How Amazon Web Services Became King of the Cloud

Amazon is crushing in the cloud services industry. Usurping it would necessitate a monumental shift in the tech industry writ large.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

In the age of AI, computing power is as good as gold. And that makes Amazon as rich as Croesus.

Amazon Web Services, or AWS, has long dominated the cloud services market, holding a large lead over the likes of its main competitors, Microsoft Azure and Google Cloud. Though the company had a first-mover advantage in the beginning, experts told The Daily Upside that its reliability, easy-to-use systems, and sticky ecosystem have kept it in the lead.

And with AI’s reliance on the resources and ecosystem that cloud service providers offer, the tech is only poised to grow. Usurping AWS would necessitate a monumental shift in the cloud service market — and the tech industry at large.

“There are three big [cloud] companies, but Amazon’s probably always going to be one of them,” said Trevor Morgan, senior vice president of operations at OpenDrives. “And always being on the short list — that’s a pretty desirable place to be.”

We’re talking about a cloud business that brought in $90 billion in 2023 and drove more than 15% of Amazon’s revenue. It’s poised to break $100 billion this year. Whole Foods would have to sell a lot of organic kale to rival results like that.

‘Its Own Customer’

Amazon’s cloud dominance began like a lot of innovation does: from a need to solve its own problems. In the early days of building its e-commerce empire, the company constantly faced the tedious and expensive issue of managing IT infrastructure. AWS was the product of reimagining that infrastructure entirely. Fixing that problem for its internal needs allowed the company to come to “much more fruitful solutions” than it would have from the outside looking in, said Morgan.

“Amazon was its own customer,” said Morgan. “Yes, that problem was everywhere, but they didn’t identify it out in the market. They identified it, proved it out, and then proved out that this was truly a marketable idea.”

Officially launching in 2006, the company had several years before any other tech firms started to notice that the need for off-site computing resources was, in fact, a problem, said Irusha Peiris, analyst at William O’Neil. “No one really took [cloud services] seriously,” said Peiris. “And [Amazon] had come up with an incredible solution that appealed to not just big businesses, but every business.”

In that time, the company had a lead in developing relationships with customers, said Peiris — and getting that lead may have cemented its fate. Even if other providers offered similar service at cheaper prices, the “switching costs” of moving from one cloud provider to another are significant, he said. “Even if something might be a little bit better and might be a little bit cheaper, it just might be too much effort,” he said.

But it’s more than just loyalty that keeps AWS in the lead. At its core, Amazon’s good at making products that are “available and quickly consumable,” said Morgan, a habit learned from its e-commerce roots. “Amazon gets that — that’s part of their DNA.”

The company’s services are easily configurable and scalable based on individual needs, almost like “Lego blocks,” said Connie Yang, principal of AI and data science at DesignMind. “You start out with the compute, and then you can just build it however you want to. It’s the configurable nature of AWS that makes it preferable to technical folks.”

Head in the Clouds

AWS, Microsoft Azure, and Google Cloud are all packed with features to help developers build, but the big three of cloud services all target different markets, said Yang. While Azure is better for enterprise clients, Google Cloud is more popular among smaller startups. AWS is popular among both. It’s also common for customers to use more than one cloud service for different things, she said, and “it’s a little bit more complicated when you dive into the different market sectors.”

