Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

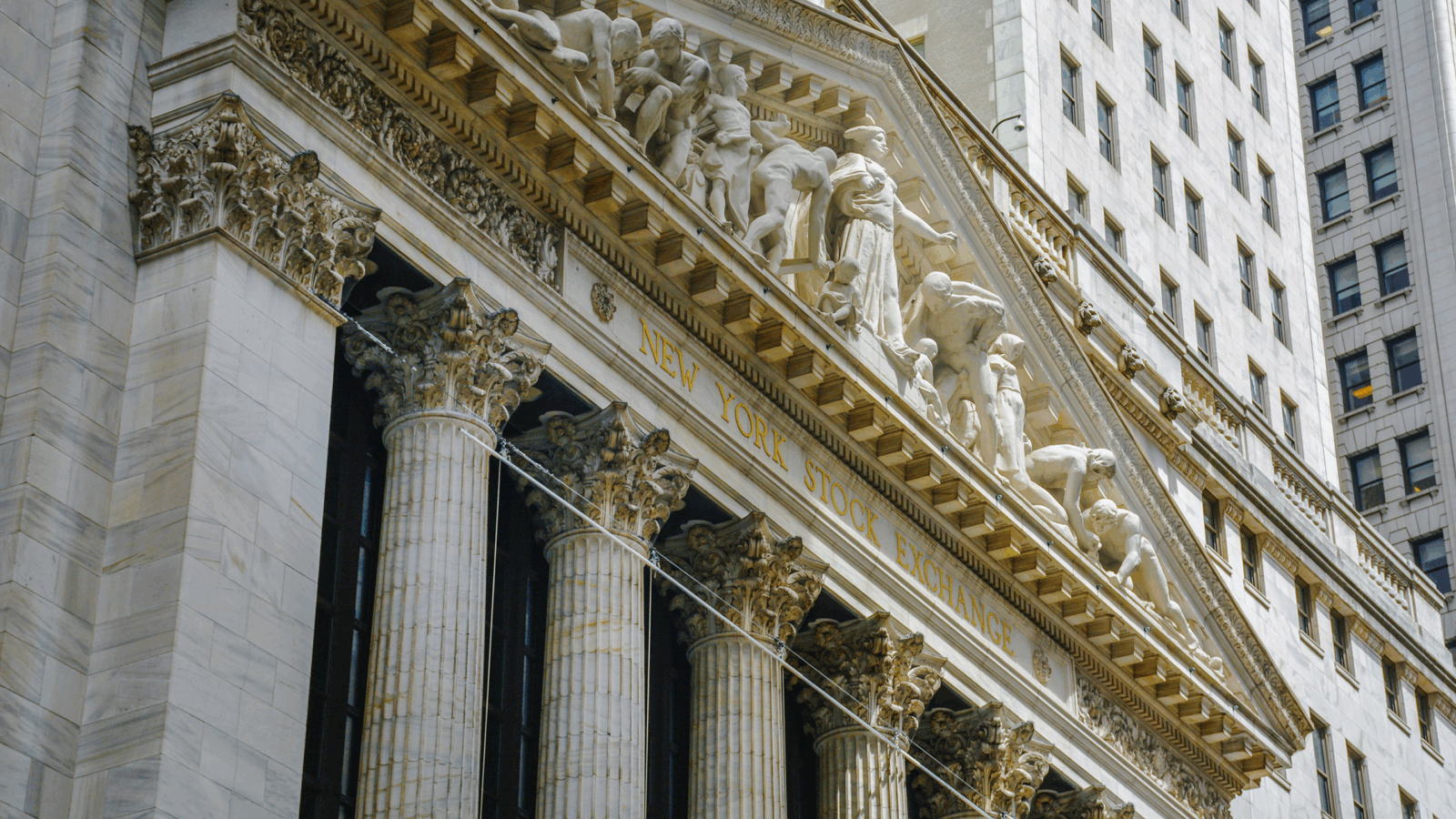

Trillions of dollars in new tax revenue could come from hikes on corporations and high earners, if House Democrats have their way.

On Monday, Democrats revealed proposals to increase the U.S. corporate tax rate, add a surtax on the country’s richest earners, and increase the capital-gains tax.

Finding $3.5 Trillion

It’s pretty simple. Democrats want to spend a lot of money in the next decade — about $3.5 trillion on antipoverty, healthcare, and climate initiatives alone. Obviously, they have to find a way to pay for it.

Tax increases on the rich are arguably one quick way to get there, and the path House Democrats laid out Monday includes some of the highest increases in decades:

- If the plan passes, people who earn at least $400,000 or married couples who earn at least $450,000 will see their top marginal tax rate rise to 39.6% from 37% starting next year. Earnings over $5 million would get hit with an additional 3% surtax.

- The top tax rate on corporations would rise to 26.5% from 21%. Taxes on U.S. companies’ foreign income would also go up to 16.6% from 10.5%.

- The capital gains tax — that’s the tax on profits investors make from selling assets like stocks — would rise to 25% from 20%. Rules around carried interest, a beloved private-equity tax break, would also be tightened.

It should come as no surprise that the plan is expected to garner zero Republican supporters — the GOP is concerned the spending will increase debt and the tax increases will hamper economic activity.

Cut Down By Compromise: The tax proposals will be voted on as soon as this week, but could change in the coming weeks as some Senate Democrats have argued for lower tax rates and less spending than is being proposed.

Be Audit You Can Be: The IRS would be gifted $79 billion to beef up its tax enforcement, so in the meantime make sure you hang on to all your invoices and receipts.