Wall Street GOAT: Nvidia Rides Deal Bonanza to $5 Trillion Market Cap

The White House hinted early Wednesday morning that Nvidia may regain greater access to the massive Chinese market.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The $5 trillion market cap club has its founding member. And to no one’s surprise, it’s Nvidia.

The chip-designing king crossed the impressive milestone just days after its GTC conference in Washington, DC, which brought news of a bevy of promising new deals. Most pertinent, however, were hints from the White House early Wednesday morning that Nvidia may regain greater access to the massive Chinese market.

Nice to GTC You

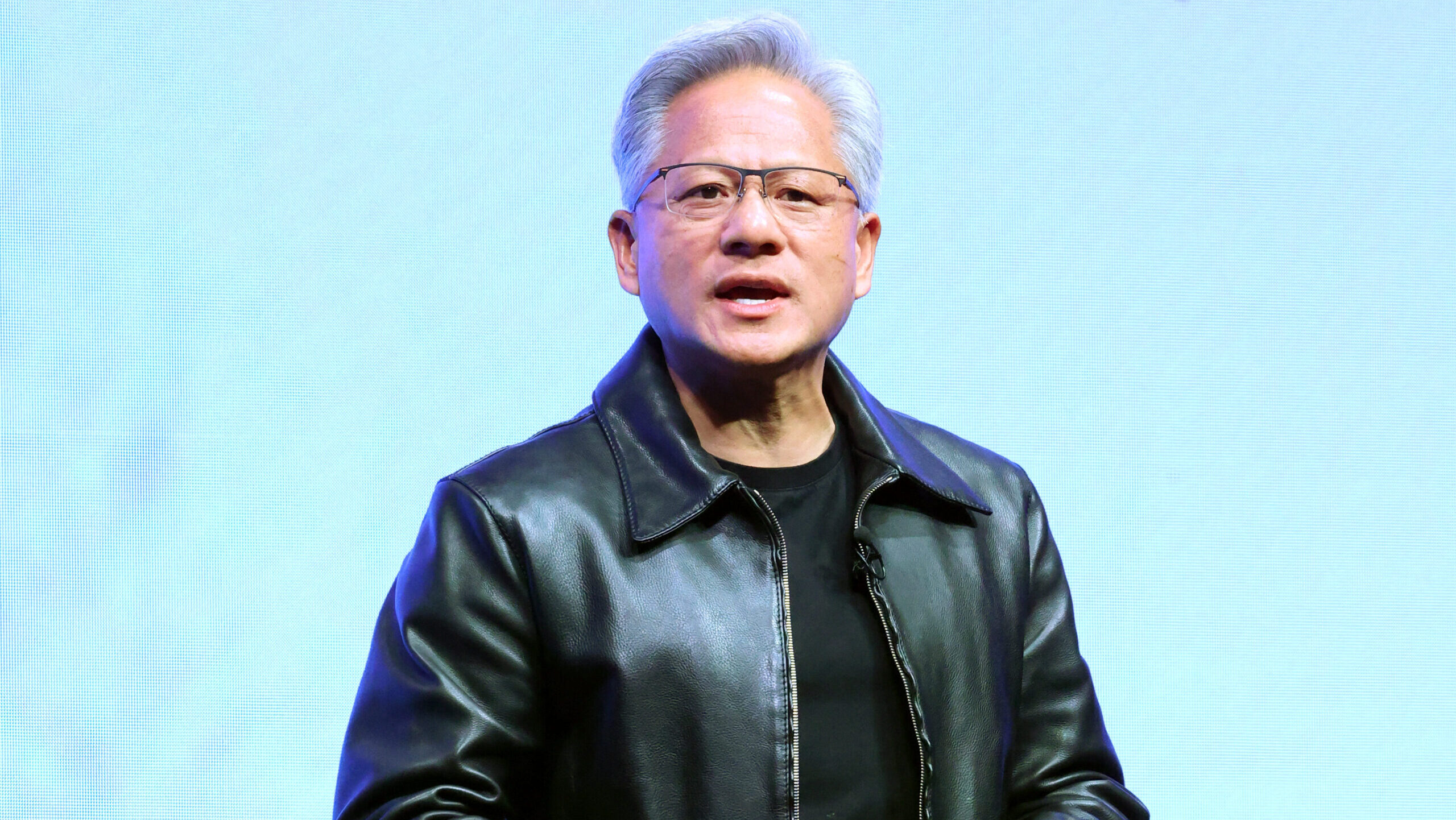

“Trillion” is a very 2025 number. Nvidia’s latest market cap achievement comes just three months after it became the first company in the world to reach a $4 trillion valuation, and after CEO Jensen Huang said during a GTC speech that the company has secured half a trillion dollars worth of AI chip orders through just the next five quarters. It also comes just a day after OpenAI, currently valued at half a trillion dollars, took critical steps toward becoming a for-profit entity, a rising-tide development that propelled Microsoft and Apple into the $4 trillion club on Tuesday. As a reminder, Nvidia was worth only about $400 billion when ChatGPT debuted in late 2022. It reached the $1 trillion mark just months later, the $2 trillion mark in early 2024 and the $3 trillion level in June of that year.

Huang claimed that Nvidia is “probably the first technology company in history to have visibility into half a trillion dollars” in revenue. It’s not exactly surprising, either, especially given recent developments:

- Among the deals revealed at GTC are partnerships with Uber to power a fleet of 100,000 self-driving cars, with both Stellantis and Lucid to help each develop its own autonomous-car platform, and with companies such as Palantir, Eli Lilly and CrowdStrike.

- The half-trillion sales projection means the company is penciling in 2026 revenue above the $258 billion expected by Wall Street, Bernstein analysts told the Financial Times, suggesting that Nvidia might see US-China relations thawing faster than expected. President Trump said Wednesday that he will discuss allowing Nvidia to sell its high-end Blackwell chip with China’s President Xi Jinping at a summit later this week.

What Goes Up: While returning to China in full force would mark a major victory for Nvidia, the company, evidently, is doing fine without unencumbered access. In fact, its greatest headwind may be coming from home. Longtime industry runner-up AMD is forging an increasingly cozy partnership with OpenAI, while veterans like Qualcomm and Broadcom are attempting to crash the AI chip party and Big Tech players are laying the groundwork to develop in-house chips, reducing reliance on third parties like Nvidia. In the near term, however, the AI spending boom doesn’t appear to be slowing down anytime soon, with Meta, Microsoft and Google each saying yesterday that largely AI-driven capital expenditures for the year are likely to be higher than projected. Seems like there’s more than enough money to go around, even with stiffer competition.