Is the iPhone Losing Power?

Apple’s staring down a trade war that could make iPhones prohibitively expensive and AI hardware that could make them irrelevant.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Apple’s running around looking for a charger as the iconic iPhone, which makes up more than half of the tech company’s revenue, faces threats on multiple fronts.

President Trump’s trade war could make iPhones prohibitively expensive, while AI hardware may make iPhones irrelevant. At the same time, Apple faces increasing competition from rivals looking to drain its market share.

Made in the USA … or Else

Apple’s supply chain could soon be upended. Trump has repeatedly urged CEO Tim Cook to make iPhones in the US, saying last week he’ll tack on a 25% tariff to any iPhones made abroad. Apple has been ramping up iPhone production in India, which Trump has in the past been on friendly terms with, to rely less on its main iPhone-production hub, China. But earlier this month, Trump said he doesn’t want iPhones to be made in India either, and he has threatened tariffs on the country that are nearly as high as those on China.

Even if the iPhone’s supply chain could be picked up and moved overseas tomorrow, an iPhone made entirely in the US might cost $3,500, a Wedbush analyst predicted, more than three times the latest model’s retail price.

A more expensive iPhone might have a harder time competing with rivals. Apple has been losing sales in China to homegrown companies like Huawei and Xiaomi, while US customers consider new options that range from foldable phones to so-called “dumb” phones built to reduce screen time.

And Apple could have new competitors built for AI hitting the market soon:

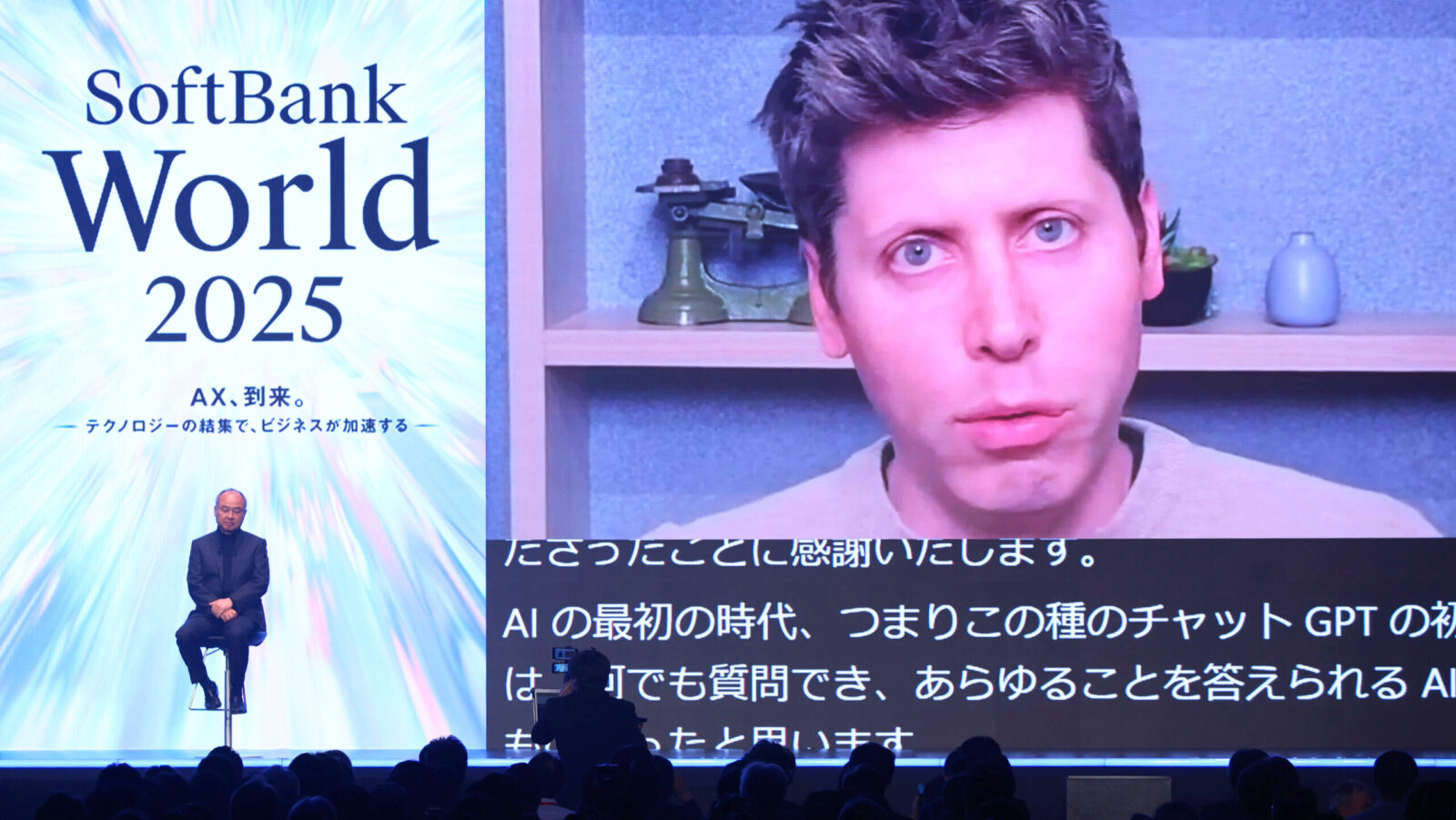

- Apple’s chief of services, Eddy Cue, said this month that AI devices from competitors, including OpenAI and Anthropic, could send the iPhone to the junk drawer within a decade.

- Last week, OpenAI brought on former Apple design chief Jony Ive, who led the design of the iPhone, acquiring his design firm, LoveFrom, for $6.4 billion. In the promo video announcing the team-up, Ive said people are trying to use decades-old products with AI — and that they need “something beyond.”

Meanwhile, Apple’s attempts to integrate AI into the iPhone have sputtered: An AI Siri upgrade was delayed earlier this year, and Apple’s main AI offering, Apple Intelligence, only handles basic queries. It outsources more difficult tasks to none other than OpenAI’s ChatGPT.

Not Locked: During Apple’s last earnings report, Cook said the impact of tariffs is “very difficult to predict.” And some analysts think Trump’s push to force iPhone production out of India is simply a negotiating tactic to clinch a better trade deal with the nation. While the iPhone’s global market share slipped last year to 18%, it still dominates more than half of the US market, according to Counterpoint. Plus, OpenAI has said it’s not immediately working on a smartphone, according to The Wall Street Journal, but rather a device that’ll work in conjunction with laptops and smartphones. A device like that could still butt into Apple’s ecosystem and hurt the iPhone’s value proposition. But Apple won’t power down the iPhone without a fight.