Tech FOMO Can Hurt on the Comedown. Can the Cycle Be Broken?

Shiny new innovations draw in ambitious founders and investors, and then FOMO brings in everyone else, making the eventual fall harder.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

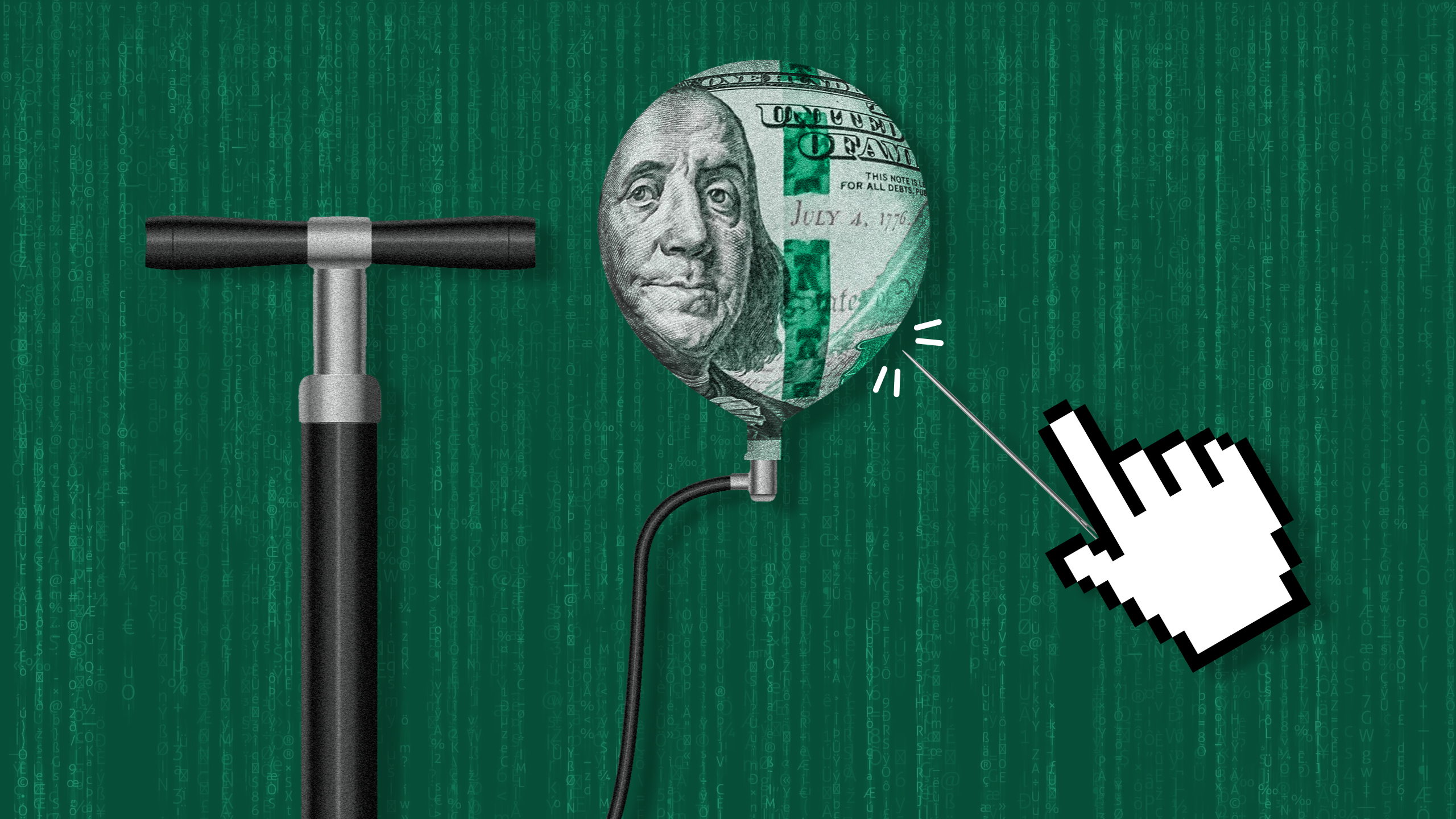

Practically every economic sector experiences boom and bust cycles. In tech, however, the booms tend to be more thunderous and the busts more painful, leaving substantial damage in their wake. It’s a story we’ve seen over and over again, whether it be the dot-com bubble, blockchain, or the metaverse. Will the industry’s current frenzy over AI be any different?

