Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

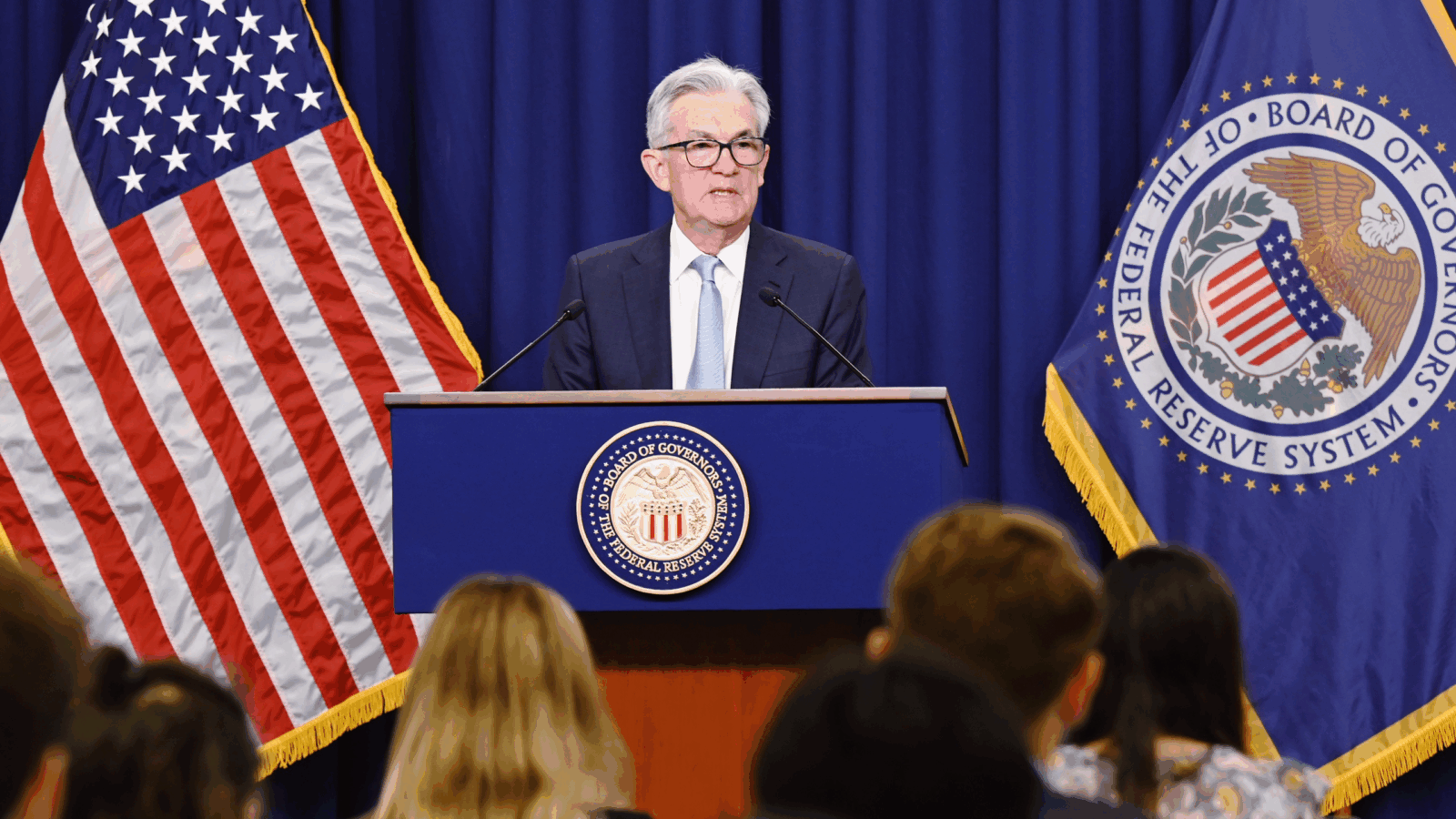

Fed Chairman Jerome Powell appeared on 60 Minutes last night and the stoic central banker painted the picture of an economy at a critical “inflection point.”

Heading into earnings season — with banks set to pave the way this week — investors are grappling to determine which way the inflection point will head.

Take Me Higher

Stocks have been on a tear to start 2021 with the S&P 500 up 9.9%, notching 20 record closes in the process.

That impressive run has stretched valuations, with the S&P 500 trading at ~22.6 times its projected next-twelve-months earnings. That’s well above the five-year average of 18.1 times, according to FactSet.

No one will be surprised to see earnings reports jump off the page. Profits will be measured against the same three-month period last year — when American and global businesses were forced into rapid shutdown by the first wave of coronavirus:

- Financial market data firm Refinitiv expects average earnings growth of 25% for the first quarter among S&P 500 companies, including 76% growth in the financial sector.

- Of the companies to report so far this year, 81% have beat estimates.

“I think earnings season is going to be constructive, and it’s going to be good enough to keep the market going higher,” Brian Rauscher, head of global portfolio strategy at Fundstrat, told CNBC.

Overall, analysts expect earnings to rise in nine of the 11 sectors in the S&P 500 in the first quarter of 2021. Meanwhile, the Federal Reserve has given every indication it will continue supporting the economy with near-zero short-term interest rates and U.S. consumer confidence is at its highest since the pandemic began.

Cool Your Jets

But there might be a catch for all those investors counting on unabated economic growth.

“Consumers are not going to buy five Peloton bikes,” said Gene Goldman, chief investment officer at Cetera Investment Management. “They’re not going to buy five new cars and five new TVs. So at what point is all that future growth already priced in?”

One harbinger could be Nike: shares of the athletic wear giant fell 4% the day after its earnings beat analyst expectations — with shipping problems overshadowing the rest of its performance.

the takeaway

The consumer confidence index, at 109.7, is still well below its pre-pandemic level of 132.6 posted in February of last year, suggesting there is still room for spending growth.