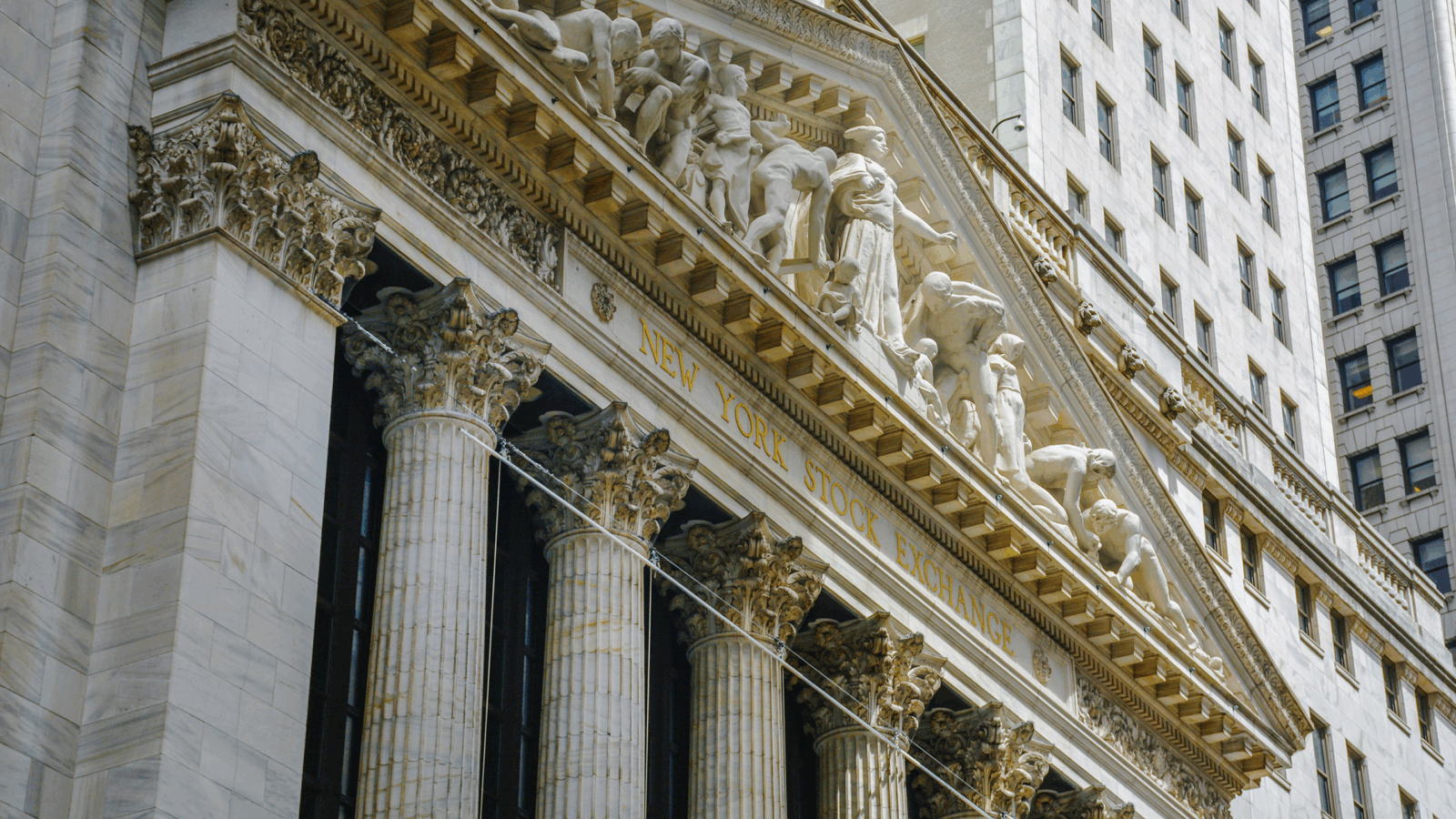

A Handful of Companies to Bare the Brunt of the New Corporate Minimum Tax, Study Finds

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Amazon and Berkshire Hathaway are among the half dozen companies that are in a class all by themselves when it comes to keeping their tax bill low. Now they may have to pay up.

A month ago, President Biden signed into law a 15% minimum corporate tax directed at massive companies with huge profits that send Uncle Sam next to no income tax. According to researchers from the University of North Carolina Tax Center, six companies — including Amazon and Berkshire Hathaway — would’ve paid over half of the estimated $32 billion the tax would have generated had it been in place last year.

Mad Tax: Beyond Thunderdome

The new tax system, which will go into effect in January and is known as a book minimum tax, mandates that companies with >$1 billion in publicly reported annual profits calculate their taxes under two different systems. First, they’ll use the regular system with its 21% rate. Next, they’ll employ the 15% rate based on book income, the kind included in financial statements, not traditional taxable income. The intention? While well-paid tax accountants are charged to deploy every R&D tax credit, accelerated depreciation scheme, or stock-based financial engineering trick known to mankind, companies that woo investors with ten-figure GAAP profits will have nowhere to hide:

- Using publicly available financial data, the researchers calculated just under 80 publicly traded US companies would be subjected to the new model, paying a total $32 billion (the tax is projected to generate $222 billion overall for the US government during the next decade). Berkshire, Amazon, Ford, AT&T, eBay, and Moderna account for roughly half the sum.

- Berkshire alone would’ve accounted for nearly a quarter of the tax revenue generated last year, paying an estimated $8.3 billion, according to the UNC researchers. Meanwhile, Amazon, which under the old system last year paid an effective federal income tax of just 6%, would have owed $2.8 billion.

Gotta Give Them (Tax) Credit: President Biden says the new reforms will end the days of profitable companies avoiding taxes, but up to three-quarters of tax liability can still be offset by generous credits, such as clean energy incentives and provisions for workplaces with defined-benefit pension plans. We’ll call that the fruit-loopholes of their accountant’s labor.