Oracle’s AI-Powered Sales Growth Threatens Elon Musk’s Reign as World’s Richest Man

Oracle said its remaining performance obligations is now sitting at $455 billion. That’s up 359% from where it stood just a year ago.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Oracle is on an all-time roll — and the prophecy written in its stock price is that founder Larry Ellison may become the wealthiest man on the face of the planet.

The company reported its latest earnings results after the bell on Tuesday, including an astounding projection that revenue from its cloud computing will increase 77% to $18 billion this year and could rise as high as $144 billion annually by 2030, thanks in large part to four multibillion-dollar deals with three different customers. By Wednesday afternoon, The Wall Street Journal reported on one of those marquee deals: a five-year, $300 billion agreement to supply cloud computing power to OpenAI.

Picks and Shovels

Oracle said its remaining performance obligations (RPOs), the contracted revenue that has not yet been realized, such as the OpenAI deal that the WSJ reported will begin in 2027, are now sitting at $455 billion. That’s up 359% from just a year ago, inspiring quite literal words of awe from Wall Street analysts during the company’s earnings call: Guggenheim’s John DiFucci said he was “blown away,” while Brad Zelnick of Deutsche Bank said, “We’re all kind of in shock, in a very good way.”

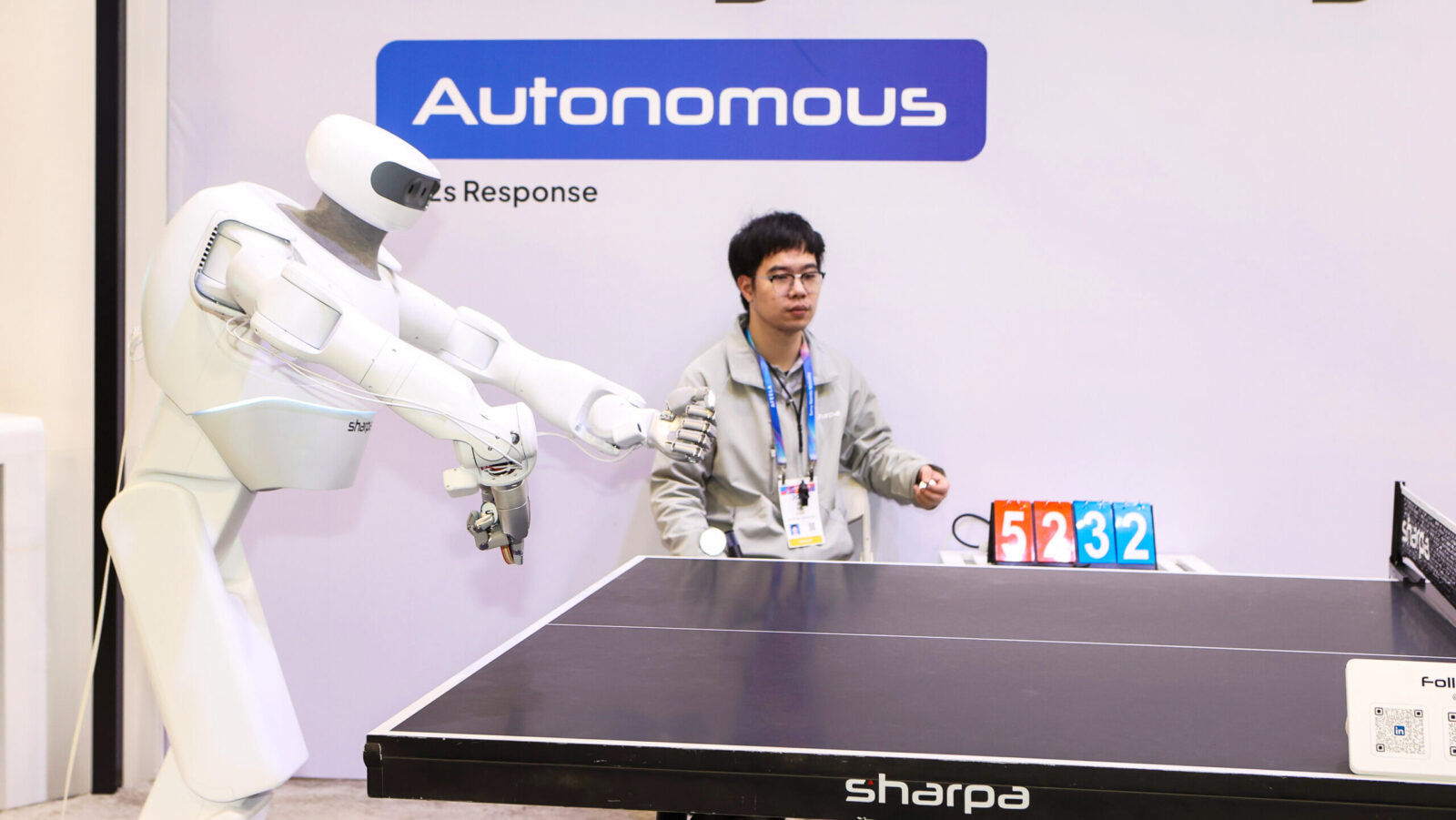

In other words, Oracle has become a favorite supplier of picks and shovels amid the artificial intelligence gold rush. And CEO Safra Catz says that’s because it’s different from cloud computing rivals such as Microsoft, Google and Amazon: “Some of our competitors, they like to own buildings … That’s not really our specialty. Our specialty is the unique technology, the unique networking, the storage — just the whole way we put these systems together.”

More importantly, Oracle’s RPO figure is an indication that the AI industry is preparing to spend big to keep the gold rush from going bust anytime soon:

- In a June filing, OpenAI revealed it was on track to generate just $10 billion in revenue this year, leagues away from the roughly $60 billion it will be paying Oracle under the deal. Meanwhile, sources told the WSJ earlier this year that OpenAI’s Sam Altman recently informed investors the company won’t be profitable until 2029 (and it’s still sorting out its for-profit structure).

- Oracle is similarly putting growth over profit; the company’s debt-to-equity ratio has soared to 427%, with S&P data showing its $21 billion in operating cash flow in the 12 months through August was eclipsed by its $27 billion in capital expenditures.

Margin Call: The AI moment has not only been very good to picks-and-shovels companies like Oracle but also to financiers on Wall Street funding the massive debt splurge. Not everyone is drooling, though. In a note published Wednesday seen by MarketWatch, D.A. Davidson analyst Gil Luria flagged that “at best,” Oracle is running its AI cloud compute services “at single-digit operating margins, if not serving compute at a loss in some instances,” a far cry from the 50% margins of its legacy business. All the same, Oracle’s share price leaped 36% by the close of trading Wednesday, and was sufficiently high during much of the trading day that Ellison’s fortune briefly eclipsed that of Elon Musk, according to Bloomberg. Oracle’s was the only single-day gain greater than 25% for a company worth at least half a trillion dollars, according to Dow Jones data. It’s also good for the company’s best single-day stock performance since 1999 … or right before a certain early digital age bubble started to burst.