Earnings Season May Have Split Up the ‘Magnificent Seven’

Several of the companies have pleased investors with their profit reports, and then there’s Tesla and Apple.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Let’s be clear about it. Meta, Microsoft, Alphabet, Amazon, Apple, Nvidia, and Tesla got together and declared themselves a bloc.

But after powering a rollicking S&P 500 rally in 2023, the tech group that Wall Street dubs the “Magnificent Seven” have taken divergent paths this earnings season as investors look for tangible results from all the AI excitement.

Return of the Zuck

A billion dollars is cool, but you know what’s way cooler? $197 billion. And that’s how much Meta added to its market cap on Friday, a day after beating analysts’ revenue expectations and reporting that its profit tripled to $14 billion — the biggest single-session rise ever in any company’s market value (the cost, at least in part, was massive amounts of layoffs and cost-cutting last year). That makes CEO Mark Zuckerberg & Co. the virtual MVP of the M-7 cohort just two years after a $251 billion market wipeout, still the biggest stock skid ever. The company also just announced its first-ever dividend.

Microsoft, Amazon, and Nvidia, meanwhile, continue to outperform the entire market — with Nvidia still riding AI hype to a roughly 37% rise so far this year. That leaves Apple and Tesla as the Magnificent Seven outliers:

- Tesla, after a revenue miss and warning of slowing growth amid increasing competition, especially in China, has seen its stock slide nearly 25% this year, making it one of the two biggest drags on the index.

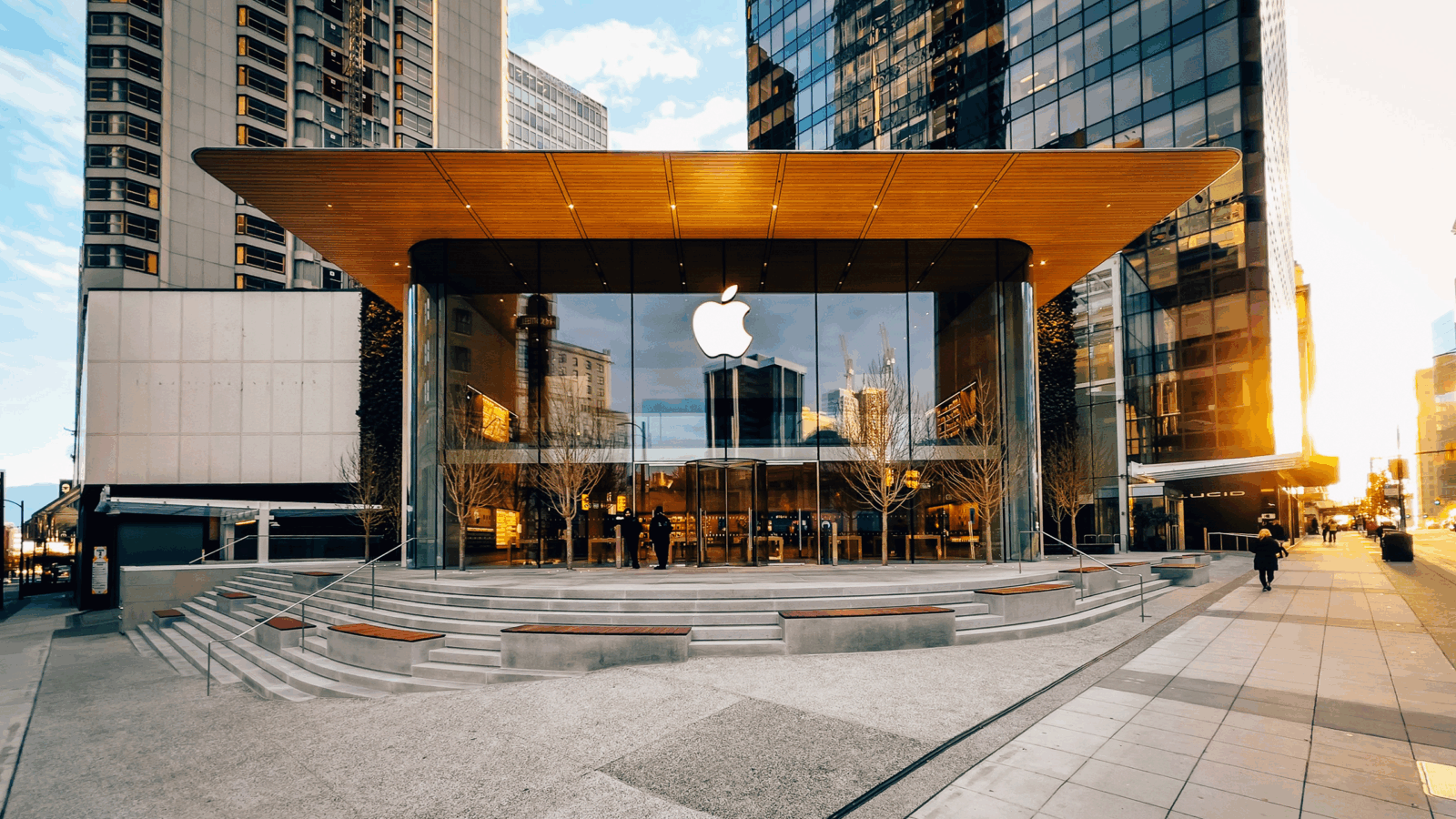

- The other laggard, Apple, has remained tightlipped about its AI plans compared to its Big Tech brethren. Meanwhile, its first major product launch in years, the $3,499 Apple Vision Pro headset, has made an impact that looks more like a raindrop than an iPhone-sized asteroid.

The Magnificent Seven “is not trading as a bloc any more,” Jim Tierney, a growth-focused portfolio manager at AllianceBernstein, told the Financial Times. “Last year everybody got the AI halo . . . [now] the market is starting to zero in on what are the individual prospects of each of the Magnificent Seven as opposed to treating them as one security.”

Fresh Blood: Tesla and Apple’s woes have left room for a new crop of competitors to crack the index’s top spots. Tesla, in particular, is now teetering on the ledge of exiting the S&P 500’s top 10, with Eli Lilly and Berkshire Hathaway surpassing it in market cap. Meanwhile, the top seven stocks have so far this year accounted for 80% of market gains, up from last year’s 60%. Mostly, we’re just wondering what’s going on with the not-so-magnificent remaining 490 companies.