The $5 Trillion Question: Nvidia, Microsoft Vie for Record High Valuation

Nvidia and Microsoft both topped $4 trillion in market cap last month. Now, they’re in a race for the symbolic $5 trillion barrier.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

What’s bigger and better than $4 trillion? $4,000,000,000,000.01? Well, yes, that’s technically true, but it’s not very exciting or interesting. What’s symbolically bigger and better than $4 trillion? $5 trillion? There we go; now, we’re talking.

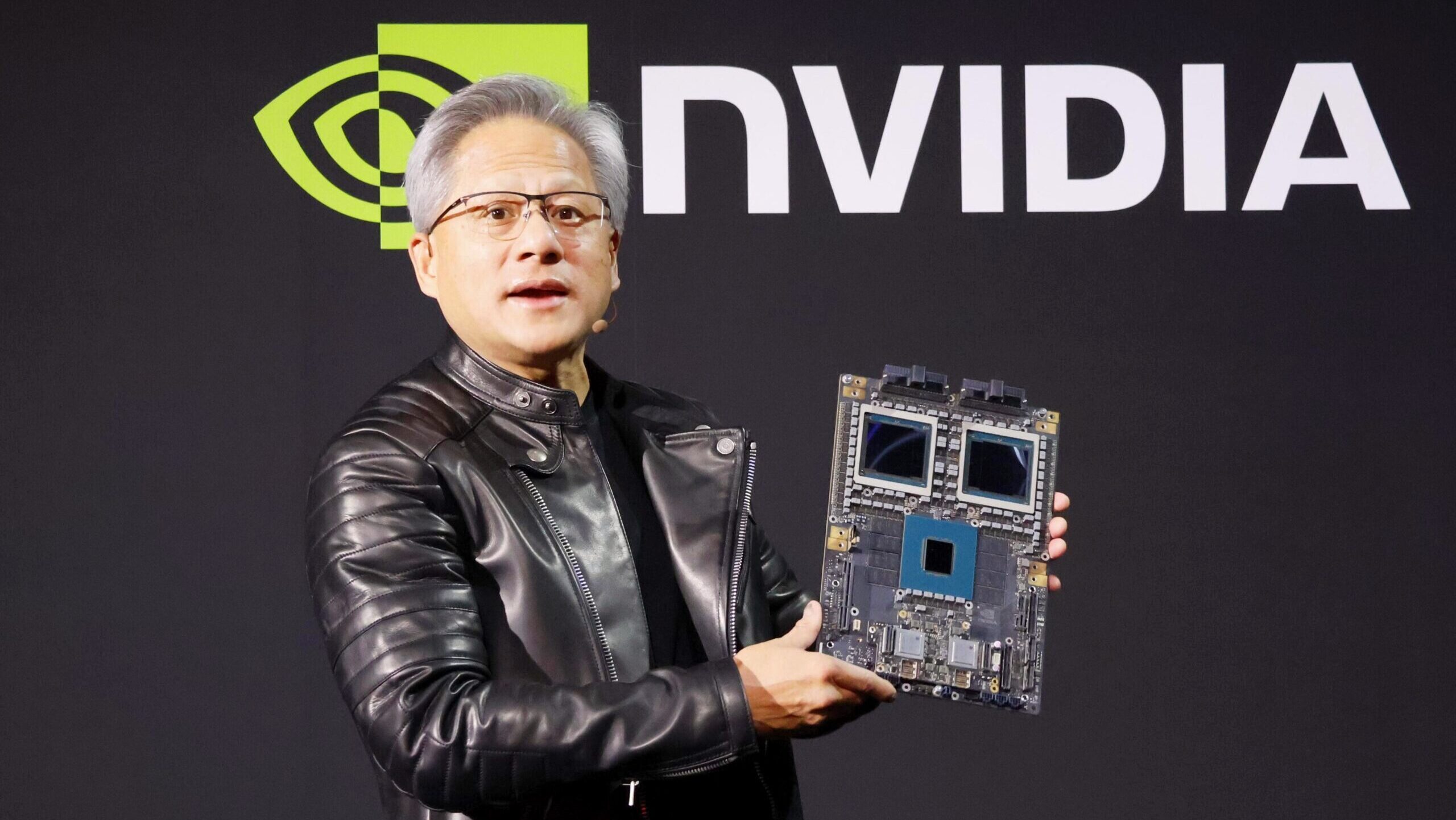

Last month, chipmaker Nvidia became the first company in the world to reach a market capitalization of $4 trillion. Currently valued at roughly $4.4 trillion, it achieved the landmark a little more than three years after tech giant Apple became the first $3 trillion company in 2022. Now, a seemingly two-horse race for the first-place $5 trillion trophy is underway.

Tale of the Market Tape

Temporarily joining Nvidia, which achieved the landmark on July 10, was Microsoft, which became the second member of the $4 trillion club on July 31 after blowing past earnings expectations. But it exited shortly thereafter, with shares softening enough to bring its market cap back down to $3.9 trillion as of Friday.

Anticipating that both companies would reach $4 trillion, Wedbush analysts wrote in June that they could reach the $5 trillion landmark in the next 18 months, noting the “tech bull market is still early, being led by the AI Revolution.” Both happen to be benefiting from overlapping tailwinds. Microsoft’s Azure is growing at breakneck speed as it has become the leading cloud platform for workplaces. The company’s cloud revenues for its latest fiscal year, which ended on July 31, rose 23% year-over-year to $168 billion. Meanwhile, the cloud computing surge that Microsoft has benefited from, of course, has increased the demand for computing hardware from chipmakers like Nvidia. Demand for hardware to support AI computing has, naturally, led to more promising growth in demand: All told, Nvidia predicted at its March technology conference in San Jose, capital expenditures on data centers will rise to $1 trillion by 2028 from $400 billion last year. As for who will hit $5 trillion with the wind in its sails first, the odds seem to favor the chipmaker:

- Microsoft does earn more money. Net income in its fiscal year ending June 30 was $101.8 billion. Nvidia’s net income for the 12 months ending April 30 was a lesser $76.8 billion — but this ultimately impressive haul was achieved as the United States revoked the company’s license to export to China. (Nvidia is poised to reenter the market after the Trump administration offered assurances last month that it will be granted licenses again.)

- Nvidia, meanwhile, is growing faster. In Microsoft’s latest quarter ending June 30, net income rose 24% year-over-year to $27 billion, and revenue climbed 18% to $76.4 billion. Nvidia’s net income in its latest quarter ending April 30 increased 26% to $18.7 billion, and revenue jumped 69% to $44 billion. And, again, it achieved that growth even with the ban on Chinese chip exports.

The Dark Horses: The only other companies with a current market cap above $2 trillion are Apple ($3.4 trillion), Google-owner Alphabet ($2.4 trillion) and Amazon ($2.4 trillion). But, unless Tim Cook rolls up to Apple’s next Worldwide Developers Conference with an iPhone that can teleport you to the French Riviera on your lunch break, these thoroughbreds are likely to remain dark horses.