Plunging large checks into nascent tech risks more than just ROI. There’s also the potential for layoffs, shuttered startups, and writing off innovation before it’s ready, experts told The Daily Upside. The difference between what sinks and what swims may be dependent on whether new tech actually solves a problem or just cashes in on hype.

“There’s pressure to stay competitive,” said Thomas Randall, advisory director at Info-Tech Research Group, “which leads to allocating resources to trendy, but sometimes unproven, technologies.”

The Rise and Fall of a Tech Darling

The first thing that many picture when thinking of tech mania is the infamous dot-com bubble: Inflated stocks from internet startups in the mid-1990s gave way to plummeting valuations in the early 2000s, wiping out $5 trillion in Nasdaq value between 2000 and 2002.

History repeated itself with cryptocurrency, whose ascent began around 2020 and whose downturn started in 2022: Once high-flying exchanges like FTX, Binance, and Voyager fell from grace, and investors lost roughly $2 trillion in value. And while metaverse tech didn’t necessarily experience the same dramatic wipeout, hype for the tech has largely fizzled out since Meta changed its name three years ago.

So when does irrational exuberance begin? Oftentimes, it’s in the hands of consumers, said Randall. Even if a technology has been researched and developed by experts for years, he said, “Where you end up with initial hype is when you can have a technology that can be readily accessed in the average person’s home.”

- The dot-com bubble, for example, coincided with the mass availability of personal computers and easy access to the internet. Meanwhile, the explosion of blockchain’s popularity in 2020 and 2021 coincided with the skyrocketing price of bitcoin, as well as crypto’s easy availability on consumer platforms like Robinhood.

- And though AI has been around for decades, the generative AI craze began when ChatGPT hit the market in late 2022, said Randall. “It starts off in the popular imagination, and then flows into the workplace, and then you end up with large providers or venture capitalists suddenly drawn to it like a moth towards a flame.”

In the moment, this hype can be exhilarating and even briefly beneficial: Jumping on a popular tech trend early can give a company access to funding, talent, and attention in a sea of competing startups, said Kyrillos Akritidis, co-founder and managing director at Schwarzwald Capital.

“The inflated value, the extra attention — it brings a lot of pressure,” said Akritidis. “Sometimes it’s a good thing, it’s a driver to perform. But on the other hand, many times, we’ve seen teams that cannot cope with that.”

Unrealistic Expectations

The problem occurs when stakeholders start to see a certain innovation “as a panacea” capable of solving every problem and making a ton of cash at the same time, said Terri Maxwell, CEO of accelerator Shift/Co.

Then, rather than using technology to tackle problems it’s well-suited to solve, Maxwell said, Big Tech and startups want to get in on the excitement, and set unrealistic expectations about the tech’s capabilities. Meanwhile, trendspotting investors — both institutional and consumer — may have a hard time discerning what has staying power.

“You get this very dangerous cycle where consumers are confused, the early adopters are jumping in erratically, investors are hyping it up, and no one really knows what’s working,” said Maxwell.

After a long spell without seeing returns, the market starts to sweat. Once it’s clear what a certain innovation can and can’t do, Randall said, stakeholders have to “entirely reset expectations.” More often than not, it’s a contraction, he said, leading to share price fluctuations, layoffs, and valuation drops.

“Once the spiral starts going down, it’s very difficult to stop,” said Randall. “You’re going to see a lot of startups falter, and a lot of initial venture capitalist investment is going to be lost.”

And along with financial losses and layoffs, the tech behind it all is often largely written off. Blockchain, despite its underlying capabilities for fraud detection and recordkeeping, suffered massive hits to its reputation because of crypto’s crash. Artificial reality tech faced a barrage of “metaverse is dead” headlines.

“Early high pressure can distort the natural development process of emerging technologies,” said Randall. “Companies might even feel compelled to prematurely launch products to try and capitalize on that interest, but that may tarnish progress over the long term.”

Is AI Next?

Nearly every other headline today mentions AI: Will the tech live up to the industry’s lofty goals, or will it be bubble roadkill?

Some have claimed AI could be as transformational as electricity or the internet, and some aren’t certain it’s a bubble at all. In other words, it’s unclear exactly “how prolific it will be,” said Anthony Aaron, professor of the practice of accounting at the University of Southern California.

“With these technologies, people sometimes overestimate what they’re really going to do in society,” said Aaron. “All technologies are just tools … we shouldn’t necessarily put them on a throne.”

The difference between an AI startup that’s worth its salt and one that’s just hot air is whether or not it’s actually solving a problem instead of “chasing the money,” said Maxwell. “That obsessive need to get there first and think there’s a real first-mover advantage causes people to chase the money rather than to focus on solving problems and adding value.”