Chip Stocks Take a Tumble as US Hints at More Restrictions on China

American chip stocks fell Wednesday morning amid the prospect of even tighter restrictions on business with China.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

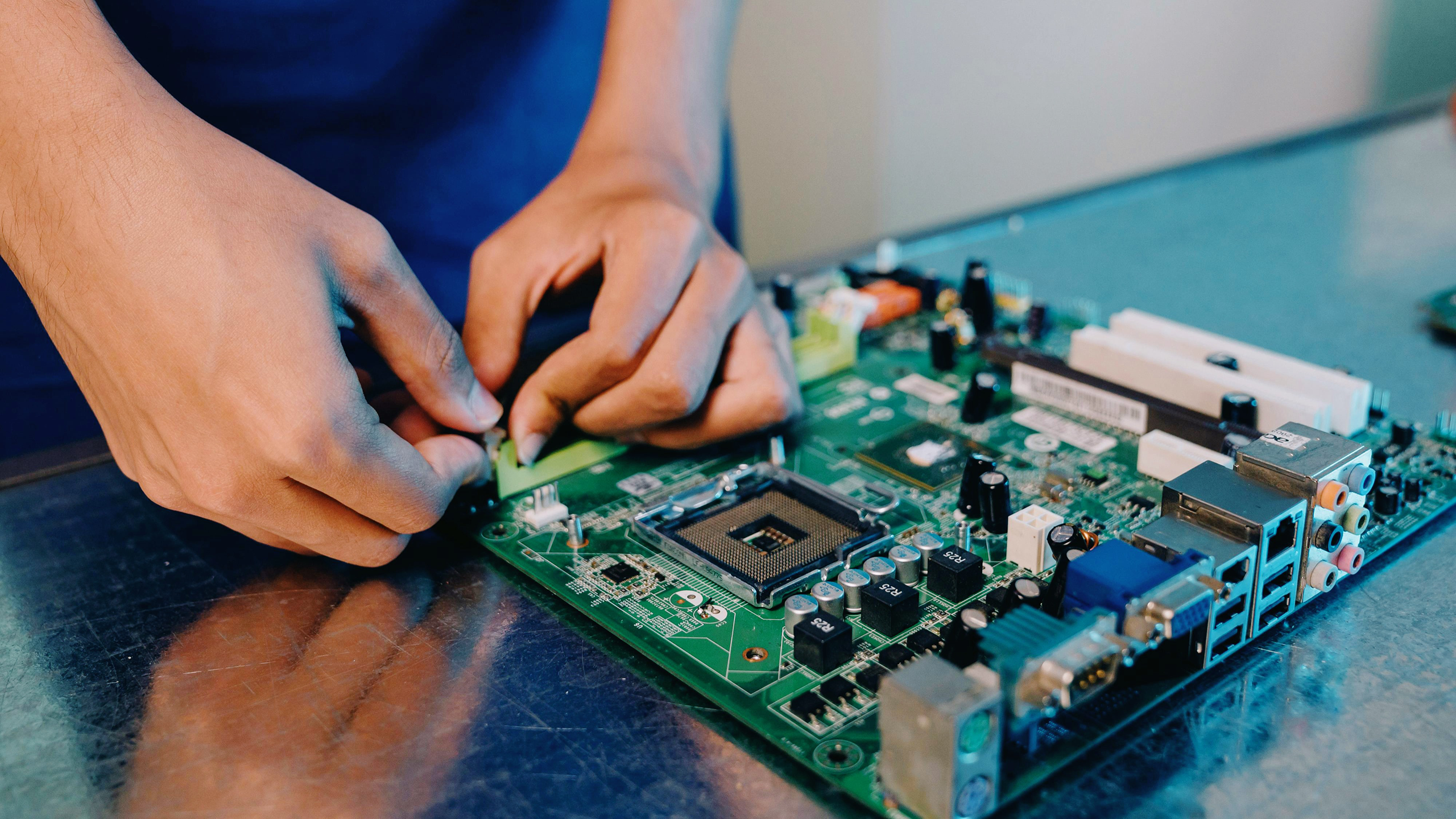

Semiconductor makers are still riding the data center and artificial intelligence waves, but the political waters are getting choppy.

American chip stocks fell Wednesday morning amid the prospect of even tighter restrictions on business with China. Plus, investors are reacquainting themselves with a certain former president’s penchant for off-the-cuff foreign policy pronouncements.

Not Feeling Too Chipper

The US-China trade war began during Donald Trump’s administration, and President Joe Biden has escalated it, passing multiple sanctions to keep Chinese companies from getting their hands on America’s advanced AI tech.

While chipmaking remains an incredibly lucrative business — global sales reached almost $530 billion in 2023 — the sanctions have hampered companies’ bottom lines. In the first quarter of last year, Nvidia generated roughly 22% of its total revenue in China. This year, that dropped to about 9.5%. And the current White House seems to be planning on more restrictions:

- This week, the Biden administration floated imposing foreign direct product rules (FDPR) on Japan’s Tokyo Electron and the Netherlands’ ASML to curb their business in China if the two countries don’t enhance their own restrictions, sources told Bloomberg. The rule allows the US to put controls on foreign-made products as long as they incorporate even a small amount of American technology.

- As a result, Tokyo Electron’s stock dropped 11% in Japan, and ASML’s US-listed shares fell 12% Wednesday. American chipmakers felt the shock, too: Nvidia dipped 6.6%, Broadcom 8%, Qualcomm 8.6%, and Micron 6%. The blows partially caused indexes to slide, with the S&P 500 dropping 1.4% and the tech-heavy Nasdaq falling 2.7%.

Intel, which is actually one of the worst-performing stocks this year, managed to make it out unscathed; its share price rose about 0.35% by market close Wednesday.

Insurance Policy: As if trade war battles weren’t enough to rattle chip stocks, the industry also felt the effect of campaign trail shenanigans. In an interview with Bloomberg Businessweek, Trump expressed disinterest in providing aid to Taiwan — home to 92% of the world’s advanced chip production — in the event of a Chinese invasion unless payment was involved. “I think Taiwan should pay us for defense. You know, we’re no different than an insurance company. Taiwan doesn’t give us anything,” he said. Shares in the Taiwan Semiconductor Manufacturing Company fell 8% Wednesday. Sounds like Trump’s got a chip on his shoulder. But Silicon Valley seems to love him more today than yesterday.