SoftBank Dumps $5.8B Nvidia Stake to Subsidize Other AI Bets

CFO Yoshimitsu Goto said on an earnings call that SoftBank’s divestment had “nothing to do with Nvidia itself.”

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

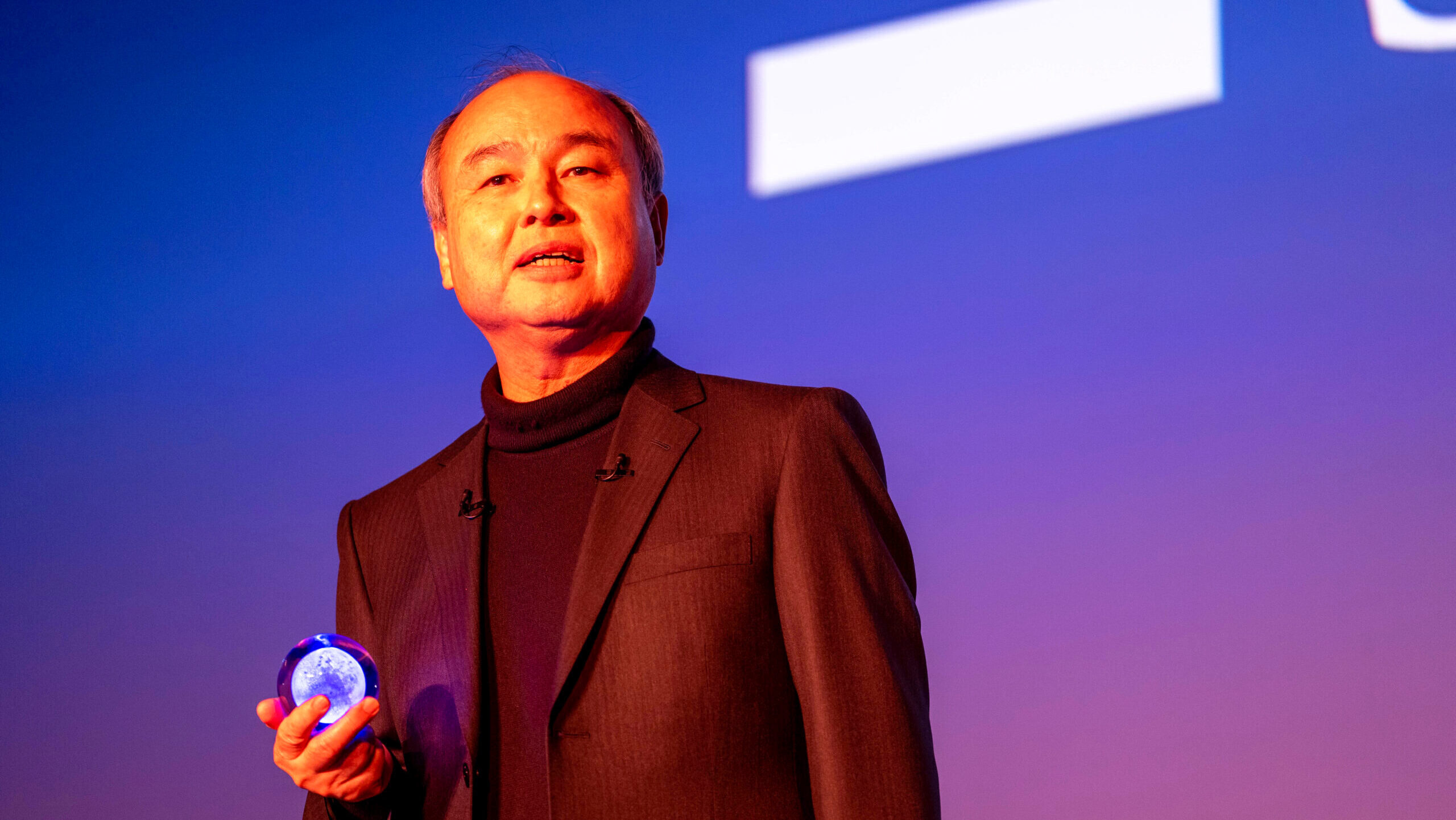

SoftBank, one of the world’s most prominent technology investors, has placed astronomical bets on the future of artificial intelligence. On Tuesday, it said Nvidia is no longer one of them.

Japanese billionaire Masayoshi Son’s firm sold its entire stake in the chipmaker at the heart of the AI boom, totalling 32.1 million shares, for $5.8 billion last month. The news reignited concerns among some investors about an AI bubble, but SoftBank said it was merely realigning its bets on the sector.

Attached at the Chip

CFO Yoshimitsu Goto said on an earnings call that SoftBank’s divestment had “nothing to do with Nvidia itself.” Nvidia has, in fact, consistently beaten analyst expectations, including in its latest quarterly report, and Citi hiked its price target for the semiconductor firm to $220 on Monday, suggesting the highly valued stock still has a 17% upside. SoftBank’s US-traded depository receipts rose 2.6% Tuesday, while Nvidia shares fell 3%.

Goto emphasized that the fresh capital from its divestment will bankroll other AI investments, namely an “all-in” bet on ChatGPT’s OpenAI. To finance its needs, Softbank also sold $9.2 billion worth of its partial stake in T-Mobile, and Son has unwound other positions to back his firm’s leading priorities. Softbank has also cashed out of Nvidia before, the last time in 2019, not long before the chipmaker began its meteoric rise. But given how firmly entrenched Nvidia is in the AI ecosystem, the two companies can hardly avoid each other:

- Along with OpenAI, Oracle and MGX, SoftBank is part of the joint $500 billion Stargate venture building AI infrastructure in the US; Nvidia is one of the initiative’s technology partners. Meanwhile, SoftBank’s sale of Nvidia shares helps finance an investment of up to $40 billion in OpenAI, which has pledged to invest up to $100 billion in Nvidia.

- Son’s other AI ambitions include a $1 trillion Arizona manufacturing hub, the $5.4 billion acquisition of ABB’s robotics unit, and a portfolio with TikTok-owner ByteDance and Perplexity AI. SoftBank and Nvidia stand to benefit if Big Tech firms follow through on pledges to spend hundreds of billions to fund the AI boom in the coming years.

Burry-ied in the Details: The doubters’ ranks are growing. On Tuesday, analysts at the Wells Fargo Investment Institute downgraded the S&P 500 Information Technology sector to neutral from favorable, citing high valuations. A day earlier, famed “Big Short” investor Michael Burry accused Big Tech “hyperscalers” of “artificially” boosting their earnings by “understating” the depreciation expenses of the semiconductors they’re buying. “By my estimates, they will understate depreciation by $176 billion [from] 2026-2028,” he wrote in a tweet.