ASML’s Earnings Flub Sinks the Chip Sector

On Tuesday, ASML accidentally published some disappointing earnings results a day earlier than scheduled, sending its share price down.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Take it from us — the tightrope between the “publish now” button and the “schedule for later” button is trickier to walk than one might think. Our occasional mistakes, however, don’t upend entire industries.

On Tuesday, ASML accidentally published some disappointing earnings results a day earlier than scheduled (a spokesperson chalked it up to a “technical error”), sending the major chip player’s share price on an epic slide. And where ASML goes, the rest of the industry tends to follow.

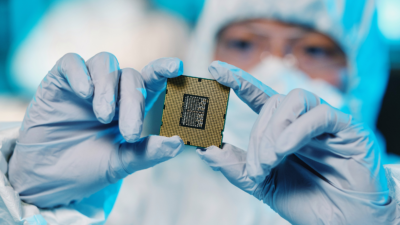

Industry Anchor

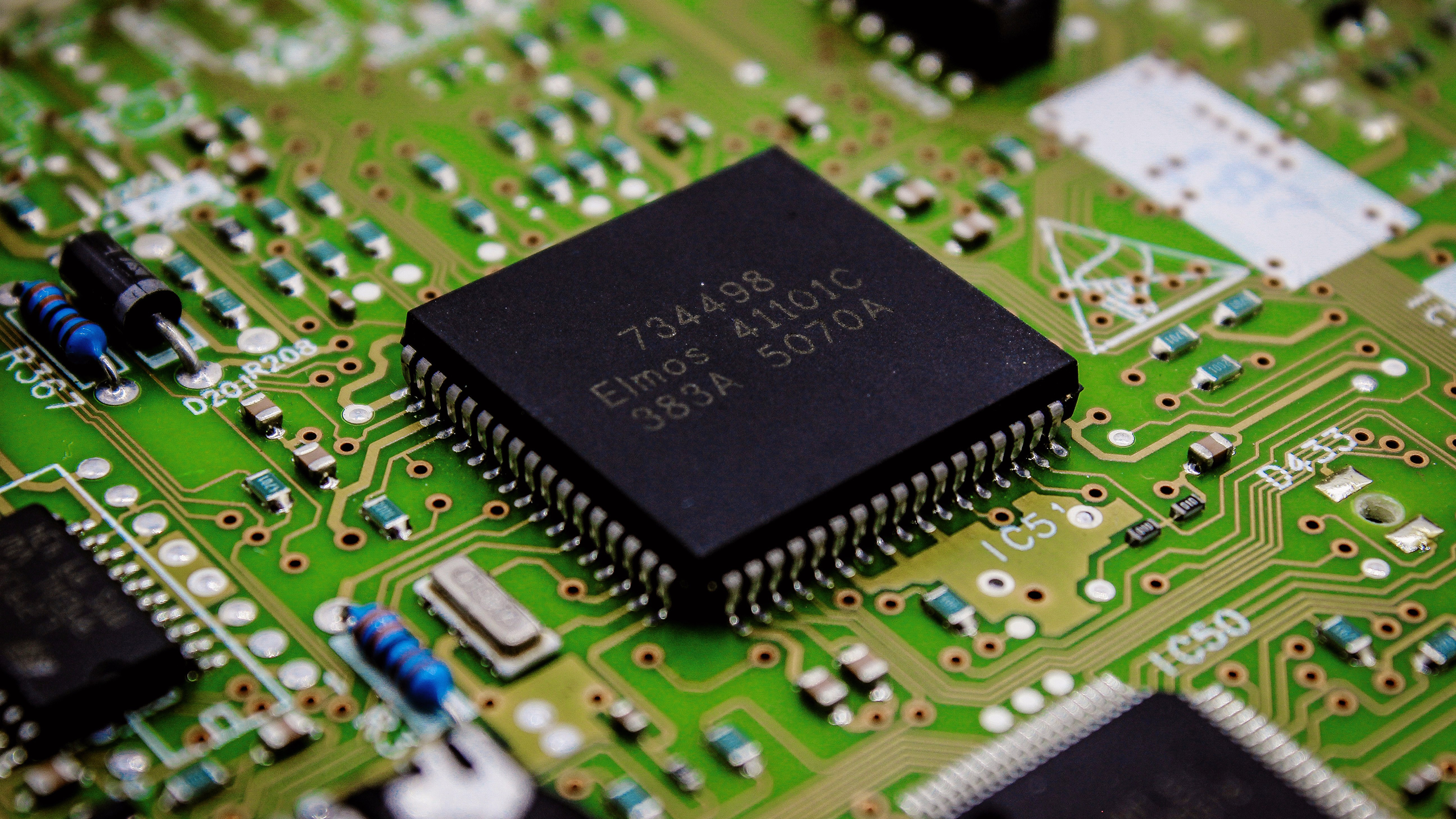

Artificial intelligence hype has had another run-in with harsh reality. In its earnings report, ASML — which creates the hardware and software needed to manufacture all-important semiconductors — said net bookings for the quarter came in at just €2.6 billion, well below consensus expectations around €5.5 billion. It also said it expects 2025 net sales to come in at just €30 billion to €35 billion, in the lower half of the range of previous projections.

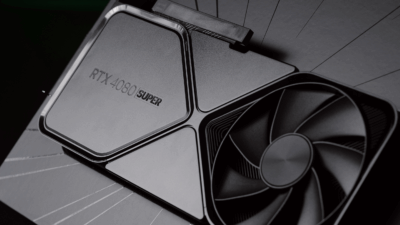

Translation: There may be some sustained weakness in the semiconductor market. Unsurprisingly, ASML’s share price skid triggered a chain reaction:

- Trading of ASML shares was halted multiple times before the stock closed down 16% on the Amsterdam Stock Exchange. That marks ASML’s biggest single-day drop since 1998.

- Shares of Nvidia, fresh off a record high, fell over 4%, AMD shares fell 5%, and Arm shares fell nearly 7%. The iShares Semiconductor ETF, which has a total of 32 holdings, fell around 5% as well.

The Great Wall: ASML placed some of the blame on Dutch and US restrictions on shipments to China. In a June earnings report, the company said China sales accounted for nearly half its revenue; next year, as restrictions mount, it expects the share to fall to just 20%. The chip industry may want to pencil in even more government restrictions soon. Also on Tuesday, Bloomberg reported that the Biden administration is considering capping sales of advanced AI chips from US firms to even more countries, such as Saudi Arabia and the United Arab Emirates, in the interest of national security.