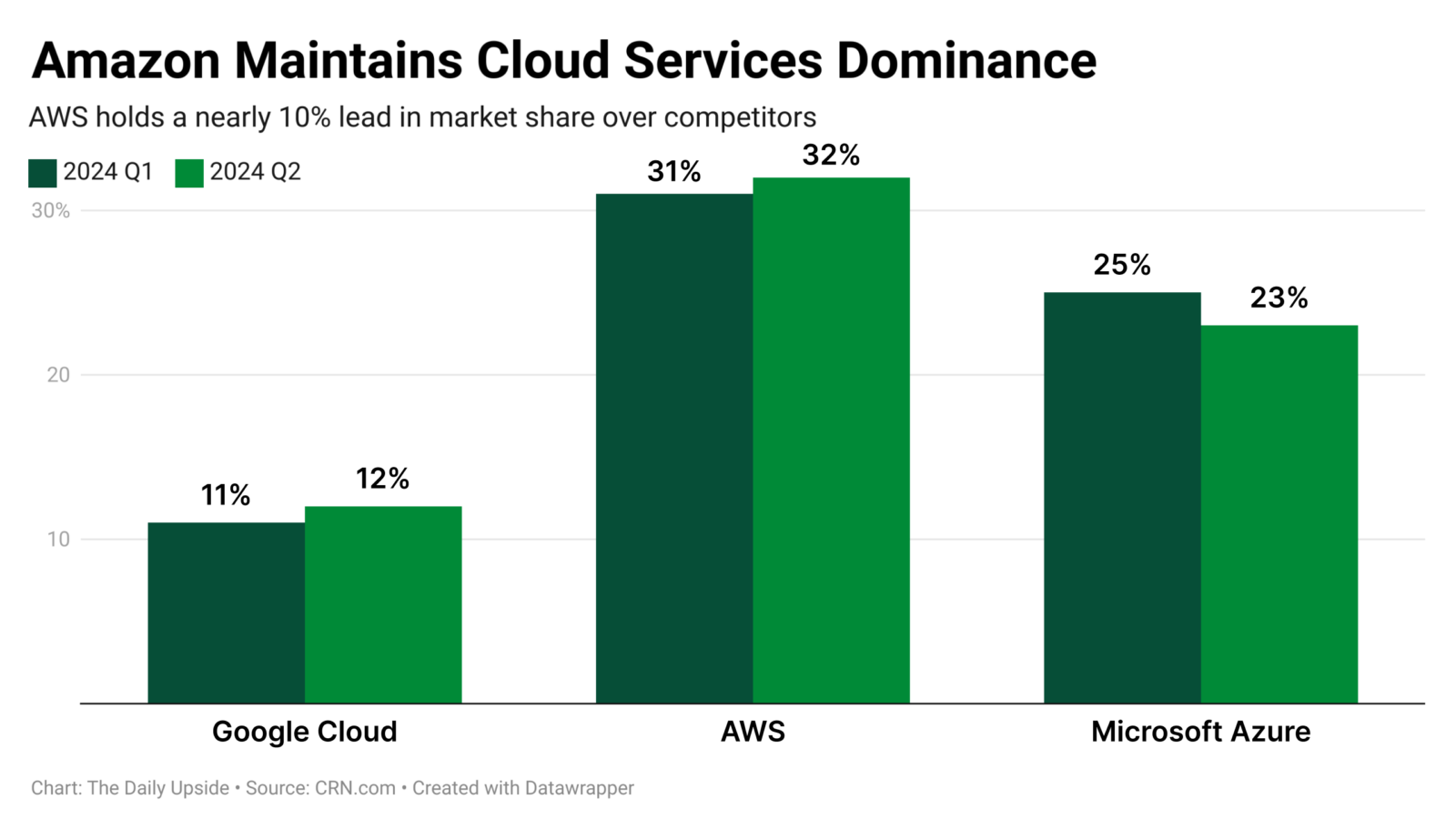

Though these companies’ services are “more similar than not these days,” Peiris said, AWS’ easy-to-use strategy is clearly working: According to CRN, AWS held 32% of the market share for the cloud services industry in the second quarter. Microsoft and Google trailed behind at 23% and 12%, respectively. The company’s lead has left everyone else in a “perennial game of catch-up,” said Morgan.

And while AI has tipped several different industries on their heads, it’s only made cloud services stronger. Cloud computing has allowed companies to develop highly-powerful AI models without burning their own power or operating their own servers. The growing demand for AI across sectors has made the major cloud players “even more necessary,” said Peiris.

“Not every company can afford to get enough resources to run their AI,” he said. “In that way, it just entrenches them more.”

And AI isn’t just handing power to these cloud services companies. It’s enhancing the way they operate, too, said Tim Peters, chief marketing officer of Enghouse Systems. AI models are capable of assisting with optimization, security, resource management, and monitoring of cloud networks, helping drive down costs and make cloud services more stable and reliable, he said. That reliability is vital when companies are trusting cloud providers with “mission-critical technology,” said Peters.

“[Amazon’s] a pioneer in the space, they’re providing great support for their customers, and they’re innovating with AI. It’s really their game to lose,” said Peters.

Where the Chips Fall

So what would it take to shake up the order? Though price of services somewhat plays a role in which direction a cloud customer goes, it’s not as big of a consideration as one would think, said Morgan. “You can try to race to the bottom in pricing, but that’s not going to do it,” he said.

A bigger edge that Amazon has over price is simply its brand, said Morgan. He compared it to the brand that Nvidia has cultivated with its AI chips: The company’s reputation and popularity further drives its reputation and popularity.

“It’s going to have to be a brand-replacement strategy, followed by the ability to make something so disruptive, so easy to consume, that it completely takes off in the market,” he said.

And unless something severely damages the AWS brand, said Peiris, the only thing that’ll shift the balance of power is an innovation that entirely changes the cloud landscape, making it impossible not to move from one camp to the other. That innovation may lay somewhere in the realm of AI, he added — whether it be a faster and cheaper chip, a program that exponentially boosts productivity and automation, or a yet-to-be-revealed innovation that revolutionizes a longheld status quo.

“It might not be obvious to us normal people, but that’s probably happening on the tech developer end,” said Peiris. “Either they come up with such a good solution that saves a ton of time, the price is so good, or it’s so much better that it leaves no other choice.”