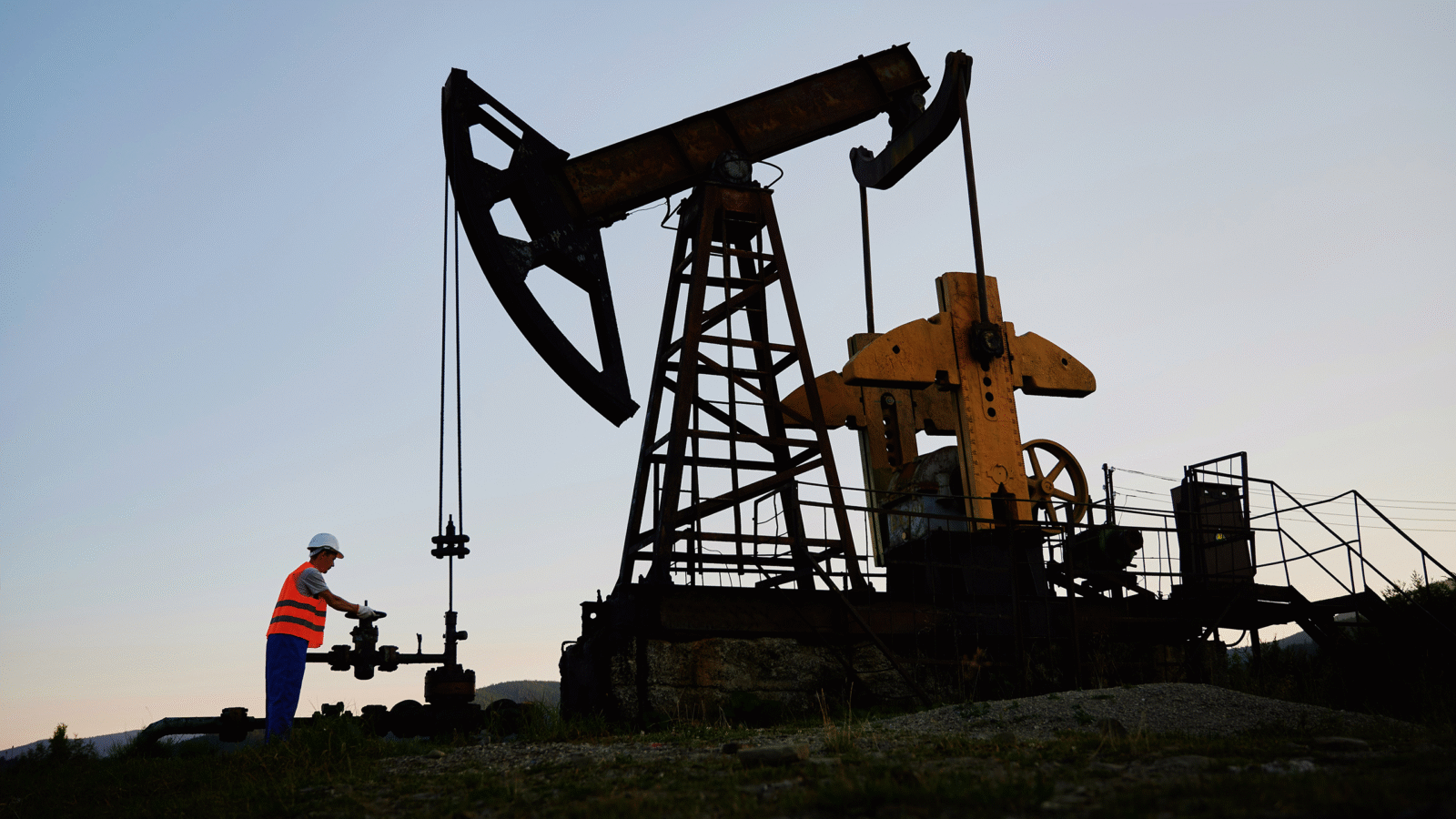

If you’ve hit the pump lately, you might have noticed your wallet a little thinner than usual upon exiting.

The U.S. crude price has doubled since the end of October, reaching $71.48 a barrel Monday. That’s its highest level in over 2½ years, as Wall Street’s growing penchant for renewables is depressing oil extraction, paving the way for supply shortages down the road.

Gassed Up

OPEC agreed this month to boost oil output by 450,000 barrels a day starting in July, and Saudi Arabia is relaxing its production cuts from earlier this year.

But with Americans packing the pumps as the summer travel season kicks into gear, and green energy investment reaching “the tipping point and beyond,” as CFO of Dominion Energy James Chapman put it, some analysts argue oil supplies could hit a snag:

- $330 billion was spent on oil extraction last year. Sounds like a lot, but it’s less than half of 2014’s record outlay, according to research firm Wood Mackenzie.

- And figures from Baker Hughes show the number of rigs drilling in the U.S. is 60% below 2018 levels.

All of this as the IEA projects oil demand to continue rising through at least 2026. To JPMorgan Chase analyst Christyan Malek, the figures suggest global oil supply investments will fall $600 billion short of projected demand by 2030.

Follow The Money: Options traders are placing bets on prices flying well higher from here – just last week, $100 options became the most widely-owned WTI calls on the New York Mercantile Exchange.

Don’t Panic Yet: Producers are still bathing in excess oil supplies withheld due to coronavirus disruptions, and OPEC can rapidly ramp up production from here. But as Wall Street continues backpedaling from fossil-fuels, funding may not be around by the time oil companies need to fill long-term supply droughts.