OpenAI

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

AI Wrestles Jobs from Gen Z Workers

Photo by Eric Prouzet via Unsplash

-

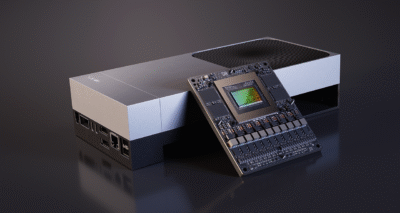

Tech Stocks Slide as AI Reality Lags Behind Hype

Photo via imageBROKER/Mojahid Mottakin/Newscom