Microsoft and Occidental Agree to Massive Carbon Credit Deal

Microsoft is is buying 500,000 carbon credits from Occidental Petroleum over the next six years to help reach its carbon-negative goal.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Man plans, AI laughs.

The energy-guzzling artificial intelligence era isn’t helping Microsoft reach its carbon-negative-by-2030 goal, so the company announced Tuesday it is buying 500,000 carbon credits from Occidental Petroleum over the next six years. The deal is the largest of its kind in the industry, the companies claim. But it comes right as some influential experts are beginning to ponder whether all this AI hype is justified, anyway.

Capture the Flag

Microsoft has a problem. Between 2020 and 2023, the Big Tech firm’s carbon emissions increased nearly 30%, due in large part to the expansion of AI and cloud computing infrastructure. And the easiest way for any $3.4 trillion company to solve a problem (one that also happens to be pushing its share price to all-time highs) is to throw money at it. Enter Occidental and its growing carbon management unit, 1PointFive.

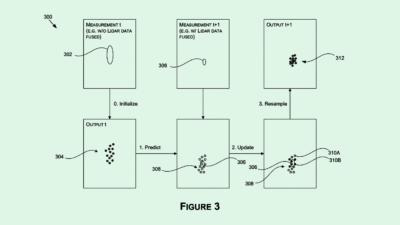

Essentially, Microsoft will be paying 1PointFive to remove 500,000 metric tons of carbon from the atmosphere via so-called Direct Air Capture (DAC) technology at its first-ever and still-under-construction DAC plant, called Stratos. The West Texas-based facility, which will be the largest of its kind, is projected to capture 500,000 metric tons of carbon from the air annually. Experts, it should be noted, say DAC is far less effective than point-source carbon capture — directly at a factory’s smokestack, for instance — while costs on a per-metric-ton basis tend to run higher than the going DAC carbon credit rate of roughly $1,000. Climate experts also say carbon credits should be reserved only for offsetting particularly hard-to-eliminate emissions.

Meanwhile, AI skeptics are rearing their heads on Wall Street, and carbon emissions aren’t the only reason. A recent report from Goldman Sachs titled “Gen AI: Too Much Spend, Too Little Benefit?” in particular is turning some heads:

- In the report, Goldman’s head of global equity research and semiconductor industry analyst, Jim Covello, argues that the costs of building out AI infrastructure — estimated at over $1 trillion in the next few years alone — and operating AI, which he does not expect to dramatically decline, are very likely to outweigh whatever efficiencies the tech may bring.

- “Replacing low wage jobs with tremendously costly technology is basically the polar opposite of the prior technology transitions,” Covello writes. He adds that unlike the internet and smartphones, “not one truly transformative — let alone cost-effective — application has been found” in the 18 months since Gen AI’s debut.

Gridlock: The report also highlights the massive energy grid expansion needed through 2030 to support the AI industry’s ambitious expansion, less than half of which is expected to come from renewable energy sources. Translation: Microsoft will likely be on the market for a lot more carbon credits.