taxes

-

Why Altruist’s New AI Tax Tool Spooked Investors in Schwab, LPL, Raymond James

Photo via Connor Lin / The Daily Upside

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

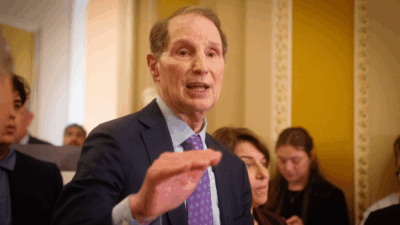

Worried You Don’t Have Enough Money to Retire? New Rules in ’26 Make It Easier to Catch Up

(Photo by Towfiqu barbhuiya via Unsplash)

-

Trump’s ‘Big, Beautiful Bill’ Is a ‘Mixed Bag’ for Advisors

Photo via Chris Kleponis-CNP/Picture Alliance/Consolidated News Photos/Newscom