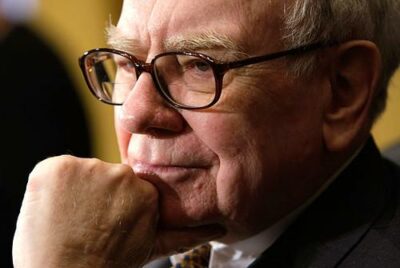

Warren Buffett

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

Unease About Warren Buffett’s Retirement Overshadows Berkshire Earnings Beat

Photo via Lu Beifeng/VCG/Newscom

-

Berkshire Shares Tumble as Buffett Has Five Months Left at the Helm to Make a Big Deal

Photo via Lu Beifeng/VCG/Newscom

-

AI Won’t Replace Advisors. But It Will Transform the Industry.

Photo illustration by Connor Lin / The Daily Upside, Photos by Gzorgz and iLexx via iStock