Alibaba Pops on Plans to Boost AI Investments

While ecommerce is currently Alibaba’s biggest piggy bank, hype is building around its burgeoning cloud computing biz.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Investors went gaga for Alibaba yesterday. The Chinese company’s US-listed shares jumped 10% after its revenue rebounded in the holiday quarter and it announced “aggressive” AI investment plans.

Think of Alibaba as China’s Amazon: It’s an ecommerce giant that makes the bulk of its revenue from online stores that sell everything from toilet paper to teddy bears. Singles Day, the unofficial Chinese holiday for people not in a relationship that’s become the world’s highest-spending shopping event, helped boost Alibaba’s retail sales in the most recent quarter.

But while e-commerce is currently Alibaba’s biggest piggy bank, hype is building around its burgeoning cloud biz, which saw revenue pop 13% in the most recent quarter. All eyes are on the cloud sector’s recent AI advancements and Alibaba’s plan to invest more in the unit over the next three years than it did throughout the past decade.

Call it ChinaGPT

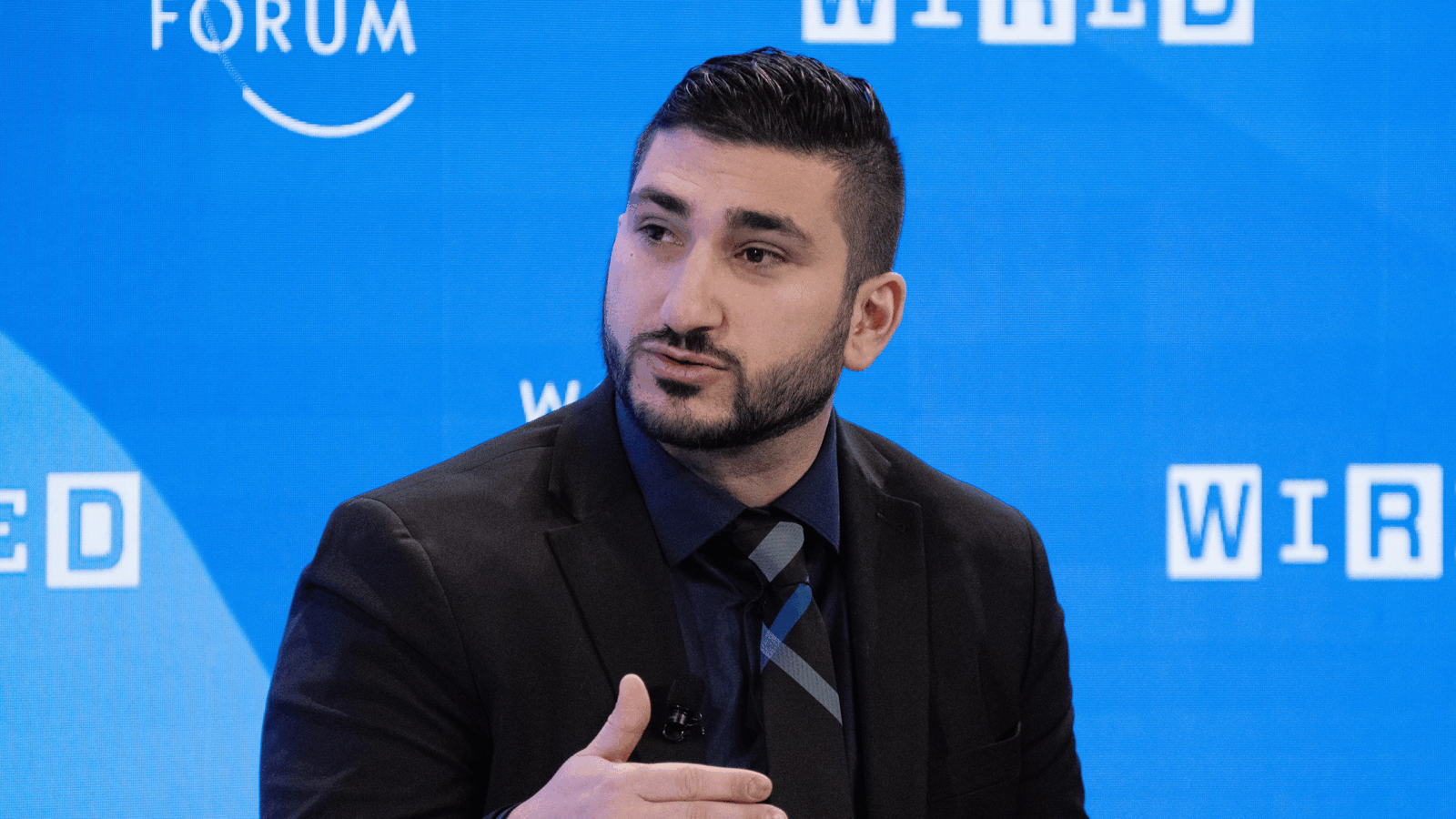

Alibaba CEO Eddie Wu said yesterday that AI could one day significantly influence, or replace, half of global GDP. And the Hangzhou-headquartered company doesn’t plan on letting US rivals own the AI economy:

- Alibaba dropped its own AI model last month, Qwen 2.5-Max, which it said outperforms rival models made by OpenAI, Meta, and Chinese startup DeepSeek.

- Alibaba and Apple said last week they’ll team up to power Apple’s new AI features on its iPhones (a.k.a., Apple Intelligence) with Alibaba’s AI tech.

Competition from China is heating up. DeepSeek dropped an AI assistant so powerful last month that it rattled shares of US-based AI companies. Within days, TikTok parent ByteDance released an update to its AI model, claiming its abilities surpassed OpenAI’s.

Limitations to Innovations: Not only have Chinese tech companies perfected the art of the export curb workaround, but their limited access to advanced tech has forced them to create final products that claim to be more energy- and cost- efficient than their overseas counterparts. Stateside AI companies that have burned through billions with no profit in sight could soon feel the need to justify or cut their costs. Thursday’s earnings call also comes just days after enigmatic Alibaba co-founder Jack Ma attended a rare closed-door meeting between Chinese tech luminaries and President Xi Jinping, who urged them to think big. Ma had kept a low profile for two years following Beijing’s crackdown on uppity tech billionaires that had sent a very different kind of message. We here in the US could not imagine a world in which a singular powerful tech billionaire wields enormous power.